To date, we have been able to save money in Tuleva’s very own third pillar fund more than three years! As in our second pillar funds, you don’t have to be a member of the association to join us in the Tuleva third pillar.

Start investing from the third pillar!

A simple rule to follow for both beginners and advanced investors: always start with the third pillar. There is no point in looking for other investment opportunities until you haven’t taken full advantage of the third pillar tax incentive. Why?

1. There are not many investments that guarantee an immediate 22% win

Anyone can transfer up to 15% of their gross income (but not more than 6,000 euros a year) to the third pillar free of income tax. If you have already paid your tax, you will receive a refund after filling in your income tax return. For example, if you invest 2,000 euros, the state will give you 440 euros back.

2. You can withdraw the money at any time

You can withdraw money from the third pillar whenever you want. You can also bequeath the units of a third pillar fund. Disbursements are taxed as follows (more here):

- If you withdraw money before the pre-retirement age (currently 60 years), you will have to pay 22% (from 01.01.2025) income tax on your III pillar assets. However, this does not cancel the effect of the tax incentive. Effectively, you will have received an interest-free leverage loan from the government.

- If you wait until your 60th birthday and have been saving for at least five years until the moment of withdrawing the money, only 10% income tax will apply.

- Those who saved in any third pillar fund or insurance product before 2021 can withdraw money at the favourable 10% tax rate from the age of 55.

As usual with investments in stocks: don’t invest the money you need in the near future. The third pillar is suitable for saving with a longer time horizon.

3. No need to pay for a securities account

There is no need to spend time or money opening a new bank account or paying a fee for buying and holding fund units. Every Estonian already has a free account in the national pension register – the one where the second pillar assets accumulate.

Why do we need our own fund?

As said, the third pillar is the best tool for long-term saving, thanks to the tax incentive. Until now, this incentive tended to shrink in the hands of bank intermediaries. First, the fees for third pillar funds are even higher than for the second pillar. Second, the investment decisions of bank fund managers have so far not been successful for savers.

When we launched our joint third pillar fund, we did two things differently than most bank funds.

- The total cost of the Tuleva fund is around three times lower than the large third pillar funds of banks – up to 0.31% per year (Updated 01.03.2025). By the way, our fund may not be the lowest at any given time, because we do not subsidize the costs of any fund at the expense of other clients. But in Tuleva, you can be sure that your fund’s fees are among the lowest and that the fees will also decrease in the future. (1)

- Second, we do not speculate on market fluctuations but simply reserve a part of our wages every month and buy more shares of the world’s largest companies. Over time, our holdings in the companies that drive the world economy will grow, and the value of our assets will increase as the companies grow and pay dividends.

Like in the second pillar, these two things give us pretty good assurance that the growth of our assets will never lag far behind the growth of world stock markets. And as in the second pillar, the long-term performance of any bank fund has so far not even come close to the global stock market average.

As with our second pillar funds, one more thing is quite certain: the value of our assets will not rise steadily. When the world economy is in recession and stock prices fall, the market value of companies and, with it, the value of owners’ assets, including ours, will decline. This is not pleasant, but the history of the markets shows that, in the long run, we are earning more by staying on the course than by timing sales and purchases and trying to outwit the market.

Where do we invest our assets?

For the money invested in the Tuleva Third Pillar Pension Fund, we buy shares in around 3,000 of the world’s largest listed companies – all of which are included in the MSCI All Country World (MSCI ACWI) index.

As a reminder, an index is nothing but a list. The MSCI ACWI index is a list of the world’s largest listed companies by market value. The relative share of each company in the index is its market value divided by the total market value of all the companies in the index. (The stocks of more than 30,000 companies are traded on world stock exchanges. The MSCI ACWI draws a line at the 3,000 largest companies for practical reasons, as the relative share of each following company in the portfolio would be negligible.)

In September 2022, we introduced one addition: we will exclude nearly 200 companies from the list of the world’s largest 3,000 companies that do not meet the generally accepted criteria for sustainable and responsible investing (ESG). This does not change the main goal of our portfolio – to achieve the average return of the world market – but it gives an opportunity to take a small step in this direction to take into account and reduce the negative impact that our investments have on the world’s natural and social environment (2).

We do not buy stocks in these companies one by one, but we invest through four global index funds. It’s just cheaper. Due to the large volumes, the purchase of stocks involves near-zero costs for the world’s leading index funds. If we were to buy stocks in each company separately every month, it would be terribly expensive for us.

Learn more: what exactly is inside our portfolio?

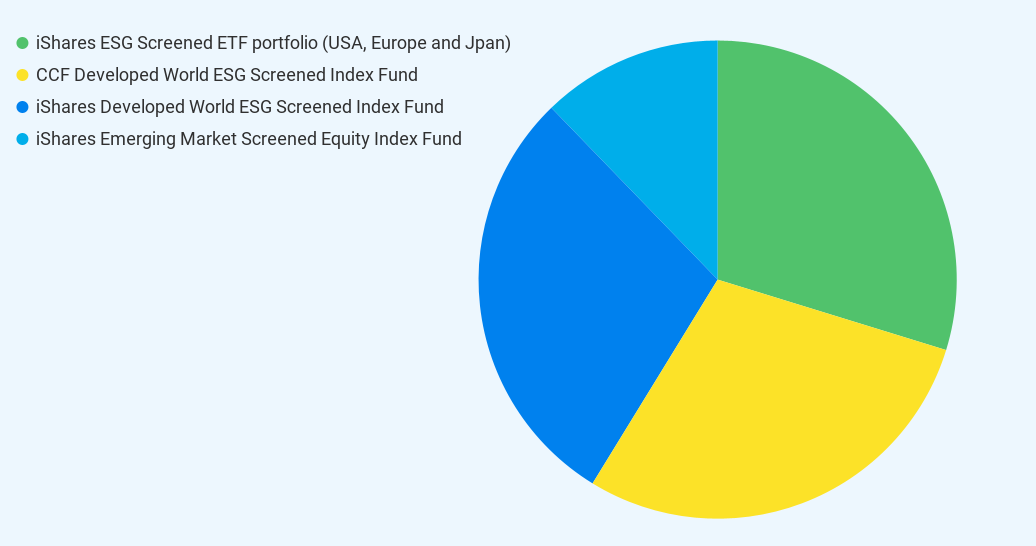

We divide each euro saved in the Tuleva Third Pillar Pension Fund between BlackRock Funds as follows:

First, 90% of the money goes in index funds that invest in stocks in developed countries. These three funds are:

- iShares MSCI USA ESG Screened UCITS ETF, iShares MSCI Europe ESG Screened UCITS ETF, iShares MSCI Japan ESG Screened UCITS ETF

- CCF Developed World ESG Screened Index Fund

- iShares Developed World ESG Screened Index Fund

Why are we using these three funds that all invest in the same stocks? The Investment Funds Act allows a maximum of 30% of assets to be invested in one fund. The legislator wants to make sure that pension funds diversify their risks, although, frankly, this restriction is quite unnecessary in the event of a global index fund. In any of these three funds, the risks would already be very well diversified.

10% of the money goes to the iShares Emerging Market ESG Screened Equity Index Fund

The vast majority of companies in the MSCI ACWI index are in the developed world, and just over a tenth are in developing countries. Funds that cover the entire MSCI ACWI index have, for some reason, a higher management fee than the separate portfolios of developed and developing country funds. This is the simple reason why we use different funds to buy stocks in companies in developing countries.

Tuleva Third Pillar Pension Fund keeps a small cash reserve at all times to cover possible withdrawals. When we started the fund, the cash reserve was as much as 3% of the fund’s assets. Today, the volumes have grown so much that 0.5 million euros is enough, which is less than 0.5% of the fund’s assets.

Savers in the third pillar can sell their fund units at any time. According to the law, such a sales transaction must be completed within three banking days. As long as the size of our fund is small, we keep a slightly larger cash reserve at the beginning and review it regularly.

The current fees of the fund are 0.31% per annum.

The current fees of the Tuleva Third Pillar Pension Fund, i.e. all expenses covered from the investor’s pocket, are 0.31% per annum. These expenses include our fund’s management fee (0.21% per annum), the custodian fee (0.03% per annum) and the fees of the funds in our portfolio (0.07% per annum).

In the Tuleva Third Pillar Pension Fund, no one has to pay a fee to start saving or to withdraw money.

Our fund’s expenses are still among the lowest and more around three times lower than those of banks’ large pension funds .

Any entry and exit fees of second pillar pension funds were abolished by the state a few years ago on the proposal of Tuleva. However, in the third pillar, some bank pension funds still charge 1% of the investor’s assets as an “exit fee” when withdrawing money.

What should you do if you have already saved money in a bank fund? Unfortunately, when switching funds, you still have to leave 1% of the assets to the bank for some funds. Nevertheless, it’s still advisable to exit these funds immediately: In less than a year, a typical bank fund would charge more than Tuleva, even taking into account the cost of switching funds.

(1) You can compare the current fees of all pension funds on the Pensionikeskus page. For insurance products, you need to look carefully for the “Key information document”.

(2) Read more how Tuleva funds implement sustainability policy

The current model portfolios of Tuleva pension funds (in Estonian).

* Article updated as of 06.01.2025