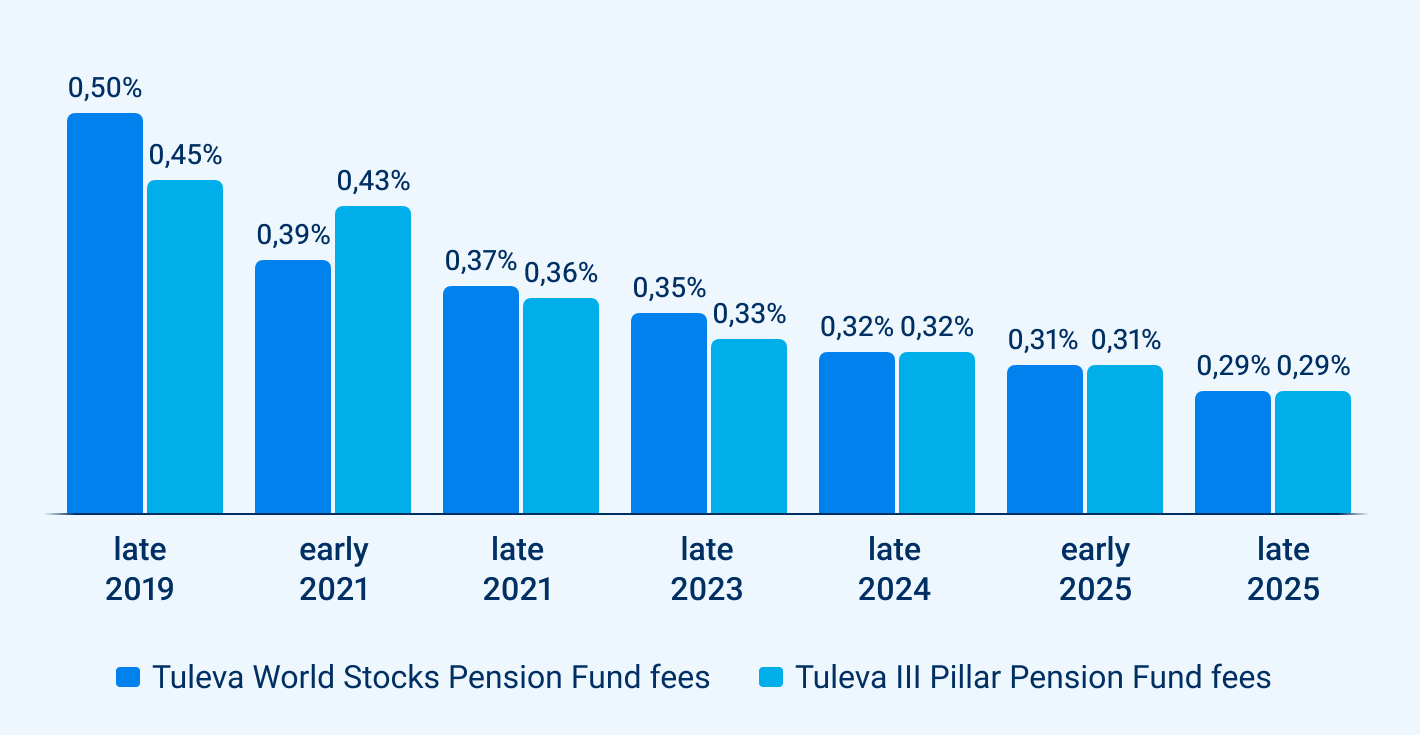

The more people save at Tuleva, the less we all pay in fees. The less we pay in fees, the more of the returns we keep for ourselves. This is the essence of Tuleva’s model. Our assets under management have grown by 300 million euros in a year and exceeded the 1.3 billion euro mark. Therefore, we can lower fund fees once again. Starting December 1, the ongoing fees for all Tuleva funds will be 0.29%.

A year ago, Tuleva’s assets under management crossed the one billion euro threshold. It took us nine years to reach that milestone. In the last year alone, our assets have grown by over 300 million euros, bringing our total volume to over 1.3 billion euros. Together we paid 160 million euros into the funds. New savers brought us 70 million euros of assets previously accumulated elsewhere. The stock markets also had a good year, despite a crash in March.

We lower fees as soon as possible

Investing is a volume-based business, and as the assets under our management grow, the costs per investor decrease. Every new euro added to Tuleva funds helps reduce fees for everyone.

In the last months, we have also made an effort to keep our costs under control. In August, we decided to conduct a larger part of our product development in sprints. This decision allowed us to reduce Tuleva’s permanent team by four people and consequently lower our running expenses.

For these reasons, we are able to reduce our fees, while still leaving ourselves adequate buffer to weather potential market downturns. Starting December 1, 2025, we are reducing fees across all Tuleva funds to 0.29%.

Tuleva members benefit further because we return a portion of our fees to ourselves. Each year, every member receives a 0.05% rebate of the value of their savings in Tuleva’s second and third pillar funds.

The more people save together with us, the more confidently fees will drop for all Estonian pension savers

Lowering fees has a small impact on the average Tuleva saver, as fees decrease by only a few percentage points. However, that is not the main priority. Tuleva was created to increase competition among pension funds. We lower fees to make saving for retirement more affordable for everyone.

Lowering our fees does not make any single Tuleva fund the cheapest on the market. However, we are confident that all of our funds are good funds, as Tuleva remains the fund manager with the lowest average fees in Estonia by a significant margin. (2)

In the Tuleva model, everyone covers their own costs – no one else pays for your savings, and you don’t pay for someone else’s. In contrast, banks offer both low-fee funds and very high-fee funds, with the latter subsidizing the low-cost options.

The less you pay in fees, the more you keep yourself

While pension fund fees may seem negligible, their impact over the long term is significant. Tuleva investors understand that saving on fees means having more wealth in the future.

One in five people who recently transferred their second pillar to Tuleva previously saved in a fund with a fee over 1.2%. On average, those transferring from such a fund had accumulated €14,500 in their second pillar. In 2025, they would pay a fee of 1.2%, amounting to nearly €175. By moving their pension savings to Tuleva, they would instead pay just €45 – almost 4 times less.

This is not some distant future projection or theoretical figure; it’s real savings. It’s like switching your family’s expensive mobile plans to more affordable ones – a small effort that saves money and generates returns for decades. You can calculate the impact of fees on your savings using our pension calculator.

Tuleva lowers fees because we can

We are not pressured by the government or competitors to lower fees. The owners of Tuleva are the same people growing their wealth in our funds, and it is in their interest to keep costs under control. Thanks to this, other Tuleva investors can also rest assured that saving with Tuleva will become even more affordable in the future. As more people save in our funds, we can continue lowering fees. The larger our fund size, the lower the costs for everyone.

Initially, Tuleva’s goal was to bring low-cost index funds to Estonia. Now we know that our greatest contribution is helping more people save wisely and consistently. That’s why we aim to cut through the noise and misleading advertisements to help people make informed decisions.

Moreover, the larger we grow, the stronger our voice in advocating for investors. Every euro saved strengthens our ability to push for a fair and modern pension system in Estonia.

See how much you’re paying in fees on your pension savings.