Don’t miss out on second pillar tax benefits

Second pillar contributions are income tax-free

How does the calculator work?

Expected returns depend greatly on the evolving rate of return, and neither we nor anyone else are able to guarantee a 7% annual return.

The calculator assumes an income tax rate of 22% and a flat tax-free income of 700 euros per month.

Assumptions

Income tax rate

22%

Basic exemption per month

700 €

Retirement age

65 y/o

Now you can save more in the second pillar without income tax

Until now, you’ve been contributing 2% of your gross salary to your second pillar tax-free. Now, until November 30 at 23:59, you have the option to increase your contribution to 4% or 6% starting from the beginning of next year. The higher the percentage, the greater the tax benefit, which will go into your pension account to earn returns.

It’s worth increasing your second pillar contribution in time because if you miss the current deadline, more income tax will be deducted from your salary next year. You’ll only be able to increase your second pillar contributions again starting in 2027.

Later, you can decide whether to keep the higher contribution rate. You can change your choice once a year before the end of November.

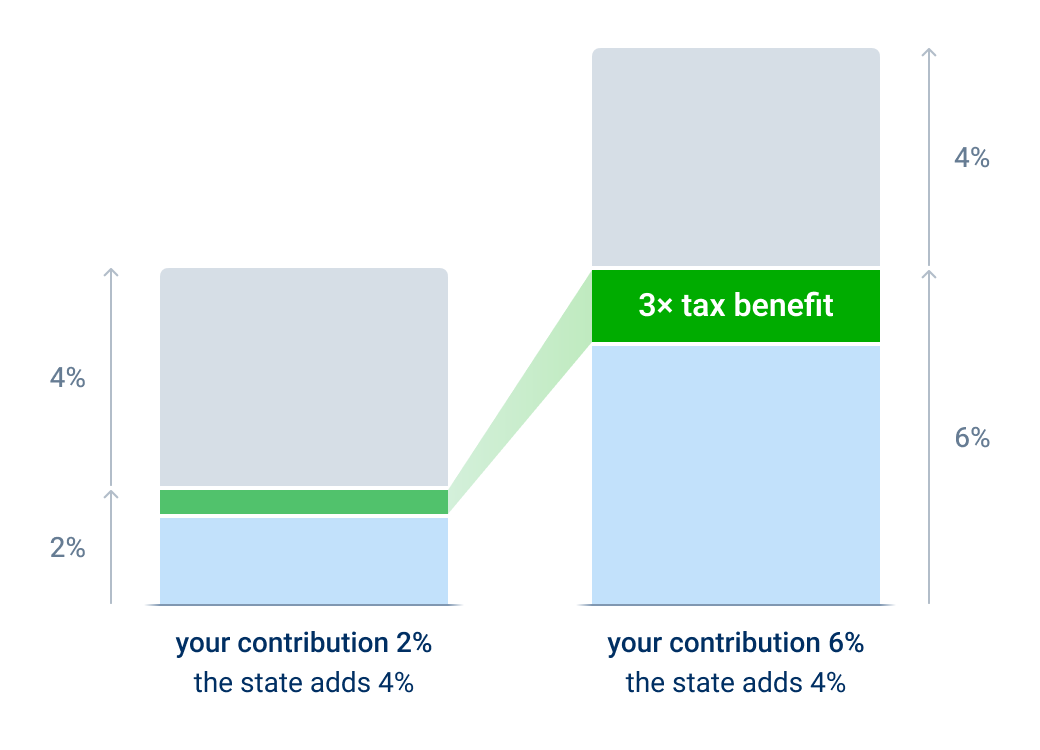

Bigger contributions mean bigger tax savings

By increasing your second pillar contributions, you benefit from tax savings and can accumulate even more with tax advantages. In addition to your contribution, the government continues to add 4% of your gross salary as a social tax contribution to your second pillar.

For example, if your gross salary is €3,000, you currently contribute €60 to the second pillar, and your tax benefit is €13.2. Additionally, the government adds €120 through the social tax—this amount remains unchanged. If you increase your contribution to 6%, a total of €180 will go into your second pillar each month, accompanied by a €39.6 tax benefit. Over a year, this triples your tax savings and adds an extra €475 to grow in your second pillar.

Government-provided tax benefits like this are hard to find elsewhere — there’s no free lunch quite like it. Plus, it gives a significant boost to your investment. This is likely the same reason you’re already saving in the third pillar as well.

Already 80% of those who have submitted applications in Tuleva have increased their second pillar contribution to 6%.

Now it’s your turn

Submit your application before November 30 at 23:59 to secure next year’s tax savings. It only takes 2 minutes to make the change. Don’t miss out!

Frequently asked questions

You can submit a request to change your contribution percentage at any time. However, changes take effect once a year on January 1, based on requests submitted no later than the end of November in the previous year.

The contribution percentage is updated once a year on January 1, based on requests submitted by the end of November in the previous year.

If your salary for work done in December is paid out at the beginning of January, the higher second pillar contribution will already be applied to the salary paid in January.

The assets held in your Pillar II belong to you. Everyone can use their Pillar II assets as they see it: all at once or little by little, from early retirement age. You have the right to request a cash payout before leaving Estonia or from abroad, subject to applicable regulations and tax obligations.

-

- If necessary, you can submit an application for an exemption from making contributions if at least 10 years have passed since you joined the second pillar.

- If you are a voluntary subscriber and your old-age pension age (including the 5-year deadline before old-age pension age) arrives before the above-mentioned 10 years have passed, you can use the accumulated pension assets immediately. Read more →

Is our money in Tuleva as protected as in bank’s pension fund?

YES!

Financial Inspection

issued a licence to Tuleva fund manager and controls that our everyday operations comply with regulations.

Swedbank

is Tuleva pension funds’ depositary bank. Depositary bank approves every transaction with fund’s assets. Exactly like with bank’s own funds.

State guarantee fund

protects all pension fund investors against the worst in case fund manager causes harm to investors.

Founding members

Tõnu Pekk

Tõnu Pekk is an investor with 30 years of experience, a good deal of it from the international financial sector. Having led development projects and managed investments, he is currently fund manager at Tuleva.

Priit Lepasepp

Priit Lepasepp's everyday work is aimed at increasing renewable energy generation, and he also serves as one of Tuleva’s legal advisers.

Indrek Neivelt

Indrek Neivelt is the founder of Pocopay. He has been in a leading role at Hansabank and other large financial institutions in previous decades, and is now putting his knowledge to work for developing better, simpler payment solutions.

Daniel Vaarik

Daniel Vaarik has dedicated his career to ensuring that people get clearer and better information they need for making important decisions. He is currently a partner at Akkadian communication agency.

Kristo Käärmann

Kristo Käärmann is a co-founder of Wise. Having witnessed inefficiency in the financial sector, Kristo is helping to lead a revolution in the way money is moved, making currency exchange easier, clearer and more transparent all around the world.

Mall Hellam

Mall Hellam is the director of Open Estonia Fund. Mall’s activities are aimed toward making Estonia more open and tolerant, fostering serious discussion on key questions and building a robust civil society.

Kirsti Pent

Kirsti Pent is a partner with FORT law offices. Kirsti specializes in financial regulations, helping clients develop clear, specific solutions for financial transactions. She is also one of Tuleva’s legal advisers.

Indrek Kasela

Indrek Kasela is an entrepreneur and investor. Indrek has longstanding experience in large corporations and has also been busy developing the cultural sphere.

Annika Uudelepp

Annika Uudelepp is a civil society and governance expert with the Praxis think tank, and has long been spotlighting and helping to address issues of concern in Estonian society.

Henrik Karmo

Henrik Karmo is an investor with a broad set of experiences in building various investment companies and developing investment strategies.

Taavi Lepmets

Taavi Lepmets is an investor. Since the 1990s, Taavi has been investing into early-phase technologies, and is still on the lookout for new avenues today.

Taavet Hinrikus

Taavet Hinrikus is a co-founder of Wise. Taavet believes in simple, clear and transparent solutions and is helping to make money transfers and currency exchange easier and more convenient for everyone.

Loit Linnupõld

Loit Linnupõld is the founder of Crowdestate. Boasting longstanding experiences in the financial sector, he is helping to bring investors and real estate developers together to develop Estonian investor culture and develop access to capital.

Veljo Otsason

Veljo Otsason is a co-founder of Fortumo and Mobi and an angel investor in more than 15 companies. Veljo’s passion is new technologies: his companies help create better wireless services and payment and authentication systems.

Rain Rannu

Rain Rannu is a technology entrepreneur and investor, and a founder of Fortumo and Mobi. Rain’s passion is enterprise and developing new ideas, and likes projects that would not exist without him.

Sandor Liive

Sandor Liive’s passion lies in the energy sector. Sandor served as CEO of the state energy company Eesti Energia for many years and now is engaged in developing new solutions in the energy sector.

Heikko Mäe

Heikko Mäe is an auditor with a passion for getting things done in a meticulous manner. Heikko shared his knowledge and experience in creating Tuleva funds

Gerd Laub

Gerd Laub is a legal adviser at Funderbeam. With a background in law, he specializes in providing consultation to financial companies and helps to solve complicated problems in the financial technology sector.

Triinu Tombak

Triinu Tombak provides financial and business advisory services. She currently serves on the supervisory boards of the power utility AS Harju Elekter and the think tank Praxis.

Kadi Lambot

Kadi Lambot is a doctor who has served as CEO of a number of large enterprises. Kadi believes that the medical system needs comprehensive, user-friendly solutions and works to that end as member of the supervisory board of the Cancer Society, Healthy Estonia Foundation, and Tartu University Foundation.

Allan Kaldoja

Allan Kaldoja is an entrepreneur. His passion is developing CSOs. As supervisory board chairman, he was instrumental in getting SA Vaba Lava (Open Stage Foundation) off the ground.

Jaak Roosaare

Jaak Roosaare is an investor and the author of Rikkaks Saamise Õpik, which translates as a primer on how to get rich. Jaak devotes his time to making Estonians financially savvier, so they could make better financial decisions and enjoy a better life.

What are your rights and obligations as a Tuleva member?

Every member has the right to:

- Have access to important documentation pertaining to all activities of the association

- Participate in the general assembly and other Tuleva events

- Elect Tuleva management and apply for management positions

- Participate in Tuleva’s profit sharing based on predetermined rules

- Use Tuleva’s services and participate in members’ information sharing (for example via e-mail or in our closed Facebook group)

- Leave the association (after 5 years of membership have passed)

- Leave their assets as an inheritance to their designated heir

Every member has the obligation to:

- Comply with laws and follow the decisions made by Tuleva’s managerial board

- Pay a one-time membership fee

- Keep Tuleva’s business secrets

- Pay additional fees if decided so by the general assembly*

* This obligation has been included in our articles of association in the unlikely event that Tuleva has an unexpected need for additional capital. If a member refuses to pay additional fees which have been decided upon by the general assembly, they will lose their membership status.