When saving money for retirement, the goal is clear: to grow the value of assets as much as possible by the time you retire and start living with the money set aside. The return of a few months or years is irrelevant.

Summary:

- What counts is the long-term return over 10, 20, 30 and 40 years. Short-term returns of 6 months or 1–2 years don’t help predict this.

- There are no guarantees in the markets. Don’t believe anyone who promises you a guaranteed return or a better result than others.

- Accept that the value of your assets will fluctuate with the markets. Falls are a natural part of market cycles.

- Choose a pension fund with low fees that invests in equities and stay on course in both good times and bad.

- With all this in mind, you’ll increase the likelihood that you will have more assets by the time you retire.

Read more:

Most importantly, your goal is a good total return over the course of your working life. Not performance measured over an arbitrarily chosen short period. Not how much the value of your fund units fluctuates in the meantime.

The thing is, nobody can tell you what kind of return you can count on. If a management company hints that it will be five per cent or eight per cent a year, they are bluffing. If a sales representative says that their fund will definitely beat others, they’re bluffing too.

Since the launch of the pension pillars, Estonian people’s money in banks’ pension funds has grown by an average of 3% a year. If we count in the rise in cost of living, the return is close to zero. At the same time, world markets have grown much faster.

Does past performance help predict the future?

You have heard that past performance does not predict future performance. But what other tools do we have besides an analysis of the past?

There are no other tools. In fact, past results do help predict the future. There are just three simple things we shouldn’t forget.

1. A forecast is not a guarantee

If July has always had many hot sunny days for as long as you can remember, you can reasonably assume that this will be the case also this year. You can’t be sure. If something is likely, there is a good chance that it will come true. But things may turn out differently. Trump’s victory and Brexit were unlikely, but they happened. Nevertheless, I would bet that there will be no snow in July next year.

2. Compare the comparable

Based on July weather, it would be foolish to assume that Estonia has a year-round Mediterranean climate. If you want your money to grow over the next 40 years, it would be foolish to choose a fund based on the results of the past four months or four years. If a fund’s sales representative shows you a chart with a bold growth curve of his employer’s fund, ask them what period that chart covers. And ask them to show you how much the fund has grown investors’ money on average since the launch of the pension pillars (this is not the same as the increase in the net asset value of a unit).

The return of a few months or years will not help you predict how much your assets will grow in the long run.

3. Don’t confuse patterns with flukes

Follow the patterns and notice which market indicators have been historically linked and which ones fluctuate randomly. The former are pretty good for predicting the future, the latter are very bad for that purpose.

What can past performance predict?

Three patterns tend to recur. Market analysis has repeatedly shown that:

1. Stocks have outperformed both bonds and bank deposits in the long run

A bond issuer agrees to repay a certain amount within a certain period of time. There is no such obligation in the case of stocks – if the company does well, the investor will get their money back manyfold, and if the company does not succeed, the investor can lose everything. (1)

So, stocks involve a higher risk and companies pay a bigger reward to investors for assuming that risk. Investors know that stock prices fluctuate more in economic cycles than bond prices. They know that there is no guarantee of a better return on stocks. But they also know that the longer the investment period, the more likely they are to end up with a significantly better return by consistently preferring stocks.

Equity funds are likely to return more in the long run.

In the Estonian pension fund landscape, this means that the long-term return of most equity funds is likely to be higher than that of funds following a conservative strategy. Also, a fund whose manager keeps money safely in a bank deposit is likely to grow less in the long run than a fund that invests in stocks as much as the fund’s rules allow.

2. Attempts to outwit the market usually fail

This is what active management means: the fund manager tries to outsmart the market by investing in individual geographical areas and business sectors and trying to time the market by braking and accelerating. Studies show that 80–90% of fund managers harm their clients by doing this. The results of eight to nine out of ten fund managers are below the market average.(2)

That is logical. Outsmarting the market is a zero-sum game. For some to succeed, just as many must fail. So, only 50% of actively managing investors can theoretically get better than average results. But active management is expensive – if the costs involved are deducted from the return, most fund managers will still see a lower than average return in the future. Not only past data, but maths can prove this.

3. Low-cost funds perform better than high-cost funds

The history of the markets has shown that, time and again, the only credible predictor of a fund’s performance is its cost ratio. The lower the costs, the higher the return. The higher the costs, the lower the return.(3)

Low costs give you a head start.

That is logical too. If you are very unlikely to beat the average, it’s best to focus on the average. And achieving an average result on world markets is surprisingly easy. Diversify your assets among the stocks of all the companies in the world and stay firmly on course – don’t try to accelerate or pull the brake. Staying on course is cheap – there is no need to hire high-paid analysts or spend time writing proud reports on the fund manager’s wise decisions. Going off course is again costly and likely to be detrimental to investors.

That’s why, in the investment world, the less you pay, the more you get. Don’t you believe me? Listen to the Freakonomics podcast, where the world’s best-known experts talk about the low-cost index fund revolution. They find that choosing a high-cost fund is “the stupidest thing you can do with your money”.

What cannot be predicted from past results?

There’s one random variable here. An analysis of past data reveals a sobering fact: no fund manager beats the market all the time.

Research shows that, on average, about three or four out of ten fund managers can perform better than the market average in a year. Unfortunately, these three or four are different each year. Only one or two fund managers out of ten can beat the market average for ten consecutive years. And again, in the next decade, the stars of the previous decade are likely to have dropped out of the competition.

So, an analysis of market statistics shows that the past success of a fund manager does not increase the likelihood of their future success.

We would all like to think that there is order in the world. That if we trust our money to the care of a wise expert, our assets will grow nicely. Every fund manager hopes that they are the exception who can be better than average. Unfortunately, reality has shown that success is largely a matter of luck in the markets. The managers of Estonian pension funds have not been lucky so far. Like a casino, it’s the middleman that always wins from active trading, says Vanguard’s founder Jack Bogle. Management companies as intermediaries have taken at least half of the already poor returns of Estonian pension funds over the years in the form of management fees and hidden costs.

How much return can Tuleva promise you?

We are not mystics. We believe in empirical evidence, not fantasies or a wise fund manager’s magic. We invest passively and keep costs very low. In this way, we achieve a fund performance that goes hand in hand with world markets. Therefore, we can ensure that Tuleva pension funds’ performance will never lag far behind the average of the world securities markets (unlike the Estonian pension funds so far).

Most people in the world currently choose passive funds.

Passive investing was once a radical idea and became the life’s work of many autonomous economists, such as Burton Malkiel and Nobel Laureate William Sharpe. To date, securities markets have shown that passive investing works. That’s why most people in the world today choose a passive investment strategy.

What does Tuleva not promise?

1. We do not promise that your assets will grow 3, 5, 8 or 10 per cent every year

The world market situation is not under our control. Tuleva does not predict the future or try to outwit the market but invests based on facts.

The money of pension savers is spread among the shares of the world’s most successful companies, as this has been proven to bring the best results to the majority of the world’s investors. Time will tell what the result will be for my assets and yours in absolute terms. Unfortunately, one thing is for sure: you can’t become rich with a funded pension alone. Don’t let advertisements of the good life fool you.

2. We do not promise that the value of your assets in our fund will never decrease

Tuleva pension funds focus on long-term returns and do not worry about short-term fluctuations. Hedging short-term risk would be costly and reduce our ability as pension savers to achieve the best possible return on our assets by the time of retirement.

When the world markets are low, you will definitely see a minus in your pension account. It’s very likely that the minus will be bigger than a friend’s who saves in another fund.

A passive investor understands that a market downturn is not a threat but a natural part of economic cycles that must be peacefully accepted. Because, remember: you care about the end result, not how much the net asset value of your fund units goes up and down in the meantime. And market analysis has proven time and again that by calmly following the up and down cycles, you are more likely to achieve a good end-result than by trying to avoid short-term downturns.

3. We do not promise that your assets will grow more in Tuleva than they could in any other Estonian pension fund

Remember, statistics show that one or two fund managers out of ten achieve better-than-market performance for their clients in the long run with active management. No Estonian fund manager has had this luck yet but may have it in the future.

We don’t guarantee that your assets will achieve the best possible results in a Tuleva pension fund by the time you retire. We can say that based on market analysis and the advice of the world’s leading economists, we have created excellent preconditions for achieving a good result.

If you want your assets to have the same potential for growth as the 55,000 people who have already moved their second pillar to modern index funds, then stop paying high fees to the bank in the old funds and get a head start.

Everyone in Estonia can save together with Tuleva members in our joint pension funds. Do you want to become a member of Tuleva? Have a look and become a member.

(1)For many years, I have been using a global securities markets database developed with one of my London Business School lecturers, which currently contains the history of securities markets in 24 countries since 1900. It is now published by Credit Suisse (Credit Suisse Global Investment Returns Yearbook 2017).

Source: Standard & Poor’s

(2)Morningstar, the world’s largest analysis centre monitoring investment funds, has been analysing this for the longest time.

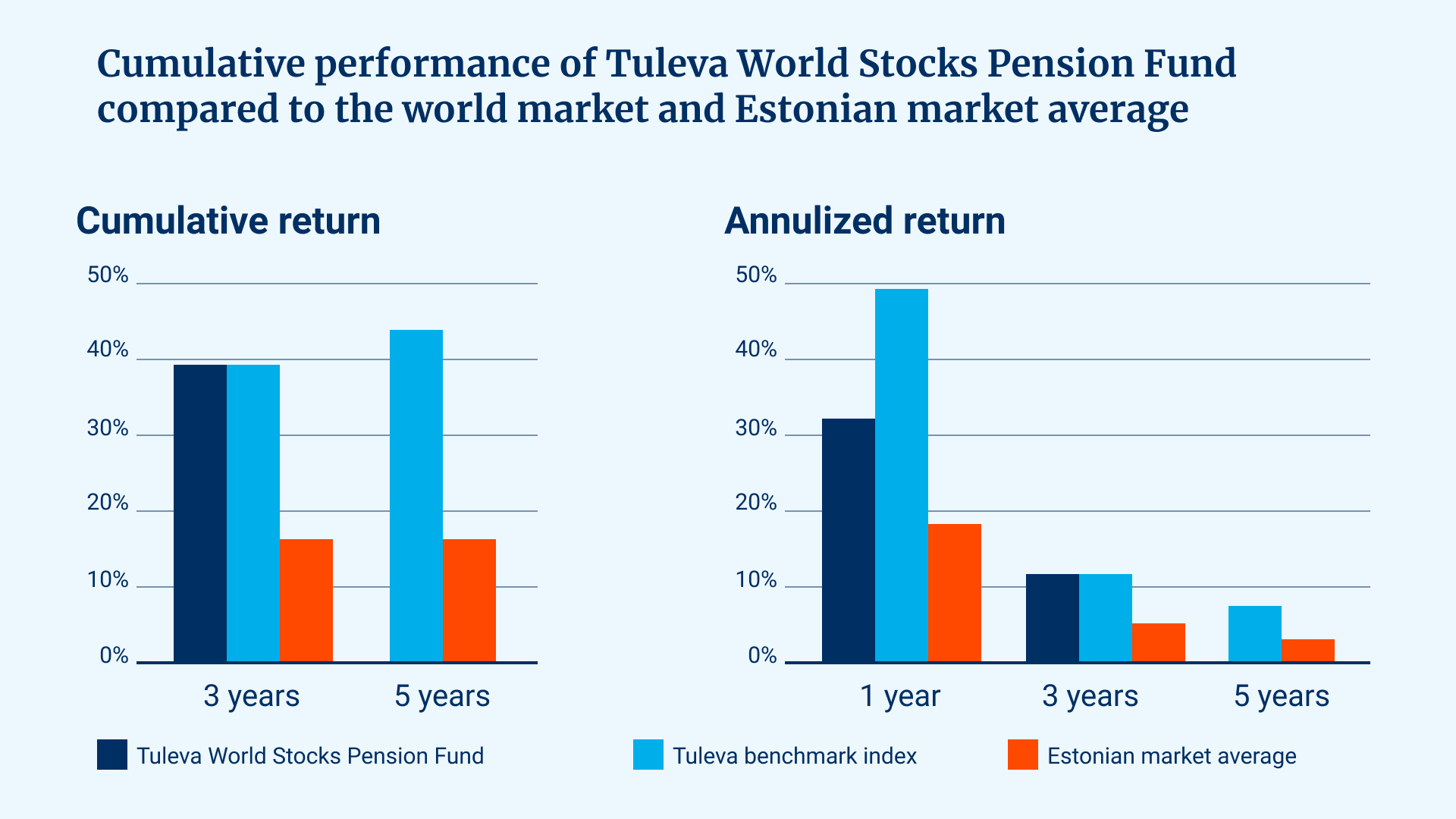

(3)The information in this article was updated on 4 November 2020. The chart above shows the unit price of Tuleva World Stocks Pension Fund, the index that the fund follows – the MSCI All Country World Index or MSCI ACWI (until 1 January 2020, our benchmark was 73% MSCI ACWI (net EUR) + 27% Bloomberg Barclays Global Aggregate (EUR)) and the Estonian pension fund index EPI as of 30 October 2020. A daily updated comparison table is here. All other data in this article is as of the end of 2019.