We implemented two positive changes in our funds. First, we lowered fees once again — now, the ongoing fees for all Tuleva funds are just 0.31%. Second, we clarified our recommendation to save in an equity fund regardless of age. The goal remains the same: to create the best conditions for growing our money as savers.

The more savers in Tuleva, the lower the fees for everyone

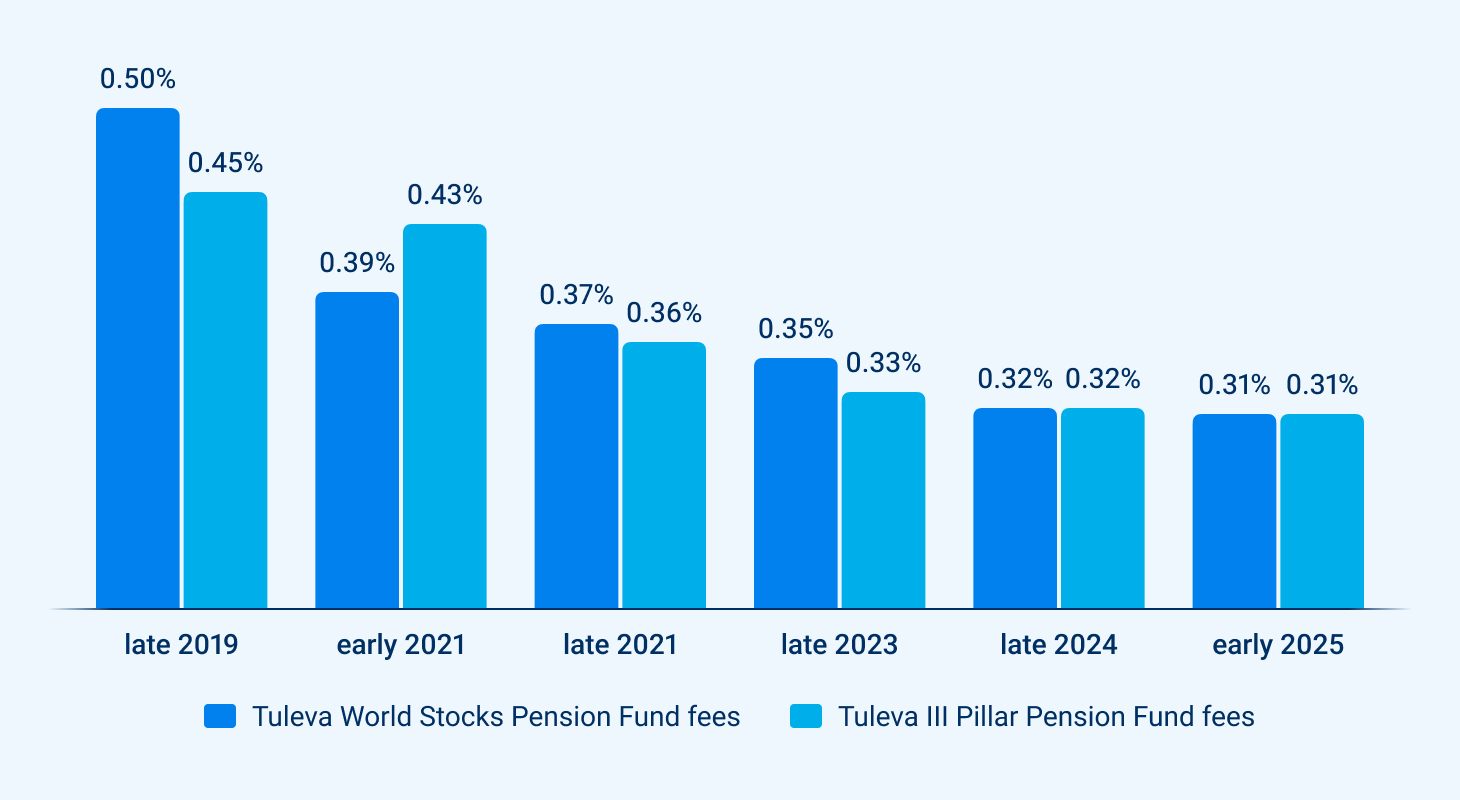

Since the launch of Tuleva, we have lowered our fees six times. Back in 2017, we started with a 0.5% fee, and now, as of March, the total ongoing fees for both the second and third pillar funds have dropped to 0.31%.

Investing is a scale business — the larger the assets we manage, the lower the costs per saver. Since our last fee reduction in November, our funds have grown by €100 million, allowing us to lower fees again.

I’m confident that we’ll reduce fees even further in the future. After all, Tuleva is owned by its savers, and we have every reason to lower costs as soon as it’s sustainable.

For Tuleva association members, saving in our funds is even more beneficial. As owners, we get part of the fee back — every year, we receive a 0.05% member bonus on our second and third pillar savings in Tuleva funds.

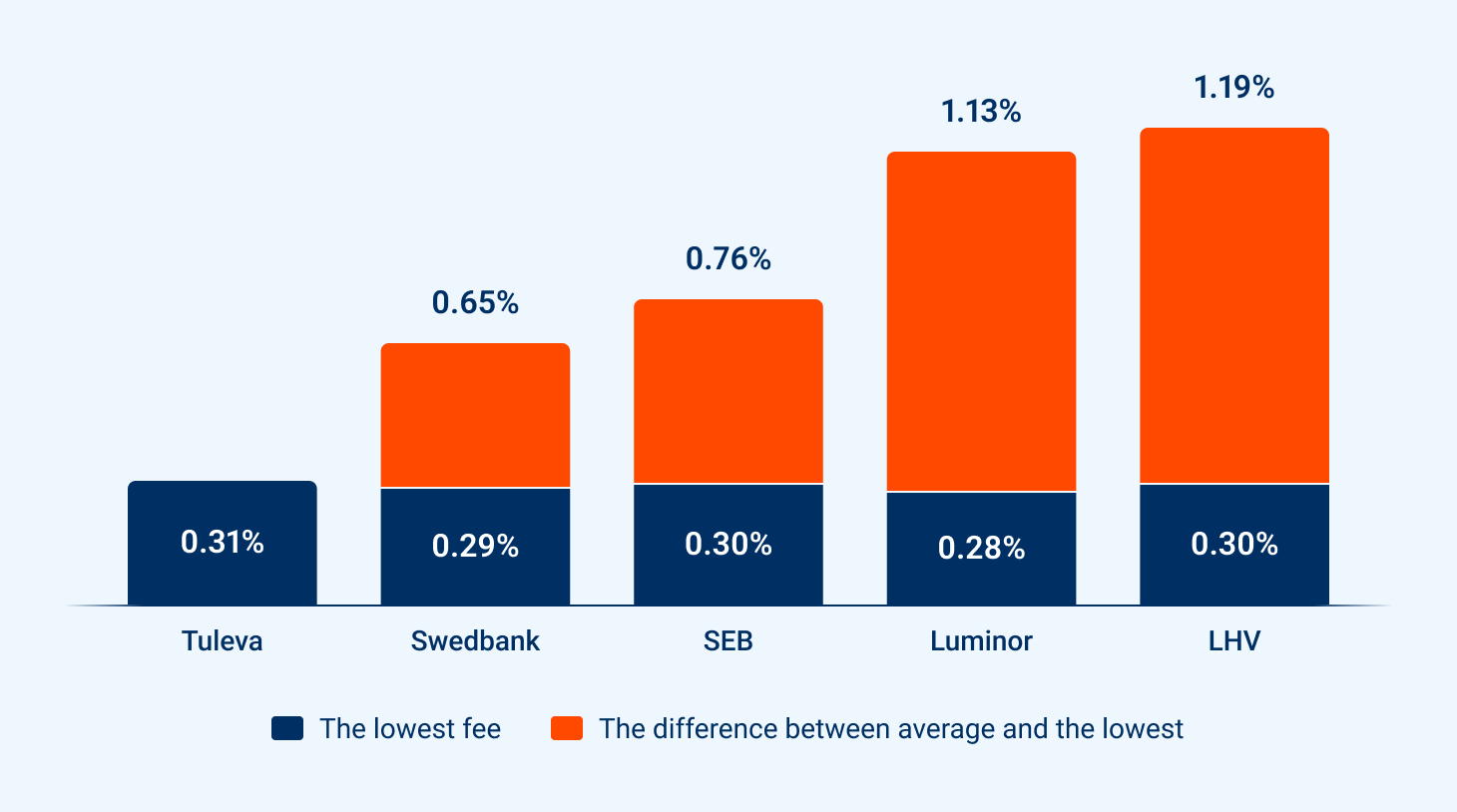

For those who are not members of Tuleva association, you can find some slightly lower-fee index funds in the pension fund selection at banks. These are also solid options for long-term saving. We’re genuinely happy that index fund fees across the board have significantly decreased over the last five years.

It’s only sad that the fees for banks’ old actively managed funds have not followed the same trend. In fact, nearly two-thirds of Estonia’s second-pillar savers are still in those expensive funds. The reality is that banks cover their high costs and generate profits for their owners at the expense of these savers.

Money should generate returns for as long as possibleIn addition to lowering fees, we also clarified our recommendation to stay in an equity fund regardless of age. Previously, we set a conditional age limit at 55, while still outlining cases where stock funds could be considered beyond that. We’ve learned that our recommendation needs to be even clearer.

So, here it is: A low-cost equity fund is the best choice if you don’t plan to withdraw your entire second pillar within the next five years.

The key point is that the biggest risk for Estonians when saving for retirement isn’t market fluctuations — it’s not saving enough. Very few of us earn high enough salaries to accumulate a sufficient amount without earning returns on our savings.

Risk and return go hand in hand in investing. While stock prices fluctuate more than bonds, the historical long-term returns of stocks have been significantly higher. Finnish and Swedish pensioners don’t live well because their governments hand out generous benefits, but because their savings have compounded strong returns over decades.

What should you do?

Market fluctuations won’t worry us as savers if we use our second and third pillar funds as a regular pension supplement. The state pension (first pillar) provides stability. That’s why Sweden, for example, automatically keeps people saving in equity funds even at an older age — because it serves as an addition to their national pension. In Sweden, people can’t even withdraw their pension savings in a lump sum; they can only take it as monthly payments.

What Sweden has made automatic for its citizens, we can choose to do manually. The good news? You don’t have to do much at all. Tuleva savers can confidently continue accumulating money in our second and third pillar stock funds until retirement without unnecessary fund switches.

If you eventually need to start using some of your savings, just log in to our website and set up regular drawdowns (by signing a fund pension agreement).

Historical stock market data suggests that with this approach, there’s less than a 2% chance that your total withdrawals will be lower than your total contributions — even if you moved your savings into stock fund just before starting withdrawals.

Of course, this is not a guarantee — the future may look very different from the past 100 years in the stock market. It’s human nature to underestimate long-term statistical probabilities. But looking at it the other way around, this is how we can make the most of the contributions we’ve made over our lifetime.

The updated fund prospectuses, along with official explanations, are linked here: II Pillar Prospectus and III Pillar Prospectus (in Estonian). These took effect on March 3, 2025.

(1) Over the past five years, fees for all Estonian second-pillar index funds have decreased by 10–20%. Meanwhile, fees for actively managed funds have mostly increased. You can see the fee trends here.

(2) Finland’s largest pension fund manager, Ilmarinen, has achieved an average annual return of 6% over the past 27 years, while Sweden’s national pension fund, AP7, has delivered an average annual return of 9% over 23 years. Sources: Ilmarinen 2024 annual report and AP7 Safa website.

(3) More specifically, historical data suggests that with 95% certainty, a person who moves their savings into an equity fund at age 55 will see their assets exceed both their starting balance and interim contributions after 10 years. For those interested in statistical analysis, this Google Sheet provides further details. I’ve kept the calculations as simple as possible.