Everyone benefits from Tuleva, but only members earn a membership bonus, which increases their share in the membership capital of our mutual company.

Who are Tuleva members and what are their rights?

When you save for your pension with Tuleva, you’re part of our community. Everyone in Estonia can save with Tuleva – membership isn’t required. Today, more than 71,000 people already save for their pension with Tuleva.

When you become a member of Tuleva, you’ll be one of Tuleva’s 8,979 co-owners. Tuleva is a commercial association, i.e. a company whose purpose is to support its members’ economic interests through joint economic activity. We help people build their future capital with confidence by saving regularly and with little effort.

But on top of that, members have some additional rights.

Members earn a membership bonus

Every year, while saving with Tuleva, members earn a membership bonus worth 0.05% of the value of their pension assets. How’s it calculated?

At the end of the year, we calculate how many Tuleva pension fund units each Tuleva member had on average during the year. We multiply the value of the units by 0.05% and transfer the resulting amount to the member’s personal capital account with the Tuleva association. So, the membership bonus starts out quite small but grows as your pension assets grow. What you’ve earned doesn’t just sit in your account. It’s a share in our joint business, which means it earns a return too.

How can I check the size of my membership bonus?

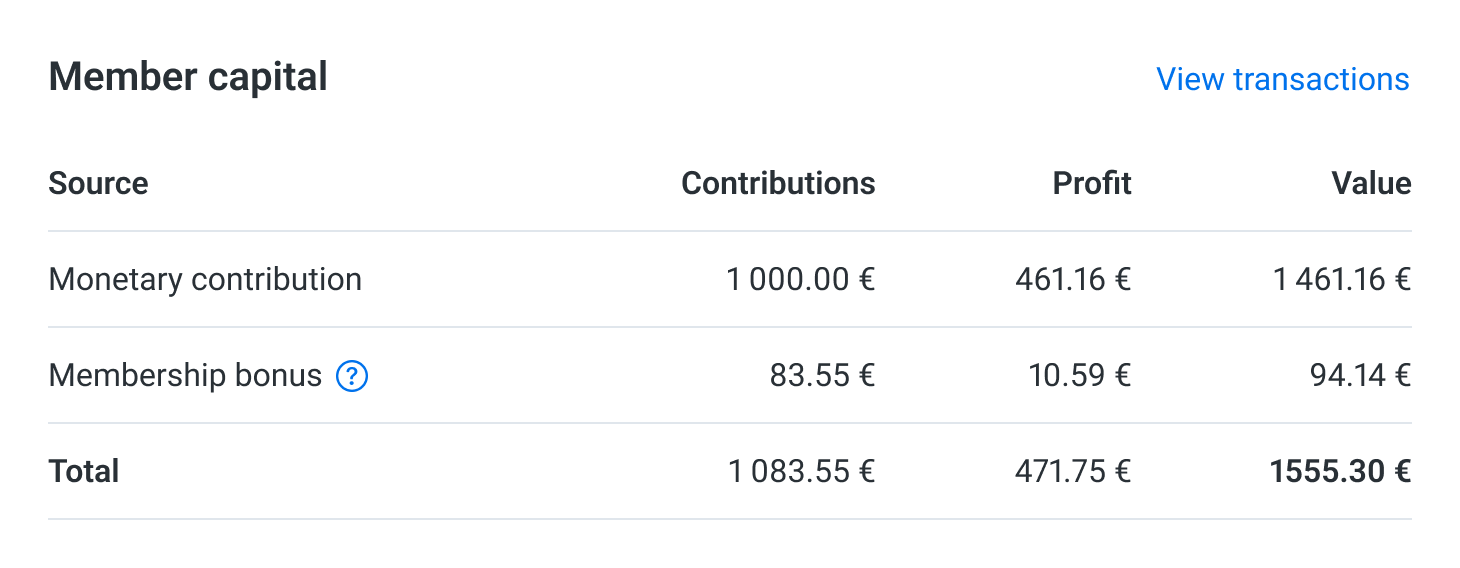

Log in to your account on Tuleva’s website and scroll to the bottom of the page. You’ll see a section called “Member capital”.

What do I get from the membership bonus?

The membership bonus is a part of Tuleva’s membership capital and entitles you to a share of Tuleva’s profits. All Tuleva members together currently hold about 7 million euros in membership capital. This means that if your total individual membership capital is, say, 700 euros, you’re entitled to 0.01% of Tuleva’s profits. Tuleva’s membership capital changes over time, as membership bonuses are earned continuously.

So far, Tuleva has not paid out profits. Under the articles of association, we decide on dividend payments at the end of each five-year period. In 2022, no dividends were paid out; instead, they were reinvested as we focused on lowering fees and bringing new investors into our index funds. The next time we’ll decide together whether to pay dividends will be in 2027.

In addition, when members leave the Tuleva association (i.e. terminate their membership), we pay them the book value of their share. However, it’s clear that Tuleva’s value goes beyond just the book value of the share. As Tuleva has grown, so has its value. Not only do we collectively own nearly 7 million euros worth of capital, but we also own a fast-growing company with 71,000 customers.

How can membership capital be acquired?

In three ways:

- By making a contribution to Tuleva’s capital. When Tuleva was established, 3,000 people made voluntary contributions ranging from 1,000 to 10,000 euros to Tuleva’s capital. In 2019, all members had the opportunity to make an additional contribution to Tuleva’s capital to help create our pillar III fund.

- By earning a membership bonus. By accumulating your pension assets in Tuleva, you’ll earn an annual membership bonus of 0.05% of the value of your assets. For example, I’ve earned a membership bonus of 76 euros since 2017.

- By making a work contribution to Tuleva. We pay Tuleva employees and service providers a portion of their salary in the form of options, allowing them to acquire a share in Tuleva’s membership capital. This has two advantages:

- it increases the team’s interest in growing Tuleva’s value, as they also own a small piece of the company;

- there’s a significant tax advantage in Estonia when paying in options. In total, we’ve paid out 418,799 euros in work contributions.

Already accumulated members’ capital has been invested in the same broad-based index funds in which Tuleva’s assets grow. When global stock markets grow, the return on membership capital grows as well. Of course, like any other investment, neither stock market growth nor returns on membership capital are guaranteed. Investment returns are also recognised in the membership capital line item.

Voting rights

Regardless of their contribution to Tuleva’s membership capital, every member is entitled to participate in the general meeting of Tuleva. Each member has one vote at the general meeting. This way, we organise Tuleva’s activities on an equal basis. Voting takes place electronically every spring, and membership bonuses are transferred to members’ accounts immediately after we’ve collectively approved the previous year’s annual report at the general meeting.

If you’re already a Tuleva customer contributing to both pillars, becoming a member is the best way to get the most out of Tuleva. If you haven’t joined us yet, do it now!

(The article was updated in April 2025)