There’s no surer way to increase your future capital than by saving more yourself. Last year, we – Tuleva investors – set aside nearly 30% more money for the future than the year before. In five years, our annual contributions have grown from 35 million euros to nearly 170 million euros.

A rising savings rate combined with good returns is paying off: the assets of 7,400 investors at Tuleva have already crossed the €50,000 mark. Just five years ago, only a thousand of us had accumulated that much.

Becoming a determined investor with ease

In 2022, we set a goal to help 100,000 people save “determinedly”. We made a simple assumption: if a person regularly sets aside 15% of their income, they have a good chance of accumulating enough capital for the second half of their life. Over the last two years, we have taken a significant step towards this goal: as of this January, over 30,000 Tuleva investors are contributing to Pillar II at a higher rate.

We know that the easiest way to save more and with greater determination is to do it automatically. That way, neither our own doubts (nor the providers of all kinds of spending opportunities) can derail our originally good plan. There is no simpler or more automatic savings system than Pillar II. That is why raising the Pillar II contribution rate is the most effective way to boost long-term savings: if you contribute 6% to Pillar II yourself, then together with the state’s contribution, your savings rate is already 10%! Add a little to Pillar III via a standing order, and you are firmly on the determined path.

What distinguishes us – Tuleva investors – from others is that we have made our decisions ourselves. No one has pushed us to switch our pension fund in a bank branch or a shopping mall. Therefore, it is no surprise that the savings rate of Tuleva investors is significantly higher than the market average.

By the way, thanks to updates from Pensionikeskus, we can now see the Pillar II contribution rates of our Pillar III investors even if they use another fund for their Pillar II. This aligns with the behavior of Tuleva’s Pillar II investors: people who save with Tuleva are significantly more likely to have increased their contribution rate. This is good to know: our goal is, after all, to increase people’s savings rate regardless of where they save.

A higher contribution rate, combined with wage growth and an increase in the number of investors, raised contributions to our Pillar II fund by 50%. One might have assumed that saving more in Pillar II would reduce Pillar III contributions. Recall the debates about whether it is more optimal to raise the Pillar II payment or fill up Pillar III first. However, it seems that most Tuleva investors have not let this theoretical debate distract them too much and have done the sensible thing.

- First, raise the Pillar II contribution rate, because this must be done in advance: an application made before the end of November this year only takes effect in January of the next year.

- Then, see if you can make Pillar III contributions, because you can make these for the whole current year – even on the last days of December.

For a vast number of us, larger Pillar II contributions did not prevent additional contributions to Pillar III. In a year, contributions to our Pillar III fund grew by 13%. The data shows that those who maximize their Pillar II contributions are more likely to make and increase Pillar III payments. In fact, those who raised their Pillar II contribution rate were more likely to continue or increase their Pillar III payments than those who did not.

For a great many people, the savings rate is surprisingly “stretchy” (or, in economic terms, inelastic relative to income). This is why activating investors continues to be such a rewarding endeavor: the effort made this year bears fruit for years to come. Of course, there are always people who simply don’t have enough money to save or who must temporarily reduce their savings rate because their income no longer covers expenses. Last year, nearly 1,000 of our Pillar II investors moved their contribution rate back to 2% (or reduced it from 6% to 4%). That is exactly the beauty of our pension system: you can adjust your strategy when circumstances change.

Employers are helping out

It is good to have helpers when trying to raise your savings rate. Some have a good friend or colleague to turn to, but the impact is greatest when saving is supported by your employer. Last year, several companies joined the ranks of Estonian employers who help their workforce save in Pillar III.

For example, Breakwater Technologies and Nabuminds recently decided, among others, to allow employees to simply tick a box indicating which portion of their salary they would like sent directly to their Pillar III account. In addition, they encourage saving by adding a little something of their own – 50 or 100 euros a month – to the accounts of those who contribute themselves.

It seems like a small detail, but the difference in savings rates is massive: while typically only one in five employees saves in Pillar III, the participation rate in these companies is 60% or more. It is also great news that state employees can now ask the State Shared Service Centre (Riigi Tugiteenuste Keskus) to direct a piece of their salary directly to their pension account. We even posted instructions for this on our Facebook page.

If your employer does not offer this option yet, but you believe your managers would be open to discussing it, let us know. I believe that the greatest opportunity for increasing the savings rate of Estonian people in the coming years lies right here in occupational pensions.

By the way, you don’t always need to create a new system or additional payroll costs in a company. In November, several progressive employers sent a letter to their teams about raising the Pillar II contribution rate. We did a small survey which revealed that if company managers really want employees to save, the results usually follow. There are companies where 80% of employees have raised their Pillar II rate or 95% save in Pillar III, and then there are “ordinary” companies.

The Additional Investment Fund is ready

When Kristi and I were recording the last episode of the Tuleva Podcast (in Estonian), she sighed: “Finally ready!”. We knew a long time ago that for many of us, pension funds alone are no longer enough—people want to save more. We promised to add another fund to our selection: one where you could contribute outside of the pension pillars, open an account for your child, or invest your personal company’s (OÜ) cash reserves.

In the meantime, the pension pillars improved: it became possible to direct 10% of income to Pillar II instead of 6%. This delayed the creation of our new fund, but we completed the work last year, and the new fund will start operating on February 2nd.

Creating the Additional Investment Fund (Täiendav Kogumisfond) gave us the chance to tackle tasks that had been waiting for a cleanup for a long time. At the beginning of the year, we did a “spring cleaning” of our internal rules, greatly aided by TGS law firm (along with Tuleva co-founder Kirsti Pent and Maria Suurna). After that, Maria actually came to work for us and has been responsible for compliance and risk control as a board member since the spring.

In the autumn, our office was full of developers because the platform for the new fund was built, once again, during Tuleva sprints. In the intervening years, we had allowed ourselves the luxury of hiring developers full-time. While development work was steady during that time, I always felt that in addition to one or two good IT experts, there are dozens of super-talented contributors among Tuleva members who would happily pitch in. That is why we went back to sprints.

Read more about the Additional Investment Fund here (in Estonian). Before you contribute to this fund, please double-check that your Pillar II and Pillar III tax advantages are fully utilized where possible.

Our assets grow together with our investors’ assets

Asset management is a volume business: the larger the volume of assets, the better the saving conditions become for everyone. While in Tuleva’s early days our growth was driven primarily by people switching funds, today the main growth engine is the monthly contributions of us, Tuleva investors. In five years, these have nearly quintupled. In our small market, it is more sustainable long-term to grow assets by having every person own more assets, rather than simply having more people.

We have quietly grown into the second-largest fund manager by contributions. Last year, we surpassed SEB and LHV with our Pillar II Stocks Pension Fund. Our growth comes mainly from our investors increasing their contributions, not from aggressive marketing.

The volume of assets in our pension funds grew by just under 30% over the year, reaching nearly 1.4 billion euros. Thanks to this, we were able to lower fees again in November. The ongoing charges of our pension funds are now 0.29% per year.

This is the Tuleva model: the more of us there are, saving at Tuleva, the less we all pay in fees. Here is our forecast for when our fund fees might drop again (in Estonian).

How to win trust?

Unlike contributions, the number of people joining our Pillar II has remained at a fairly similar level over the years. Tuleva funds have never been at the top of the “fund switching leaderboards”. We don’t have the kind of tools that nudge huge numbers of people who aren’t making a truly conscious decision.

However, a window opens from time to time when people suddenly take an interest in Pillar II. The pension reform of 2019–2020 was one such moment where people looked for “beacons of truth” and often found them among our investors (from influencers to financially savvy colleagues or relatives). The major campaign in 2024 regarding the increase of Pillar II payments also brought us a multitude of new exchange applications. Increasing the contribution rate last year did not generate enough excitement to set Pillar II in motion.

It is hard to create such big changes ourselves, but we can ensure that we have enough of these good “beacons of truth” among our investors, to whom people look at critical moments. That is why we did a lot of work regarding the influencer regulation proposed by the Financial Supervision Authority. It seemed to us that it excessively restricted the ability of financially literate individuals to share their knowledge. We gathered the opinions of financial literacy promoters known to us to send a well-argued position to the state. We are waiting for the amended proposal at the beginning of this year.

The best way to grow assets through fund exchanges is still to ensure that people who have already started saving with us do not leave lightly or in disappointment.

Market growth and equities suit the long-term investors

A significant part of the growth for both Tuleva as a whole and for each of our personal pension accounts comes from returns. Over a long period, we expect returns to contribute at least as much as our own contributions. One could half-jokingly say that for most of us, income is not high enough to accumulate sufficient capital for the future without the help of returns.

Our goal is to achieve a long-term result as close as possible to the global market average return. We know that for shorter or longer periods, returns can be near zero or largely negative. The past year also showed that significant mood swings can happen in the global market over a short time. The trade war unleashed by the USA at the beginning of the year took stock markets down 18% at one point. It didn’t matter whether the companies were headquartered in the USA or elsewhere. The global economy is tightly interconnected, and a change in one region often affects many.

Seeing a sudden drop of 10%, 15%, or even 30% in personal assets is unpleasant. Financial sector intermediaries therefore quickly offer tools to reduce volatility. Unfortunately, they all have one flaw: they all significantly reduce long-term returns. It is no wonder that the return of Estonian Pillar II investors has been poor for years: fund managers kept a large part of investors’ assets in low-yield bonds or even bank deposits to “avoid volatility”.

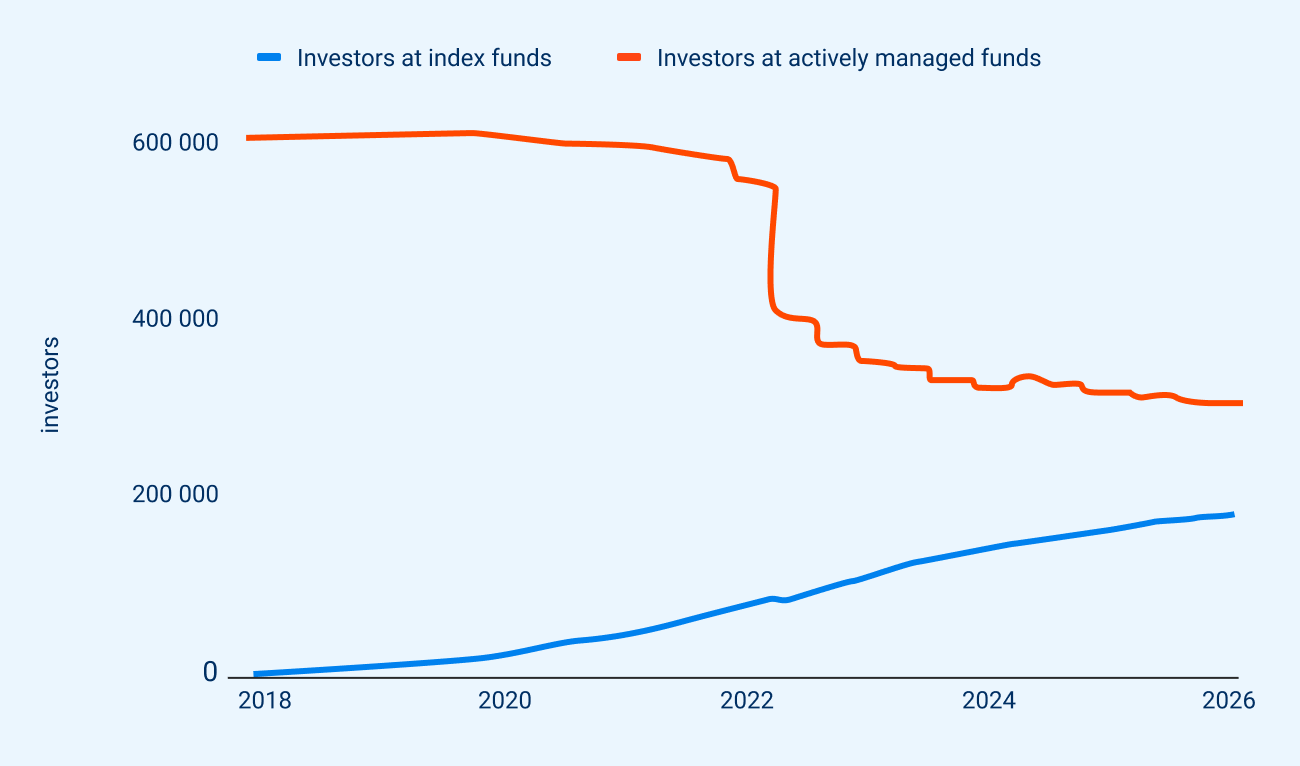

The situation has improved in recent years. While in the 2016–2020 period the global stock market grew by an average of 10% per year and Estonian Pillar II pension funds barely 3%, the ratio for the last five years was better. From 2021–2026, global stocks produced 12% and Estonian Pillar II pension funds 8% per year. Behind this are the investors themselves – increasingly, the assets of Estonian people are growing in index funds that invest 100% in equities.

However, a large portion of Estonian people’s assets still does not earn a fair share of the return offered by the global market. We cannot blame only high fees here – they are just part of the story (though not an insignificant one). Fear and established habits also play a part. For example, the idea that “as retirement approaches, one should supposedly prefer bonds over stocks”. I do not agree with this.

Global bond markets have not offered acceptable long-term returns to investors. Although global central banks lowered short-term interest rates, long-term interest rates rose slightly. This lowered bond prices. The drop in the US dollar also had a negative effect on the return of the Tuleva World Bonds Pension Fund. Namely, the portfolio of this fund holds approximately 10% in US government bonds denominated in dollars. The fund’s unit price fell by 0.5% over the year. Over five years, the unit price has fallen by an average of 2.5% per year.

…

We don’t know any secret tricks to earn returns exceeding inflation in the long term without taking risks. Instead, we look for ways to better tolerate volatility. We know that the best protection against risk is time: the longer the period we look at stock returns, the smaller the fluctuations become. The good news is that we remain long-term investors even when we are over 60.

Upon reaching retirement age, it is most sensible to use your money in the pension fund via a drawdown contract (in Estonian: fondipension) – periodic withdrawals that allow you to redeem accumulated fund units tax-free, bit by bit, over a couple of decades. All this time, the unwithdrawn units continue to earn returns. This means that even a 60-year-old person has another twenty years to invest and earn returns.

Therefore, we changed our fund terms in the spring. Our equity funds are suitable for saving through life, regardless of age. A pension fund is a good tool for hedging equity risk: it is best to make both contributions and withdrawals gradually. By putting a piece of our salary aside every month, we buy stocks when they are expensive and when they are cheap, achieving an average over the long term.

Most of our investors over 60 already follow this recipe and save in equities anyway. Now, this is also clearly stated on our website and in fund documents.

Financial result: larger volume enables even lower fees

We lowered fees twice last year and still earned a decent profit. We collected a total management fee of 2.7 million euros. This is 22% more than the year before. The average volume of assets grew by 29% over the year.

Our gross margin, i.e., the part of revenue from which we can cover our fixed costs and profit, grew to 2.2 million euros (22% more than the year before). Our gross margin is best measured as a ratio to the volume of fund assets. Last year it was 0.19%, dropping by 2 basis points from the 0.21% level a year ago.

There are always two main sources for lowering our fees. If variable costs fall – for example, the depositary fee or guarantee fund fee – we immediately reduce fees by the same amount. Likewise, if we manage to negotiate lower fees for BlackRock funds, this also immediately reduces our ongoing charges. Additionally, volume growth allows us to cut the fee at the expense of our own margin. Thus, a falling gross margin is our goal: the larger the asset volume grows, the less we need to charge to cover costs and profit.

According to initial estimates (the audit is still ongoing), our fund manager earned an operating profit of 0.2 million euros for the year. A significant difference from previous years is that, starting from the past year, our fund manager pays a license fee to the association (Tuleva Tulundusühistu), which equals 0.05% of the average volume of our funds’ assets. Last year, we transferred nearly 0.6 million euros to the association’s account. Thus, on a comparable basis, we earned twice as much profit as the year before.

As always, the change in the value of pension fund units owned by us is added to (or subtracted from) our net profit. Last year, this added 0.6 million euros to the result (in 2024, it added 1.5 million euros).

| 2025 | 2024 | |

|---|---|---|

| Service fee income | 2 687 909 € | 2 191 358 € |

| Service fee expenses | −1 067 779 € | −365 291 € |

| Financial income and expenses | ||

| Interest income | 15 213 € | 11 457 € |

| Change in fair value of financial investments | 608 753 € | 1 521 513 € |

| Labor costs | −908 884 € | −962 955 € |

| Miscellaneous operating expenses | −485 397 € | −496 257 € |

| Other business income | 67 120 € | 82 931 € |

| Operating profit (EBITA) | 229 934 € | 407 869 € |

| Depreciation of fixed assets | −63 035 € | −41 917 € |

| Net profit/loss for the reporting period | 853 899 € | 1 940 838 € |

Table: Key financial indicators of Tuleva Fondid AS. 2025 results are not yet audited.

The year ahead: new depositary, more automation

We are starting the new year with a significant change in our operations. We have used Swedbank as our depositary bank for eight years, and now we are changing providers: starting in March, our depositary bank will be SEB. The new fund will start with SEB immediately.

The list of depositary service providers in Estonia is restricted by law: one must hold an Estonian credit institution license. Therefore, the world’s largest depositary service providers cannot offer us services: no one will apply for a credit institution license here for such a small volume. So, in reality, we only have a choice between two providers, SEB and Swedbank. I believe we are paying the lowest fee in the market, but in international competition, there would still be room to cut costs further.

What will the new year bring for the funded pension system?

Our neighbor Lithuania started the new year by implementing its funded pension reform. Since the beginning of January, Lithuanians can withdraw the money they contributed to Pillar II, along with all earned returns. We are carefully watching these developments to better participate in the (re)starting pension reform debate here. (4)

In the funded pension reform debate that took place over five years ago now, I managed to get a word in for a moment during a stormy TV debate. “It’s good that we got Tuleva up and running so quickly. There are already enough of us to save money more effectively together. We are no longer affected by whatever decisions the government makes or fails to make,” I managed to add to the discussion before it went back into the twists and turns of comparing Pillar I and Pillar II.

Today, this is even more true than back then. Naturally, we take advantage of the tax deductions and opportunities created by the state’s funded pension system, but the state does not have to stand guard over the effectiveness of our investing. Nevertheless, we actively participate in the discussion. After all, we continue to be the only organization that truly represents the interests of the people whose money is accumulating in pension funds. (5)

(1) We based this on the estimate by the Arenguseire Keskus, stating that within the Estonian pension system, a person who regularly saves 15% of their salary secures a 70% replacement rate by their 65th birthday. This means that upon retiring, they can achieve an income equal to 70% of their last salary through the Pillar I (state pension) and accumulated capital. Since we do not know the income level of many of our investors, we use the Pillar II contribution rate as the simplest proxy for estimating the savings rate.

(2) The Financial Supervision Authority requires fund managers to clearly warn that the “state contribution” to Pillar II is not free but reduces the size of a person’s Pillar I. We are not big fans of such vague warnings (called disclaimers). Just as the “read the terms and consult an expert” warning means nothing in reality, knowing that the portion of social tax directed to Pillar II “might reduce” your Pillar I pension is of little help to a person. Therefore, instead of an empty warning, we created a simple tool (in Estonian) that calculates exactly how much less Pillar I pension units you have earned over the last 8 years due to participating in Pillar II, and what you have gained in return.

(3) In October of last year, the Financial Supervision Authority shared a draft document outlining good and bad practices for those sharing financial knowledge, which received quite a lot of public attention in the Estonian media.

(4) For this reason, I accepted the invitation from Tuleva co-founder Henrik Karmo to become a member of the supervisory board of the modern Lithuanian pension fund manager GoIndex UAB. I am also a member of the supervisory board of Wise Assets Europe AS, a subsidiary of Wise plc led by another Tuleva co-founder, Kristo Käärmann. The latter company offers Wise customers a possibility to hold their cash in their Wise accounts in either a money market or an equity fund.

(5) The TV show “Suud puhtaks” (in Estonian) on April 9, 2019. My turn to speak only came during the very final minutes.