Dear Tuleva pension savers and members,

If you have just one minute to read:

- In the first six months of the year, Tuleva pension savers contributed 53 million euros into the second and third pillars, which is a third more than in the same period last year. The number of people contributing to the third pillar increased by 25% compared to the previous year.

- Global stock markets rose by approximately 15% in the first half of 2024. We cannot predict the future performance of stock markets, but historically the best returns have been earned by investing regularly in diversified, low-cost index funds that hold shares in many global companies.

- Tuleva already has some 72,000 second or third pillar investors. The number of investors is gradually but steadily increasing.

Read more:

How low can fees go?

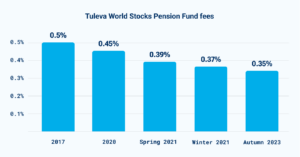

Low fees are one of the surest ways to increase the return on your pension assets. It makes perfect sense: the less you pay in fees to the fund manager, the more return you get. In Tuleva, pension savers can be sure that the more people there are who save together, the lower the fees will be.

We have to cover two types of costs from our fees. The rate of variable costs, such as the fees to the depositary bank, the guarantee fund fee and the registry fees paid to Pensionikeskus (the Pension Centre), is a fixed percentage of the assets in our funds.(1) With these fees, it’s simple: as soon as the rate is reduced, we can immediately reduce our fee. This is what we did at the end of last year, for example, when we managed to negotiate a lower fees that we pay to the depositary bank.

Fixed costs, such as salaries and costs related to office space, IT infrastructure, auditing, etc., need to be covered regardless of the size of our assets. A downturn in the market can quickly lead to a significant reduction in the value of the assets. On the other hand, if these costs are well under control, there is scope for a reduction in fees in the long term.

One thing you can be sure of when you save with Tuleva is that all our funds have low fees. In the second half of the year, together with the Supervisory Council, we’ll review the fees for our funds and decide whether we can reduce them further, given the rapid growth in assets.

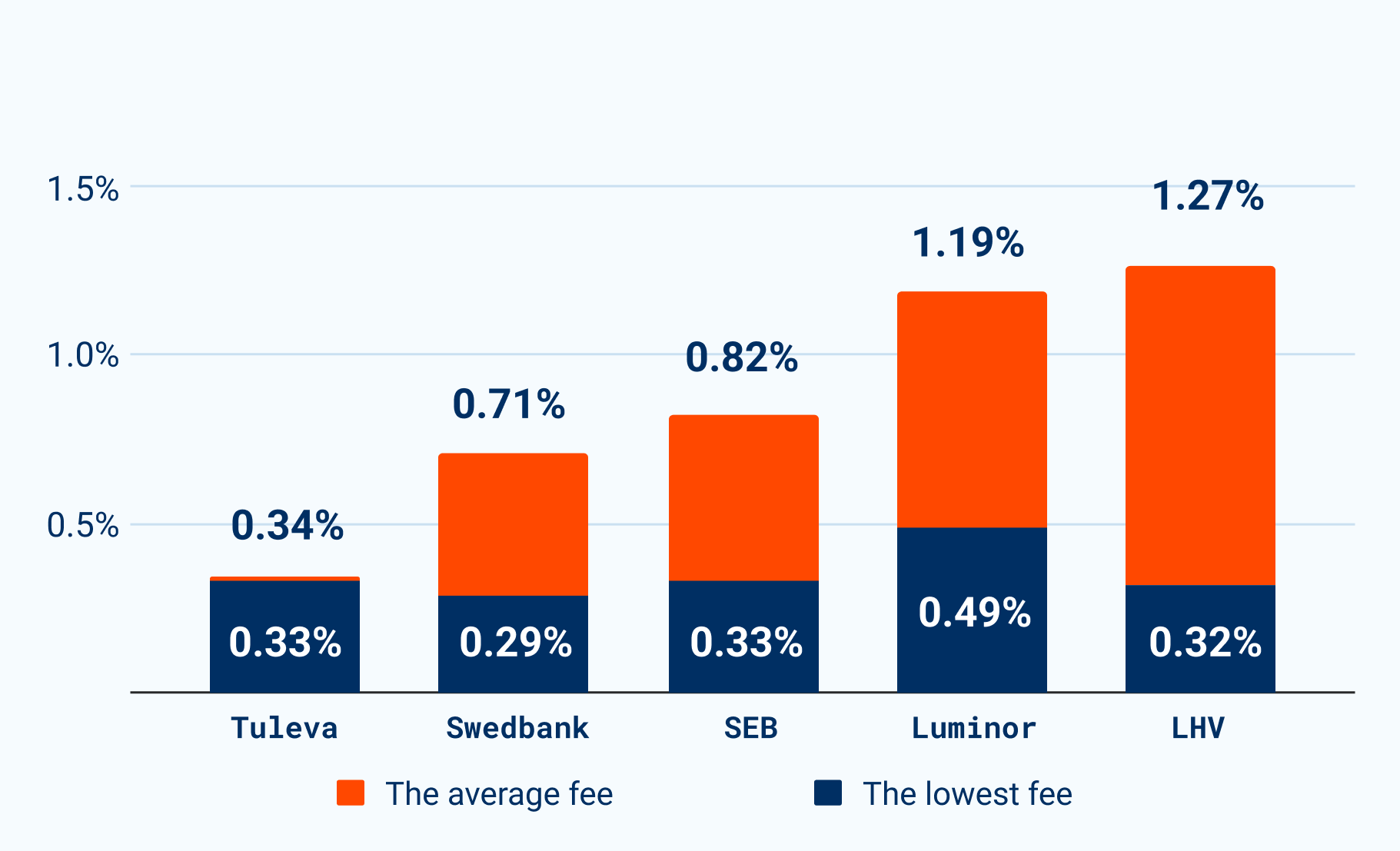

The graph shows the average ongoing charges per fund manager, weighted by the volume of pension fund assets. Data as at 18 July 2024.

The graph shows the average ongoing charges per fund manager, weighted by the volume of pension fund assets. Data as at 18 July 2024.

What most people can do immediately to reduce their fund fees is to simply move their second or third pillar assets from an old, high-fee bank fund to a low-fee index fund.

Growing share of index funds

As elsewhere in the world, the share of index funds is also on the rise in Estonia. Today, they already account for a quarter of the assets in the second pillar and for a third of the pension savers. Index funds are growing fast for two reasons. Firstly, for the fifth year in a row, young people entering the labour market are automatically allocated to an index fund with a high proportion of stocks. Secondly, every year a large number of people switch from a high-fee fund to an index fund.

This is a very positive trend. The popularity of index funds has forced all fund managers to include a low-fee index fund in their range, lowering the average fees of all fund managers.

As Tuleva pension savers, we can be proud to say that, thanks to all of us, Estonian pension savers have lower fees and more choice. At the same time, we still have a lot of work to do, as 75% of second pillar assets are still held in old, high-fee bank funds.

Strong growth in contributions

In the first six months of this year, those of us who save with Tuleva contributed 53 million euros to our second and third pillar accounts. This is one third more than in the same period last year.

In the first half of the year, more than 32,000 people made a contribution to our third pillar fund. This is 25% more than in the previous year. In addition, people who had already saved in our third pillar fund last year increased their contributions – by as much as 37% compared to the first six months of the last year.

The most reliable way to achieve your savings goal is to set up a standing order. At present, almost 19,000 people save automatically in our third pillar through a standing order. This is 30% more than a year earlier. If you also want to simplify the way you save, you can make a contribution to the third pillar here.

A new option to save even more tax-free is to increase the amount you contribute to the second pillar. Nearly 4,700 Tuleva pension savers have already increased their second pillar contribution to the maximum of 6% of gross salary. This is about one fifth of the total number of applications (around 38,000) made by people in Estonia to increase their contributions.

Interestingly, quite a significant proportion of those who have submitted the above application have their third pillar only in Tuleva, while their second pillar is elsewhere. You don’t even have to be a Tuleva pension saver to submit an application through our website. It’s easy and takes just a few minutes.

Another 760 people have raised their second pillar contribution to 4% in Tuleva. However, a large number of pension savers haven’t yet submitted an application. After all, the deadline is the end of November, and it’s only human to leave important things to the last minute. But it’s good to see that every time we send out a reminder email, more people submit the application. We’ll keep nudging you in the months ahead. (2)

The easiest way to save more: pay less in fees

We have more than 20,000 pension savers who contribute to our third pillar fund, while their second pillar savings are held elsewhere. Some of them are already saving in a low-fee index fund managed by a bank, but most are still paying into some old, high-fee pension funds. It would be very easy for them to increase their savings rate immediately: all they’d have to do is stop paying high fees to their current fund manager. For example, if you have accumulated 10,000 euros in your pension account, switching from a high-fee fund to a low-fee index fund will save you around 6 euros each month. If you have saved 20,000 euros, then you will save even more. This way you’ll increase your savings right away.

In the first half of the year, 1,182 of our third pillar savers took this simple step, withdrawing almost 12 million euros from high-fee funds. Together, they now save at least 10-12,000 euros more each month thanks to lower fees. Transferring your second pillar takes two minutes and costs nothing.

Stock markets continued to rise in the first half of the year

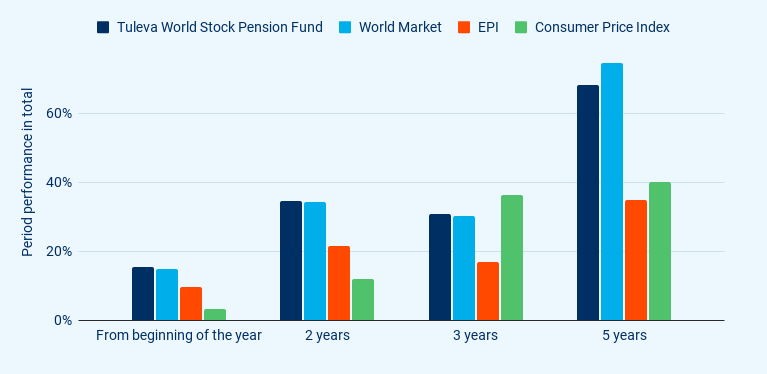

In the first six months of this year, global stock markets grew by 15% on average. The global market does not always move in a straight line upwards: just two years ago, for example, the year started with a similar decline. It’s not possible to predict the exact return on our assets over the long term. However, we can ensure that the returns on our assets are in line with the average returns on global equity markets.

By regularly investing a portion of our income each month in the shares of companies around the world, we are steadily increasing our stake in the drivers of the global economy. This has historically been the best way to ensure that our wealth grows in line with global growth and outpaces inflation. (3)

The graph shows the performance of the Tuleva World Stocks Pension Fund compared to the global stock market index (MSCI ACWI), the Estonian pension fund average (the Estonian Pension Index, EPI) and the inflation rate in Estonia. Sources: Pensionikeskus data as at 28 June 2024, MSCI and Eurostat.

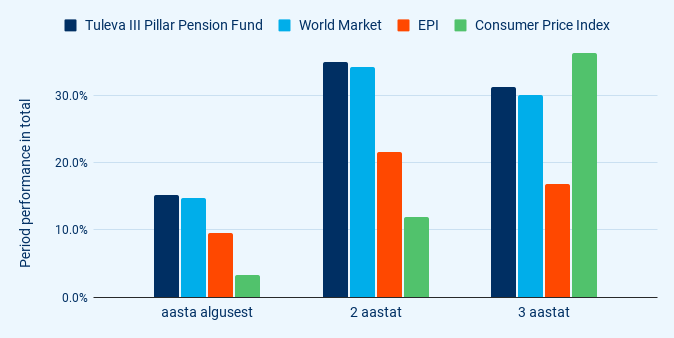

Our third pillar fund is less than five years old. Like our second pillar stock fund, the Tuleva Third Pillar Pension Fund tracks the global stock market average.

The graph shows the performance of the Tuleva Third Pillar Pension Fund compared to the global stock market index (MSCI ACWI), the Estonian pension fund average (EPI) and the inflation rate in Estonia. Sources: Pensionikeskus data as at 28 June 2024, MSCI and Eurostat.

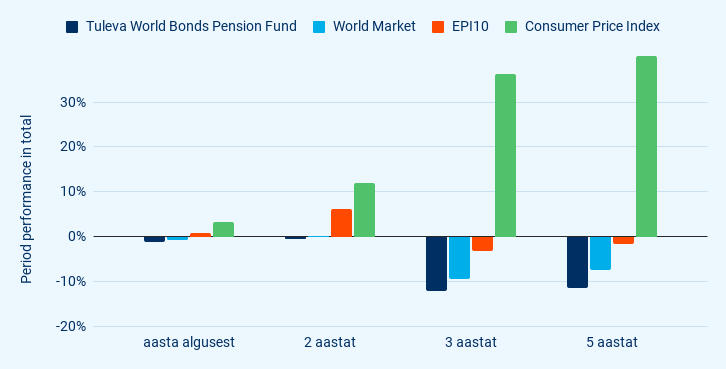

Global bond market returns and the returns of the Tuleva World Bonds Pension Fund were slightly negative in the first half of the year, as global bond yields rose somewhat compared to the beginning of the year. (4) Despite this small decline, a year and a half of higher interest income has slowly but steadily reduced the 15% decrease in the value of bonds in 2022. To date, the fall in the unit price of our bond fund has been reduced to 11% compared with early 2022. If interest rates remain at the same level, the interest income, after taxes and fund fees, will add 2-3% per year to the unit price of our fund.

The graph compares the performance of the Tuleva World Bonds Pension Fund with the performance of the global bond market index (50% Global Aggregate and 50% Euro Aggregate), the Estonian conservative pension fund average (Conservative Strategy Funds Index, EPI-10) and the inflation rate in Estonia. Sources: Pensionikeskus data as at 28 June 2024, Bloomberg and Eurostat.

Committed pension savers do not switch funds often

It’s important to make sure that you continue to save in both good times and bad. A committed saver won’t switch funds when a salesman in a shopping centre offers a deal, won’t stop contributing to the third pillar when the markets are falling and won’t withdraw from the second pillar before it’s time to retire. Life is full of temptations and it’s easy to find compelling reasons to stop saving. We are pleased that Tuleva’s pension savers are committed to securing their future financial well-being.

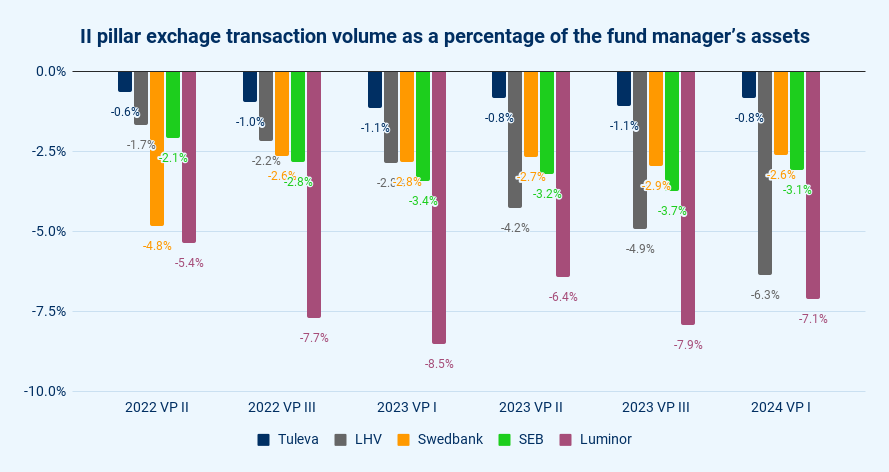

The graph shows the volume of second pillar assets transferred to other funds per fund manager as a percentage of the fund manager’s assets.

It’s no wonder, then, that our savers have more in their pension accounts than their peers. More information can be found in the comparison calculator (in Estonian).

A couple of months ago, we looked at the assets of our young (under 35) active savers and asked them whether their higher pension assets were simply due to higher wages or whether they had another secret trick. We found out that Tuleva’s savers also outperformed their peers with similar incomes, simply because they save more and their pension assets have earned higher returns.

Moderate but steady growth in new savers

Tuleva already has more than 70,000 second or third pillar investors, but most people in Estonia have never even heard of us. That’s why we continue to look for new ways to reach out to people whose friends are not yet saving in Tuleva. We also want to encourage those who have already shown interest to take the next step.

So far, we have used various platforms of Meta (especially Facebook) to distribute our blog posts for free or for a fee. Over the past year, we have also been experimenting with other channels to avoid becoming too dependent on one. For example, we signed an agreement with the business portal Delfi Ärileht to support its investor section Investeeri, launched an Instagram account and are trying out online advertising on the news portal Postimees.

Every month, several hundred people take the first step: they either open their third pillar account with Tuleva, transfer their second pillar account to us or do both. Of course, we would like this number to be higher. After all, just under 6% of all second pillar investors in Estonia save with Tuleva. Despite the fact that one third of the total market has opted for the third pillar in Tuleva, the market for the third pillar itself is still in its infancy – just under one in six wage earners in Estonia made contributions into their third pillar last year.

However, we must be mindful that the cost of finding new customers is at our expense, as Tuleva pension savers. And it’s not good for people to make a decision they haven’t thought through properly because of advertising or aggressive sales tactics. That’s why our outreach is and will continue to be moderate. Satisfied savers are our best publicity. Indeed, it’s always good to hear that most of the new savers at Tuleva have joined us on the recommendation of a friend.

Very good financial results

A larger volume of assets also means more income for Tuleva. In the first six months, we earned nearly 1 million euros in management fees. After deducting variable costs, we had a gross margin of 0.8 million euros to cover our fixed costs. This is 66% more than in the first six months of the previous year.

In the first half of the year, our fixed costs increased due to salary costs, mainly in connection with the recruitment of new employees. We have managed with a very small team since the inception of Tuleva, but the growth in the number of pension savers and the volume of assets, as well as the increasing regulatory complexity of the financial sector, has also created the need for us to strengthen the team with full-time staff. Nevertheless, we remain a fund manager with the smallest team of 13 employees. As our income grew significantly faster than our expenses, we made a strong operating profit in the first half of the year.

As is always the case, the net profit is significantly affected by the revaluation of the Tuleva pension fund units that we own. This time, the increase in the unit price added a large proportion to the net profit, whereas sometimes a revaluation can reduce profits substantially. We don’t take into account changes in the price of fund units when assessing our performance. After all, since Tuleva’s inception, we have agreed with our members that our equity is invested in our pension fund units and that price movements are not under our control.

This report also excludes a portion of our operating expenses, which have historically been borne by the fund manager’s parent company, the commercial association Tulundusühistu Tuleva. It consists mainly of work contribution expense, where the association issues work contributions to acquire shares in the membership capital in return for work done for Tuleva. In the first half of the year, the association paid 46,640 euros towards these costs.

| 01.01-30.06.2024 | 01.01-30.06.2023 | |

| Service revenue | 995,194 | 656,947 |

| Service costs | -166,143 | -157,058 |

| Staff costs | -365,669 | -288,915 |

| Miscellaneous operating expenses | -219,906 | -215,439 |

| EBITDA | 243,476 | -4,465 |

| Financial income and expenses | 909,724 | 587,171 |

| Depreciation of fixed assets | -21,252 | -20,473 |

| Net profit for the period | 1,131,948 | 562,233 |

The table shows the main financial indicators for Tuleva Fondid AS.

Advocacy: the fine imposed by Finantsinspektsioon is still pending a court decision

At the end of last year, we were imposed a fine by Finantsinspektsioon (the Estonian financial supervision and crisis resolution authority) for a breach of the rules of information activities. Earlier this year, we decided to challenge the fine in court. At the time of writing this report, we have information that the court is expected to make a decision in September.

However, the legal dispute is only one part of the process of finding a solution to the problem. In the meantime, we have met with both Finantsinspektsioon and ministry representatives to discuss the issues of communicating about pension funds. We are still of the opinion that an honest discussion about pension funds should not be so complicated that it can only be held with the help of lawyers.

Improving pension payments

We accumulate assets in our pension accounts with the intention of using them one day. In the early days of Tuleva, we worked hard to get the state to remove unnecessary restrictions on the use of pension assets. Today, these restrictions have been lifted and almost 50,000 people in Estonia who have reached pre-retirement age in the last four years have been able to use their second pillar assets as they wish.

Deciding how to use pension assets is as important as deciding how to accumulate them, and a wide range of choices does not necessarily ensure the best outcome for the individual. Last year, savers of retirement age withdrew almost 70 million euros from their pension accounts as a lump sum, paying almost 7 million euros in income tax. In our view, this is an unnecessarily high cost for pension savers.

We’re pretty sure that most of the people didn’t take the money out to spend it immediately. They probably deposited the money in a bank or elsewhere, with plans to spend it in small amounts over many years. They took the money out all at once, instead of having a funded pension, just so that they could finally “hold it in their own hands”.

The challenge we face is how to help second and third pillar savers understand that they don’t have to transfer their pension assets to a bank account and pay income tax on them. After all, regular payments from the pension pillars are exempt from income tax. Over 19 years, a 65-year-old Estonian is likely to earn a fifth more or even twice as much from their pension pillars than they would by withdrawing it as a lump sum or even putting it in a bank deposit.

In June, we started developing a system for withdrawals from pension account and hope to release the first version to the public in the coming months. However, this is only the first stage of a longer process. If you or a member of your family, a colleague or an acquaintance is about to start drawing on their pension assets, please refer them to us. This is the quickest way to learn what is important for savers.

Happy saving!

Tõnu Pekk

Member of the Board of Tuleva Fondid AS and Fund Manager

You can find the Tuleva association, Tuleva Fondid AS, and Tuleva pension funds audited reports here.

(1) Because of the way pension funds are regulated, the management fees of our second pillar funds must cover both the deposit fee and the guarantee fund fee. In the third pillar, the deposit fee is paid directly from the fund and there is no guarantee fund fee. It makes no difference for the pension saver, however, as in both cases all costs are reflected in the fund’s total expense ratio. That’s why it’s always worth looking at a fund’s ongoing fees.

(2) In fact, you can also apply for an increase or a decrease in your contribution at any time after November. However, if you want your second pillar contribution to increase from the beginning of the next year, you’ll have to submit the application before the end of November. Applications submitted later will not take effect until early 2026.

(3) The view that long-term returns in global equity markets have consistently outperformed inflation is supported by the creators of one of the most comprehensive databases on equity markets today, Professor Dimson from Cambridge University, and Professor Marsh and Dr Staunton from London Business School. An annual summary of their database is available here.

(4) In other words, bonds are fixed-income securities whose price rises when interest rates fall and vice versa.