In spring 2016, 22 Estonian entrepreneurs and prominent public figures made a promise to one other to help make pension saving more cost-effective for people in Estonia. We established Tuleva.

The birth of better pension funds was made possible by the 3,000 Tuleva members who teamed up with the founders right from the first months. Today, the dream is a reality. Nearly 80,000 savvy people are already saving for their future with Tuleva’s modern, low-fee pillar II and pillar III funds.

If you work in Estonia, you’re most likely already investing in pillar II. (1) You can contribute 2%, 4% or 6% of your gross salary to pillar II, income tax-free. In addition to your own contribution, the state adds 4% of the social tax to your pillar II. (2) Choose a low-fee index fund today, because the less you pay in fees, the more you’ll have left for the future. Choose Tuleva, because the more people there are who invest together for their pension, the more favourable it becomes for all of us.

If you can spare just a moment,

here’s what I’d say:

Tuleva will be useful for you.

Tuleva’s pension funds are among the most favourable in Estonia: the total expense ratio is 0.31%, including a management fee of 0.24%.

Tuleva is as safe as a bank fund.

Tuleva’s customers have, of course, all the same rights and guarantees as the customers of banks’ pension funds. We are supervised by the Financial Supervision and Resolution Authority, and investors’ assets are always held separately from the management company’s funds by the depositary, which is Swedbank. Additionally, the state Guarantee Fund protects investors in all second pillar pension funds against the worst. Find out more at pensionikeskus.ee.

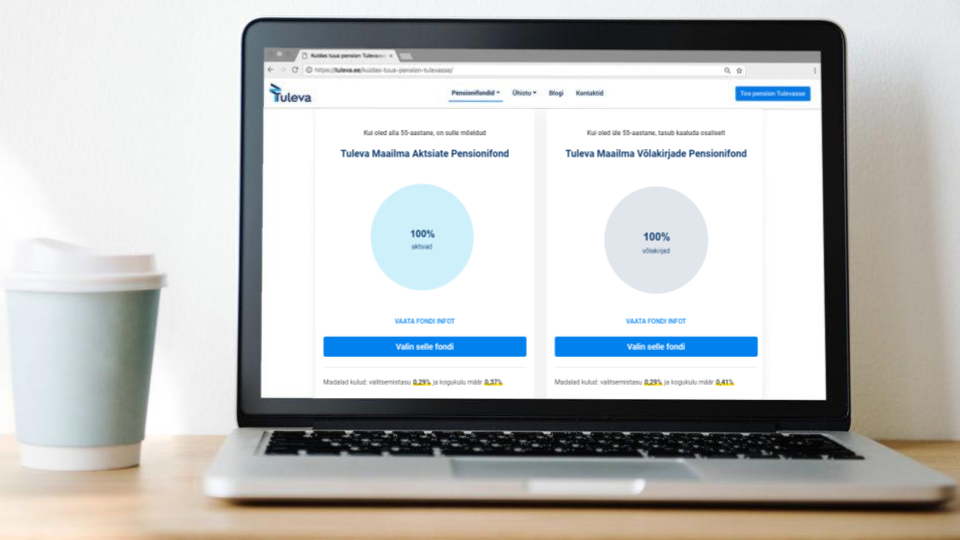

Tuleva World Stocks Pension Fund

It’s a low-fee index fund that invests entirely in stocks. The performance of this fund can fluctuate sharply from year to year. The expected return is still significantly higher than that of a bond fund.

It’s suitable for you if you want the best long-term returns and don’t plan to withdraw your entire pillar II within the next 5 years. It’s the fund in which most Tuleva members and founders invest for their pension.

Tuleva World Bonds Pension Fund

It’s a conservative index fund that invests entirely in low-risk bonds. The expected return of this fund is significantly lower than that of a stock fund. A good return just isn’t possible with low risk.

It’s suitable for you if you plan to withdraw your entire pillar II within the next 5 years and are willing to trade returns for security.

Transferring your pension to Tuleva will only take a few minutes.

Transfer your pension to Tuleva

A closer look: what’s inside Tuleva’s funds?

Tuleva’s funds have a low cost base and invest, according to clear rules, in the stocks of the world’s leading companies and in sovereign bonds. We’re not trying to outsmart the market – we’re simply spreading the risks over time and across space. When markets rise, the value of your investment portfolio grows, but the new fund units that you buy for your monthly contribution will cost you more. When markets fall, you can buy new units at a lower price, which helps balance things out.

This is known as a passive investment strategy. The world’s economists consider this to be the most reasonable approach for pension investors. Why? Because eight or nine times out of ten, a passive investment strategy has delivered better long-term returns to investors than active fund management (3).

You’ll get the most out of Tuleva if you transfer all the pension fund units you’ve accumulated so far and also redirect your future contributions to a Tuleva fund. No one knows which fund will give the best return over your lifetime, but you can be sure you’re saving as much as possible on fees and commissions. And those savings will, in turn, earn you returns in the long term. I’ve already transferred all my pension assets to Tuleva World Stocks Pension Fund – as far as I know, the rest of Tuleva’s team and its founding members have done the same.

Tuleva World Stocks Pension Fund

We invest 100% of the money received into this fund in stocks. (4)

We spread the money across three funds that track a developed world stock market index. Why three funds that are essentially the same? Because the law allows pension funds to invest a maximum of 30% of their assets in a single index fund.

Therefore, we invest:

29,5% in iShares Developed World ESG Screened Index Fund

29,5% in CCF Developed World ESG Screened Index Fund

22,6% in iShares MSCI USA ESG Screened UCITS ETF

7.6% in iShares MSCI Europe ESG Screened UCITS ETF

0.8% in iShares MSCI Japan ESG Screened UCITS ETF

You can click the links to read more about these funds and see how they’ve performed so far.

The rest of our fund’s stock investments go into an index fund that tracks the stock markets of developing countries:

10% in iShares Emerging Market Screened Equity Index Fund (IE)

Why is this a separate investment? Well, for some reason, the management fee for the fund that tracks the global index is higher than the combined fees of its components. The biggest difference comes from the funds of large markets (developed countries) versus small markets (mainly developing countries).

It’s important to note that all the funds in our portfolio are denominated in euros, but they include assets that may be denominated in US dollars, Japanese yen, or other non-euro currencies. So, if the euro strengthens against those currencies, the value of many of the assets in our portfolio could drop in euro terms. And vice versa.

In principle, Tuleva could also have access to funds that hedge currency risk. We don’t use them, though, because exchange rate fluctuations aren’t the enemy of pension investors. Historically, the average long-term saver has not gained or lost anything from hedging currency risk. If hedging were free of charge, we’d perhaps consider it. Unfortunately, nothing comes free of charge and hedging involves costs for the investor. Like with any other costs – if they don’t add value for the investor, we won’t incur them.

In September 2022, we introduced a change to exclude from the list of the world’s largest 3,000 companies nearly 200 companies that don’t meet generally accepted criteria for sustainable and responsible investment (ESG). This doesn’t alter the main goal of our portfolio – to match the average return of the global market – but it allows us to take a small step towards considering and reducing the negative impact our investments have on the world’s natural and social environment.

At Tuleva, we believe it makes sense to save in a stock fund for as long as possible. Simply for the reason that the real risk for people in Estonia who save for retirement isn’t that your accumulated assets might lose value – it’s that you won’t save enough. Few of us earn a high enough income to build up a sufficient amount without earning some returns. In investing, risk and return go hand in hand. While stock prices fluctuate more than bond prices, the long-term historical return on stocks has been significantly higher than that of bonds.

Tuleva World Bonds Pension Fund

Tuleva’s second pension fund is highly conservative and doesn’t invest in stocks at all. By law, every pension fund management company must offer a fund for people who want a chance at better returns while saving for retirement but can’t afford fluctuations in the value of their pension fund units. This fund might be right for you if, for example, you’ve already saved enough for retirement and plan to withdraw the entire amount from your pension fund at once. In that case, it might also be worth considering transferring your assets to a pension investment account instead of a bond fund to avoid losses in your assets’ value. Although the value of bond fund units tends to fluctuate less than that of stock fund units, changes in asset values cannot be ruled out because the bond market is affected by interest rate movements.

In addition, some people get very nervous when the value of their investments fluctuates. By the way, if you’re one of them, remember that by saving for retirement in small amounts, your purchases are nicely spread out, so you don’t have to worry about short-term ups and downs. Jack Bogle, the founder of the Vanguard index funds, advises: “Don’t peek”, meaning don’t constantly check your pension account balance. But if you can’t help yourself, the bond fund might be for you, because an investor has no greater enemy than themselves when they panic during a market downturn.

Tuleva World Bonds Fund invests half of its assets in a global bond index (Bloomberg Barclays Global Aggregate) and the other half in a euro-denominated bond index (Bloomberg Barclays Euro Aggregate Bond). Why this split?

On the one hand, spreading investments across bonds denominated in different currencies lowers the risk. That’s what the global index provides. On the other hand, short-term currency fluctuations affect the prices in euros of the funds that track the global bond market index. In order to hedge the currency risk, assets should be invested in a euro-denominated bond index fund.

Here we use the simplest risk-hedging strategy: if it’s not possible to determine which strategy is better, we choose a half-and-half approach.

The volume of Tuleva’s bond fund is small compared to our stock fund. This affects its costs. Therefore, we maintain a very simple portfolio made up of just four funds, each holding a quarter of our assets.

To track the euro-denominated bond index, we invest in the following two funds:

25% allocation to iShares Euro Aggregate Bond Index Fund

25% allocation to iShares Euro Government Bond Index Fund

This makes our fund slightly more conservative than the general index, as the share of government bonds is higher.

To track the global bond market index, we invest in the following funds:

25% allocation to iShares Global Government Bond Index Fund

25% allocation to iShares Euro Credit Bond Index Fund

The latter invests in global corporate bonds denominated in euros, thus tilting the portfolio towards the euro area. As our fund grows, we’ll certainly gain new opportunities to better mirror the global market without incurring excessively high costs.

Tuleva’s pension fund fees will always be among the most favourable in Estonia

The total expense ratio – i.e. ongoing charges – of our funds is 0.31% per year. Why does this number differ from the fund management fee, which is 0.24% in Tuleva’s pension funds?

Just like when you buy a car and have to think about how much it’ll cost to keep it running, when you choose a fund, you should look beyond the purchase price and consider all the other costs you’ll pay as an investor.

A pension fund reinvests its assets into other funds, which in turn charge their own management fees. Brokerage fees must be paid for every transaction made with fund assets. In bank-run pension funds, these extra costs can eat up just as much of your money as the management fee.

Essentially, the total expense ratio shows how much lower the return of our pension funds is compared to the returns of the indexes we follow, after taxes. The lower the total expense ratio, the bigger the advantage our investors have in growing their wealth.

Put simply: the lower the cost, the higher the pension.

Since the launch of Tuleva’s pillar II funds in 2017, the state has pushed other pension funds to significantly lower their fees too. Even so, the costs of Tuleva’s stock fund are still at least three times lower than those of some larger pension funds investing in stocks, such as LHV L and XL (now called LHV Ettevõtlik and LHV Julge), SEB 55+ and 60+, and Luminor 16–50 and 50–56 pension funds (5).

Learn to keep track of the ongoing charges, i.e. total expense ratio, because the management fee alone only tells you half the story. You can track the ongoing charges of all funds on Pensionikeskus’ website, but to check your fund’s total expense ratio, you can use Tuleva’s calculator.

Our bond fund’s costs are lower than those of the two other favourable conservative funds in the market: Swedbank Pension Fund Conservative and SEB 65+.

Costs are particularly important for bond funds, where returns are limited. The average annual return on bonds in a typical Estonian conservative pension fund portfolio is less than 1% after tax. If the expense ratio of such a fund is also close to or even above 1%, you’re paying the entire return to the bank.

I, of course, transferred all my pillar II pension assets to Tuleva World Stocks Pension Fund. I exchanged all of my accumulated pension fund units for those in the Tuleva fund and redirected all my future contributions there too. Kristi Saare, chair of Tuleva’s council, did the same. She’s also known as a host of the Investeerimisraadio podcast and the founder of the Female Investors’ Club. Most of Tuleva’s founding members are also investing in our stock fund.

Here’s the guide to switching funds once again.

Good luck with saving for your pension!

Tõnu Pekk, Tuleva’s founder and fund manager

[email protected]

(644 5100)

Please note: This article was updated on 21 May 2025.

You can find an overview of the model portfolios of Tuleva’s pension funds here.

(1) If you were born before 1983, you had until October 2010 to choose whether to join pillar II.

(2) People who’ve joined pillar II will get a slightly smaller pillar I pension than those who haven’t. For most people, the difference is small, and it’s still more useful to save in pillar II.

(3) According to S&P, 91% of US equity funds underperformed the index over the past decade.

(4) Until 2019, the law only allowed pension funds to invest up to 75% in stocks, so our fund used to allocate the rest of the money to bonds issued by the world’s largest governments. Today that restriction no longer exists, and we won’t buy any more bonds. We gradually sold off the existing bonds and replaced them with stocks, and since March 2023, our entire portfolio has been in stocks.

On 1 September 2022, we adopted the principles for sustainable and responsible investment, excluding companies that don’t meet the criteria from our portfolio. Everything else stays the same. Read more here.

(5) See Pensionikeskus’ website for a comparison of ongoing charges.

Check out the terms and conditions of our funds here and here, and talk to an expert if you need advice.