Tuleva pension funds will follow the principles of environmental sustainability and social responsibility, excluding investments in companies that do not meet the relevant criteria.

Rather than creating an additional small “green fund”, Tuleva will make its large funds more sustainable. In exactly the same way as we don’t have a single good pension fund hidden among old, high-cost funds. Low fees and an awareness of the impact of our investments on the world are core values, which it would be cynical to apply selectively.

The introduction of the principles of sustainability will not lead to an increase in fees. Tuleva’s passive investment strategy will also remain in place. We will continue to lower the fees and diversify the risks by constantly increasing our stake in the global economy. This has been shown to lay a good foundation for investors to get the most out of their savings in the long run.

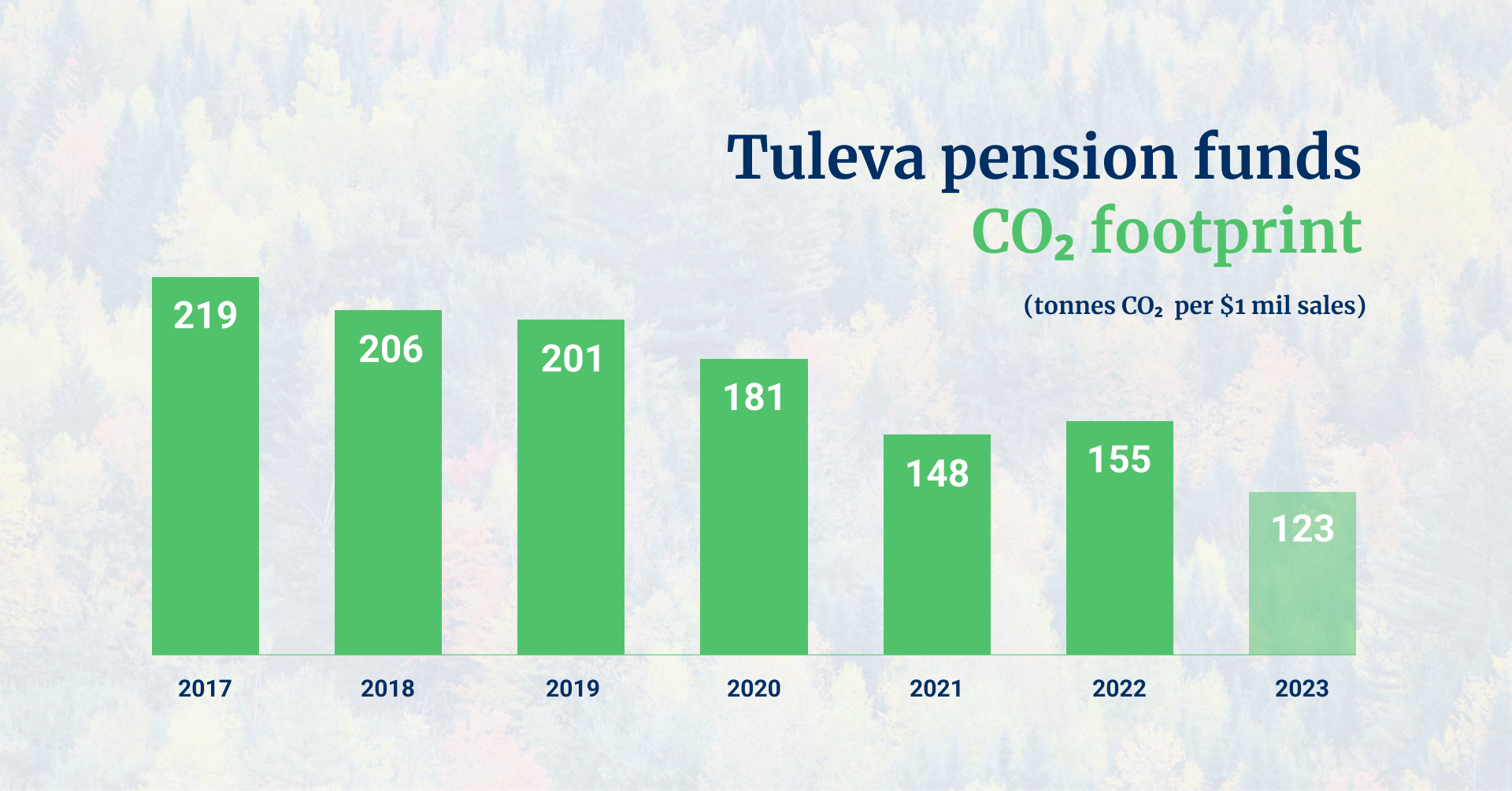

Applying an ESG filter will further reduce the carbon footprint of Tuleva funds by around 15%.

Tuleva’s goal is to achieve a return as close as possible to the global market average. The application of the principles of sustainability will have a minimal impact on the performance of the funds. This impact may be either slightly positive or slightly negative.

The ESG (environmental, social, governance) filter excludes investment in companies that:

- have 5% or more of their turnover coming from the extraction or use of energy coal or oil sands, the manufacture or sale of tobacco products or the production and sale of civilian firearms,

- are related to the production and sale of controversial or nuclear weapons,

- or violate the United Nations Global Compact governance principles.

In practice, this means removing almost 200 companies from Tuleva’s portfolio. We have found the necessary replacements in the model portfolio in cooperation with our partner, the world’s largest management company BlackRock.

The CO2 intensity of Tuleva investors’ investments is currently 155 tonnes per 1 million US dollars of sales. Since the launch of our funds, it has fallen by around 30% due to the world’s capital moving towards less polluting industries. Thereby the market value of polluting companies falls and their share in indexes and index funds declines. For example, among our biggest investments are now technology companies instead of ExxonMobile.

Applying an ESG filter will further reduce the carbon footprint of Tuleva funds by around 15%.

Our climate footprint is likely to be already smaller than that of the large pension funds of banks. Unfortunately, we can only say this on the basis of estimates because no management company except Tuleva has so far published these figures. We hope this will change. Then people who care about the impact of their investments on the world can make decisions based on facts, not green advertisements.

Important information for Tuleva investors:

The management board of the Financial Supervision Authority approved the amendments necessary for the implementation of the principles of sustainability to the terms and conditions of the Tuleva World Stocks Pension Fund and Tuleva Third Pillar Pension Fund on 9 May 2022, Decisions No. 4.1-1/77 and 4.1-1/78. The amendments will take effect on 1 September 2022.

When fund rules are amended to a significant extent, unit-holders have a statutory right to leave the fund without paying an exit fee before the amendments enter into force.

Tuleva never charges extra fees for entering or leaving our funds. Therefore, you can leave the funds at any time without paying an exit charge. However, if you want to move your assets elsewhere just before the amendments to the terms and conditions take effect, file an application in the internet bank or Pensionikeskus by 31 July 2022 at the latest.

Documents (in Estonian):

Terms and Conditions of Tuleva World Stocks Pension Fund from 1 September 2022

Terms and Conditions of Tuleva Third Pillar Pension Fund from 1 September 2022

Prospectus of Tuleva World Stocks Pension Fund from 1 September 2022

Prospectus of Tuleva Third Pillar Pension Fund from 1 September 2022

Key Investor Information of Tuleva World Stocks Pension Fund from 1 September 2022

Key Investor Information of Tuleva Third Pillar Pension Fund from 1 September 2022

Assessment of the significance of the amendments