Since you brought your money from the old bank pension fund to an index fund, the return has been much better. You can be satisfied! But what if one day you see a minus instead of growth in your account?

Let’s take a closer look at the example of the already familiar Laura.

In Chapter 1, we saw how Laura, whose gross monthly salary is 1,900 euros, plans to save a million euros for retirement. (1) To reach the goal without much effort, she has made a few clever decisions.

First, Laura invests in the second and third pension pillars, to which the government will add significant leverage through a tax incentive. Second, Laura opted for low-cost index funds so that intermediaries will not take out a large chunk of her investment returns.

Third, Laura prefers pension funds that invest in equities. For Laura to make a million through the second and third pillars, stock markets should grow by an average of 5.5% a year over Laura’s lifetime. The actual average return during the past century has been slightly better. (2)

A gain from the tax incentive and low fees is certain. But no one knows how the markets will actually behave. Although stock markets have successfully grown investors’ long-term assets in the past, there are no guarantees about the future.

One thing is quite clear: Laura’s assets will not grow in a straight line.

If we can infer anything from the history of the markets, it is that stock prices go up and down. Sooner or later, the time will come when Laura sees a deepening minus in her account for months or even years in a row. And yet, Laura isn’t anxious about recessions and stock market crashes. Why?

Be prepared for the value of your assets to fluctuate with the markets

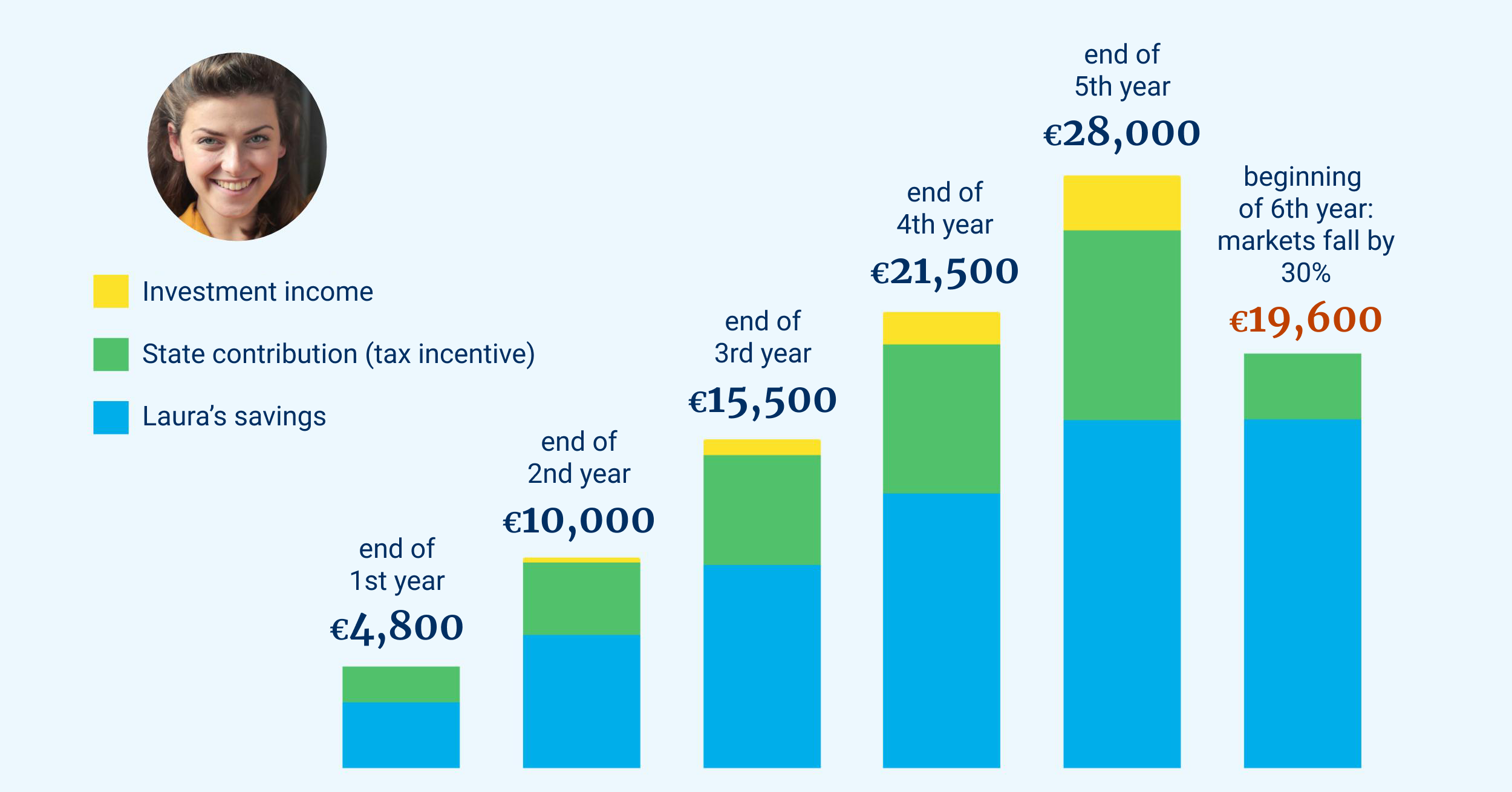

Let’s first analyse a scenario which Laura is likely to witness more than once in her lifetime. For example, Laura’s assets may grow steadily by about 5% a year for five consecutive years but fall by 30% at the beginning of the sixth year.

By setting aside some money every month, Laura saves 28,000 euros over the first five years.

- Her contribution is 16,400 euros,

- the government’s contribution is nearly 9,000 euros, and

- the remaining 2,600 euros is investment income.

The market then crashes, and Laura loses more than 8,000 euros of her assets.

It’s not the worst outcome because Laura is still on the gains side – thanks to the government’s contribution, she still has almost 20,000 in her account, which is over 3,000 euros more than she personally contributed.

Other good news is that Laura continues to pay into the second and third pillars, and her pension funds are now buying stocks for her at 30% cheaper than before.

When markets fall, keep saving as before!

Stock price fluctuations across market cycles are not the biggest peril that Laura faces during her investment journey. The most significant danger is that Laura may panic when she sees a minus in her account and make one of two mistakes:

- She exchanges her index fund units for units of a more conservative fund during a market downturn.

- She sells her pension fund units entirely, pays income tax to the state and, in frustration, stops saving money.

We all know that it’s foolish to sell stocks when the markets have hit bottom. Why do so many give in to temptation? Because we are likely to see a graph in the newspaper that only shows a short-term loss rather than a longer-term return. Something like this:

This kind of illustration builds up drama as the news headlines grow gloomier and one expert after another advises ordinary people to stay away from stocks. You might indeed sell your fund units.

You might meet a sympathetic-looking sales agent from a bank. “You see, we have a fund here that has nicely protected investors’ assets!” He forgets to add that, in a fund preferring bonds and bank deposits to stocks, investors’ assets don’t grow much and are additionally eaten away by fees and inflation. Nor does he explain that his exemplary fund may contain assets that are not traded on a stock exchange and whose probable impairment is not yet reflected in the price of the fund unit.

A short-term loss seems more terrifying to you than ditching your patient long-term asset-growing plan, and harmful decisions are quick to happen.

How can you make sure that the next crisis will not hit you hard?

Fortunately, Laura has made a firm decision and continues to save. What can you do to stay on course?

First, do not invest in stocks or equity funds money that you will definitely need in the near future. Otherwise, you may find yourself in a forced situation where you have to cheaply sell assets that have lost value during a sudden crisis.

Second, follow the advice of Jack Bogle, the Father of Index Funds: invest regularly and don’t peek into your account. Month-to-month, even year-to-year fluctuations will not tell you anything about the long-term return of your investment portfolio. These only add unnecessary anxiety to your life.

Stock market returns have been surprisingly stable in the long run

The sudden ups and downs described above are common in the markets. But if we measure growth only once every 30 years, the result has been surprisingly stable so far. The average historical return on stock markets has then been between about three and ten per cent per annum.(2)

Of course, this difference also significantly affects the final result over a long saving period. If stock markets return only 3% a year during Laura’s lifetime, she will only collect 600,000 euros instead of a million. And if the annual return is 10%, Laura’s savings will grow to a staggering 3.5 million euros.

Life can bring surprises that no stocks, real estate or bank deposit can save you from

What if the world will be shaken by something in the coming decades that turns all reasonable expectations upside down? This is not a question from a fantasy world. Not every surprise in your life is pleasant. Stocks do not offer more or less certainty than other asset classes.

My grand-aunt left 3,000 roubles to my brother and me each. I have no idea how she managed to set aside so much from her 80-rouble invalidity pension. When I took out the money from the savings bank when I reached adulthood in 1991, it wasn’t worth much.

Had my grand-aunt saved up such a sum earlier, she could have bought a nice summer cottage by Lake Peipsi, which would be valuable to this day. My aunt and uncle, on the other hand, invested in real estate. They bought a cooperative apartment with all amenities in the Oru district of Kohtla-Järve. By the mid-1990s, the Oru peat plant was bankrupt and the apartment buildings remained unheated. My aunt and uncle had no choice but to give the apartment in the empty district away free of charge to the first person who agreed to take on the utility debt.

My current home in Tallinn is located in a typical Lender-type apartment building. The lady who built the house lived there in a large apartment and successfully rented out the smaller ones, earning a nice income for some time. In 1940, she had to sign a nationalisation deed for her house just before being deported to Siberia.

No investment, be it stocks, real estate, bank deposits or gold, will protect you from all the twists and turns of life. By the way, this is one of the reasons why I like Laura’s way of saving money – her investments do not require disproportional attention.

Every month, Laura increases her stake in all the world’s largest companies through the second and third pillar index funds. She does not spend time analysing individual companies or forecasting market cycles.

Thanks to this, Laura does not have to deal with her investments continually but can focus on things that are really important in her everyday life, even if the future should bring surprises.

Do as Laura does:

- Exchange your old second pillar bank fund for a low-cost index fund.

- Set up your third pillar. Make the first investment before the end of the year to get your income tax refund in the spring!

- Keep saving in good and bad times, and don’t peek into your account too often. This will save your nerves and leave you time to notice the things that make your life liveable on this wonderful and dangerous planet.

Chapters of the article series Laura’s Journey to Wealth:

- 1. Starting to invest is easier than you think

- Bonus chapter: Questions and hesitations

- 2. Which fund is the best to save in?

- 3. How can I win on taxes?

- 4. What if stock markets fail?

- 5. What if you want to earn even more?

- 6. Summary: Tõnu’s real-life investment portfolio

(1) As a reminder: We assumed that Laura’s salary would rise by an average of 3% per annum, that the securities markets will yield an average of 5.5% per annum and that the fund’s costs will be 0.5% per annum.

(2) Source: Dimson, Marsh and Staunton database. Annual summaries are available in the Credit Suisse Global Investment Returns Yearbook (see the latest one here).