Dear Tuleva member,

2019 was a landmark year for Tuleva. We achieved the goals we set at the beginning almost three years ago. We have successfully launched our joint second pillar, and now also the third pillar, pension funds.

In other words, while politicians are still arguing about pension savings, we Tuleva members have already done our pension reform!

Pension pillars are not a cure-all remedy. Each of us still only saves as much money as we can put aside; just the return on investment is added and fees are deducted. That’s why the principles of saving are quite simple:

- The earlier you start saving, the less you have to economise. To reach the same amount by your 65th birthday, you have to set aside about 3.5 times less money every month if you start at age 25 compared to starting at age 45.

- That is why I encourage all Tuleva members to continue to save in the second pension pillar even if it becomes voluntary. And if you haven’t done it yet, start saving in the third pillar right now – even if you can’t save more than 25 euros a month in the beginning! (1)

- No one can predict the return on an investment. Nor is there any need to do that. Instead of trying to outwit other investors, it is wise to buy more shares regularly. That is what our joint funds do. Being shareholders in companies that drive the global economy, the value of our assets is increasing as the global economy grows. It is known that the economy tends to develop cyclically – during economic depression, the value of our assets also falls. This is inevitable. This is also why – as the Tuleva fund manager and unlike my colleagues in banks – I do not rush to stress how successful 2019 was for our pension funds. Yes, the net asset value of a unit of Tuleva second pillar stocks fund increased by 23% over the year. Yes, it’s an excellent return, and better than most bank-managed funds. But we would have had a good year even if stock prices in the markets had been in the red, as they were in 2018. Because raising money for retirement is a long game: we need to make sure the value of our assets goes hand in hand with the market average – one year’s rise and another year’s decline are insignificant in the long run.

- The impact of pension fund costs, however, is easily predictable. Every euro that an intermediary takes away from your assets today will not earn you any income in the following decades. Last year alone, those who saved money in Tuleva pension funds paid about 570,000 euros less in fees than they would have had at the average rate of bank-managed funds. (2)

Don’t trust anyone who says the impact of fees isn’t all that important. The history of the markets clearly shows the cost level is effectively the only reliable indicator that predicts the long-term performance of an investment fund.

Important events in 2019

Growth

At the end of 2019, there were twice as many Tuleva savers as at the beginning of the year – 17,072 people. The assets of our funds also more than doubled, from 67 million to 143 million euros! During the year, 1,704 people became members of the Tuleva association. As of 31 December, we were 5,641 co-owners of our own pension funds.

The third pillar

Tuleva Third Pillar Pension Fund, launched on 15 October under the leadership of Mari Kuhi. By the end of the year, 3,749 people began saving money for their future in our new fund, and the fund had grown to 9 million euros.

In less than two and a half months, we gained almost 5% of the number of third pillar savers in Estonia, but this does not matter. What matters is that members of Tuleva (and others in Estonia) now have a tax-efficient, low-cost tool for saving money using an evidence-based investment strategy. Whether you are an experienced investor or only thinking about building your investment portfolio, it is worth taking advantage of the third pillar’s tax-free limit before considering other investments. (3)

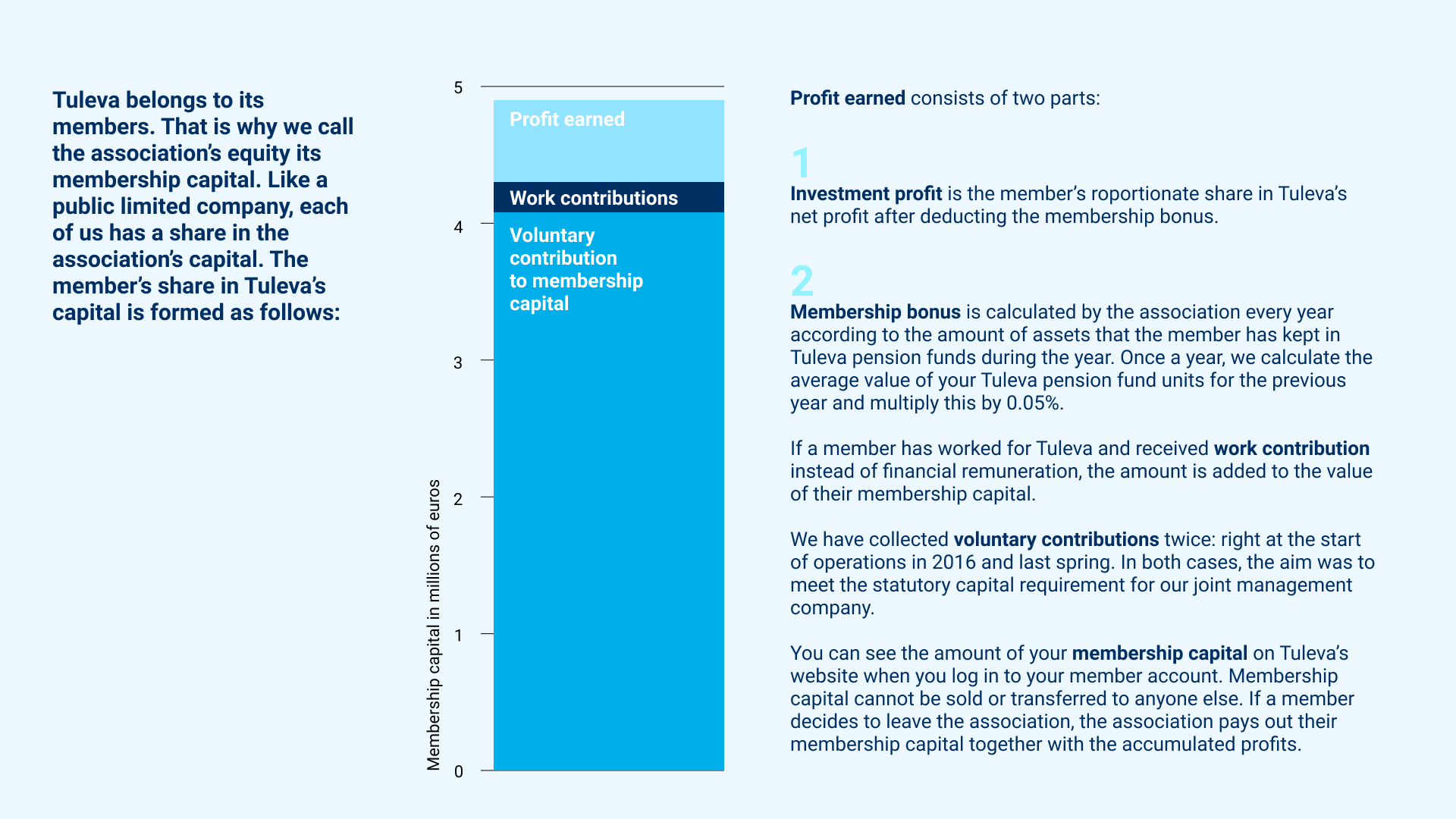

Financial results of the association

Tuleva Commercial Association ended 2019 with a profit. Consolidated operating profit (i.e. profit before financial income) was 42,258 euros, from which we covered the previous years’ operating loss. I will briefly remind you how our first years’ financial results differ from those envisaged in the original business plan. (4)

Expenditure on Tuleva IT infrastructure development

Our original business plan envisaged Tuleva’s information system as a simple website. We anticipated that people who want to save with us could apply and monitor their account balance through their internet bank.

But Tuleva grew into an influential player on the Estonian pension fund market faster than we expected. To keep our back-office operations up to date, we decided to start building the IT infrastructure earlier than planned. We realised that if we want to make saving easier and straightforward for people, we need to create our own account management system in Tuleva, allowing users to change their pension fund and monitor their pension assets’ rate of return. In 2019, more than 2,000 third pillar and almost 1,000 second pillar applicants joined us directly through the Tuleva information system.

Over three years, we have invested 250,000 euros in Tuleva IT infrastructure. Log in to your account on pension.tuleva.ee to view your second and third pillar performance and compare it to the world market average and inflation. Simultaneously, you will discover how much you would have earned by investing in another pension fund. Keep in mind that a year or two is a very short period in the context of pension funds, and you can draw no far-reaching conclusions at this stage. (5)

Lower fees – more gain for savers, slightly less income for the association

Our original business plan envisaged we would start with a 0.55% management fee, and the first opportunity to reduce fees would arrive after the fifth year of operation. Savers’ keen interest in Tuleva encouraged us to review our plans, and we decided to start promptly with a lower fee by one-third in the spring of 2017.

As Tuleva members, we are both the management company owners and fund clients; the lower management fee is as much a financial gain for us as the income we earn from the association’s fees. Since the launch of our joint pension funds, Tuleva members have saved nearly 900,000 euros on fees compared to the average fees of Estonian pension funds. Compared to the 0.55% management fee planned initially, we have saved almost 200,000 euros. (2)

Tuleva’s main advantage over banks acting as management companies is that we are not playing a zero-sum game between the management company’s owner and the pension saver. Our management fee must cover reasonable costs and provide the management company with the profit necessary for development. Suppose we start to have operating profit left over after that. In that case, we can choose as members whether to pay a higher dividend, lower the fund management fees or invest in a new project with significant effect.

Social impact

Estonia needs a smart, efficient and sustainable pension strategy. The legal amendments passed at Tuleva’s proposal have led to significant steps that will bring real financial gain to the people who work today.

Main achievements in 2019:

- The state now directs people at the start of their working careers who have not chosen a pension fund for themselves to one of the three lowest-cost equity funds. Whereas, in the past, they were directed automatically to a bond fund. The seemingly minor change – that came into force in June at Tuleva’s proposal – will give thousands of young people improved opportunities to earn a better return on their pension money.

- All the leading parties have finally acknowledged the system of funded pension disbursements needs to be reformed. At the beginning of 2020, the Parliament will start the second reading of a legal amendment package that will remove the unreasonable obligation to transfer all assets saved in the second pillar to an insurance company.

- The Financial Supervision Authority warned pension fund managers: When talking about the costs of funds, all fees charged from savers by intermediaries must be honestly disclosed. Although the legal amendment proposed by Tuleva and entered into force obliges management companies to disclose any hitherto hidden fees beginning from 2018, the marketing materials for bank funds still tended to give the impression that there were no costs other than the management fee. In a 1 November memorandum, the Financial Supervision Authority drew attention to the issue and stated clearly: “Pension fund managers must not mislead people by emphasising only the level of management fees in their advertisements but not mentioning other charges and expenses.”

How will making the second pension pillar voluntary affect Tuleva?

There was intensive debate in 2019 on the future of the funded pension system. A legal amendment package prepared on the initiative of one government party, which led to heated debates, reached Parliament by the end of the year.

The debate on whether saving for retirement should be mandatory or voluntary can be endless. One thing is clear: automatically saving in the second pillar is a good thing precisely for the reason that the proponents of a voluntary second pillar like to repeat: Nobody at age 20 should think about old age and death. However, making the second pillar voluntary favours those who consider and start saving for their future at a young age. The reform will disadvantage those who start thinking seriously about retirement only in middle age.

The most important achievements of the reform plan that have reached Parliament are greater flexibility and lower costs in using the money saved in the second pillar. Thanks to the much-needed payout reform, those who continue to save in the second pillar will benefit. The dramatic improvement in the opportunities to use pension assets will be useless for those who do not save anything in the pension pillars.

The funded pension reform plan’s critical weakness is that making the second pillar voluntary does not help solve, but rather exacerbates, the Estonian pension system’s most acute problem: many people face poverty as they retire. The plan will not help improve the return on people’s savings or bring down the costs of pension funds.

I certainly intend to continue saving in the second pillar. For those of us who save with Tuleva, the pension reform will make saving even better, as restrictions on using the money in retirement will be removed. The good thing is that there is no need to take action or apply anywhere to continue saving.

Can pension reform affect the performance of Tuleva pension funds for the savers? No, there is no need to worry about that. Our money is invested in liquid assets – shares and bonds of the world’s largest companies and sovereign bonds. If some of our savers decide to sell their fund units, the effect on the value of the units will be negligible. So, the potential reduction in fund size due to the second pillar reform will not harm those of us who continue to save.

However, the financial results of the association may be affected. If a significant percentage of savers in Tuleva funds decide to leave the second pillar, less revenue will be received from management fees. It is difficult to predict the extent of the impact without total clarity about the proposed reform. Still, it is not unreasonable to assume that most of the unit-holders in Tuleva funds will continue to save for the future. First, the clients of our funds are more aware than average. They understand that, even if the second pillar becomes voluntary, it makes sense to continue saving with Tuleva due to the low costs, the evidence-based investment strategy and the second pillar’s tax advantage. Second, by saving together, we will certainly continue negotiating better conditions with international management companies than any of us would when buying index funds individually.

In any case, it is important to remember that the assets of our savers are not exposed to the business risks of Tuleva as an association.

Future plans

Now that we have successfully launched our joint second and third pillar pension funds, it is time to focus on strengthening the organisation and preparing for the next strategic steps. We will make our back office more efficient, automate important operations, expand the Tuleva team and elect a new supervisory board for the association. In the second half of the year, we will start analysing the opportunities for developing the next saving solutions – for example, those who want to invest more than the third pillar’s tax-free limit or who want to set aside money earned as business income. We will still follow the principle that we will only develop our own product if it has a significant advantage over those already available on the market.

Improving back-office efficiency

We continue to be the only management company in Estonia that only manages index funds. We operate in an environment created for traditionally “manually managed” funds. Our operations can be largely automated, but this requires cooperation with service providers, including Pensionikeskus and the depositary, and the Financial Supervision Authority. Many of our own rules and procedures can now be improved based on actual experience.

Developers, follow our blog, Facebook page and other information channels – we will definitely continue to use the sprint format when building IT infrastructure.

Expanding the team

In addition to Tuleva’s three employees, other top experts from Tuleva’s membership pool also play key roles in developing the association. In this way, we build a dynamic team that reflects the opportunities and needs of the modern world and the association format.

Tuleva currently has three people on the payroll:

- Mari Kuhi is a member of our management company’s management board and the controller of the association and management company. Mari’s responsibility is to ensure that our everyday operations and transactions work in full compliance with the law and internal procedures. The project to launch the third pillar was successfully completed in 2019 under Mari’s leadership.

- Media editor Kristel Raesaar develops the Tuleva blog and is responsible for sharing honest, transparent and understandable information on social media and other channels.

- Tõnu Pekk, a member of the management board and fund manager of Tuleva association, is responsible for strategic and daily organisation of work, implementing the investment strategy of our pension funds and managing IT development projects.

Significant contributions to the association’s development were also made last year by:

- Kristi Saare, who helped with raising membership capital and provided expert input in third pillar matters;

- Liis Aljas, who acted as controller while Mari was launching the third pillar fund;

- Liis Reinhold, who keeps the accounts for the association and the management company;

- Erko Risthein, Jordan Valdma and Maido Käära, who develop and maintain our IT infrastructure and ensure the results of IT development sprints are implemented;

- Katrin Vilimaa-Otsing, who helped carry out our social media information campaign in spring.

In 2020, we plan to hire at least two more people for our full-time team. Working in a start-up company with a social impact, which focuses on long-term investment, requires specific knowledge. We do not expect to find professionals with a ready set of skills. Instead, we are looking for people who are willing to develop with Tuleva. Our main requirements for current and future employees are shared values and a desire to work effectively, with a vision, constantly learning while being responsible for results and detailed accuracy.

If you are interested and have the prerequisites to work for Tuleva in the field of financial and management analysis or product development, let us know today or keep an eye on our blog and Facebook page!

Electing the new supervisory board together

The term of the supervisory board will come to an end this spring. Tuleva’s first supervisory board began its work when the association had only 22 founding members. The supervisory board sets the strategic development directions for Tuleva and ensures the executive team implements these effectively.

The founding members continue to play an essential role in the election of the supervisory board, as they elect half of its members. This is an insurance policy outlined in our articles of association to prevent a hostile takeover and departure from the original objectives.

Each member of the association votes in electing the other half (five members) of the supervisory board. Also, every member of the association can set up their own candidacy and nominate candidates. You will find the invitation and instructions for nominating candidates in the e-mail sent to members in early February. Voting will occur during an electronic general meeting, and the new supervisory board will meet for the first time in May. Be sure to use your right to have a say in the development of the association!

Tõnu Pekk

Member of the management board of Tuleva Commercial Association

In Tallinn, on 9 January 2020

Consolidated Balance Sheet as of 31 December 2019 and Income Statement for 2019 (in estonian)

Tuleva TÜ 2019 Annual report (in estonian)

Auditor’s Opinion on Tuleva TÜ 2019 annual report (in estonian)

2019 Profit Distribution Proposal (in estonian)

___________________________

(1) If you have time, read the “Laura’s Journey to Wealth” articles series on our blog. It is a guide about saving on taxes and accumulating decent wealth with the second and third pillars’ help. Start here.

(2) The calculations used in the management report with references to the sources are here.

(3) See more: https://tuleva.ee/en/third-pillar-slidedeck/

(4) The figure given here is consolidated operating profit; financial income is added to it in the association’s income statement. This is the gain or loss arising from the revaluation of our main financial asset – pension fund units purchased for membership capital. Although in 2019 it added as much as 660,728 euros to the profit, there is no reason to get excited about this figure. After all, we know that the financial markets fluctuate and this year’s profit may be next year’s loss.

(5) Remember what the return on our assets in Tuleva funds depends on: https://tuleva.ee/en/recommendations/what-return-expect/