It is said that you have to set aside at least one-fifth of your salary to have a sufficient income in the second half of your adult life, after retirement.

The first good news is, it’s easier than you think. The second good news is that you’re pretty likely to make a million if you really do so. Let’s take a closer look.

Please meet Laura – a fictional character who has been on my mind since the creation of Tuleva. Laura is a member of Tuleva. Our task in Tuleva is to help Laura become wealthy by setting aside small sums. This is why we devised our low-cost second and third pillar funds – tools that every person working in Estonia can indeed easily use.

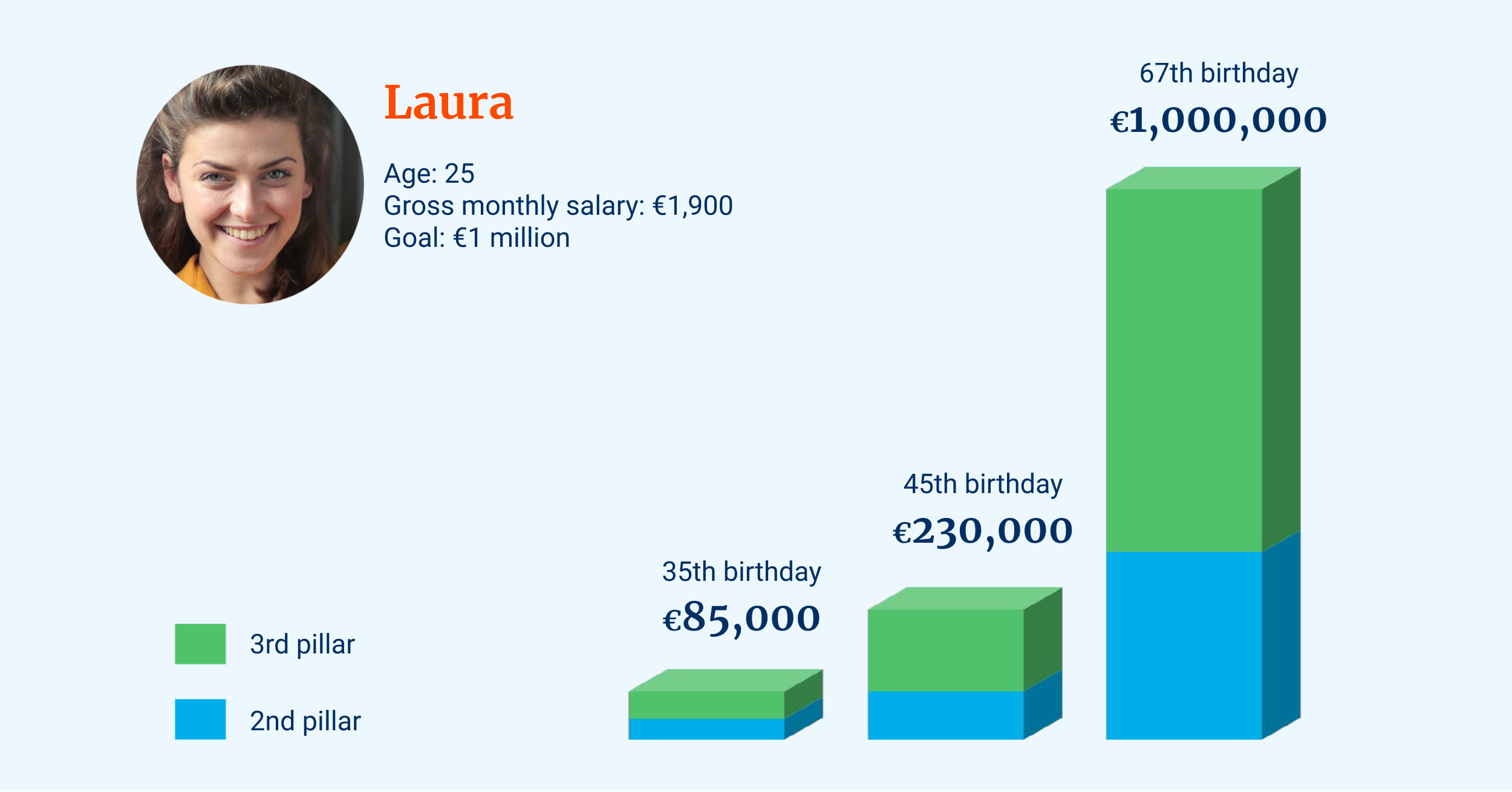

Laura is 25 years old. She works and earns 1,900 euros a month before taxes. What does Laura have to do to collect 1 million euros by her 67th birthday without thinking about investing on a daily basis?

First: 6% of Laura’s salary automatically goes to the second pillar. This way, Laura will collect about 300,000 euros by her 67th birthday.

Second: Laura takes full advantage of the third pillar tax incentive and contributes 15% of her gross salary to a third pillar fund each month. This way, she will collect another 700,000 euros.

And that’s a million.

I’ve made some simple assumptions here:(1)

- Laura’s pension funds invest all their money in equities and spend less than half a per cent of Laura’s money on fees every year. Read more about why this is important.

- Laura’s salary is gradually increasing – on average by 3% a year. Stock prices in global markets will grow by an average of 5.5% a year in the coming decades. That’s a little less than the world stock markets’ historical return over the past hundred years. No one knows what the markets will offer in the future – maybe much less, maybe more. What is certain is that growth is not one-way: when the economy is good, Laura’s assets grow boldly. In times of crisis, she will have to accept significant falls. Again: no one can predict the future, but those investors who have stayed on the course in both good and bad times have done the best so far.

- Hence, the third, most crucial assumption: Laura contributes to the second and third pillars regularly every month. She doesn’t change her mind. She doesn’t panic when she reads the news about an economic crisis and stock markets crashing. She doesn’t exchange her low-cost fund for a high-cost fund when a salesperson in a shopping mall shows her a colourful chart. In short: Laura started making contributions at age 25 and doesn’t need to think about pension anymore.

Why don’t you start the simple way? First, fix your second pillar: choose a low-cost fund.

Next, set up the third pillar – you will receive an income tax refund on this year’s contributions already next spring.

Now you are all set to accumulate a decent fortune. Easy.

Read the following articles in the series:

- 1. Starting to invest is easier than you think

- Bonus chapter: Questions and hesitations you may have after reading Part 1

- 2. Which fund is the best to save in?

- 3. How can I win on taxes?

- 4. What if stock markets fail?

- 5. What if you want to earn even more?

- 6. Summary: Tõnu’s real-life investment portfolio

(1) The calculations are here – feel free to make a copy of the file and try out other assumptions.