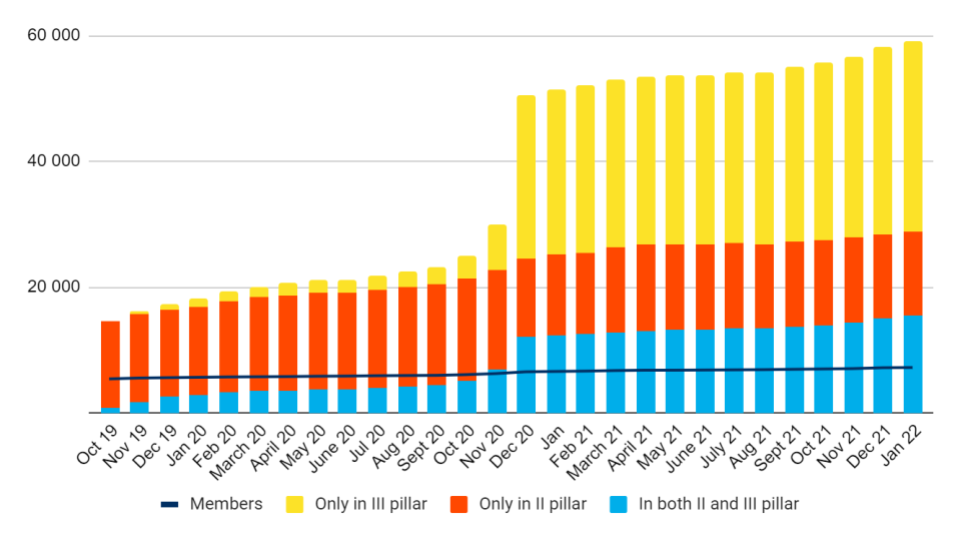

The more people save capital for the future in our mutual funds, the better for all of us. The year 2021 confirmed this more than the previous years combined. While other management companies lost assets due to the pension reform, our funds increased by 150 million euros.

The regular contributions made by all of us (almost 60,000 people), more than 8,500 new investors and the rapid rise of the world’s securities markets all contributed to the growth of our assets.

The arrival of Tuleva five years ago brought the issue of high fees and poor returns to the focus of public debate in Estonia. By now, following Tuleva’s example, banks have added index funds with lower fees to their product range. I am glad that most people who have decided to switch their old high-cost pension fund for a low-cost index fund have chosen Tuleva. At the end of the year, our pension funds had twice as many assets as the index funds of all Estonian banks combined. (1)

We helped Estonia’s third pension pillar out of the doldrums. We launched our fund just two years ago. We, Tuleva investors, have invested almost as much money in the third pillar as the clients of all other management companies combined during these two years. Already at the end of 2021, our mutual fund was the largest in terms of the number of investors. In January, we outperformed the market leader, which has been operating for almost two decades, in terms of fund volumes.

All Tuleva investors will benefit from the volume growth

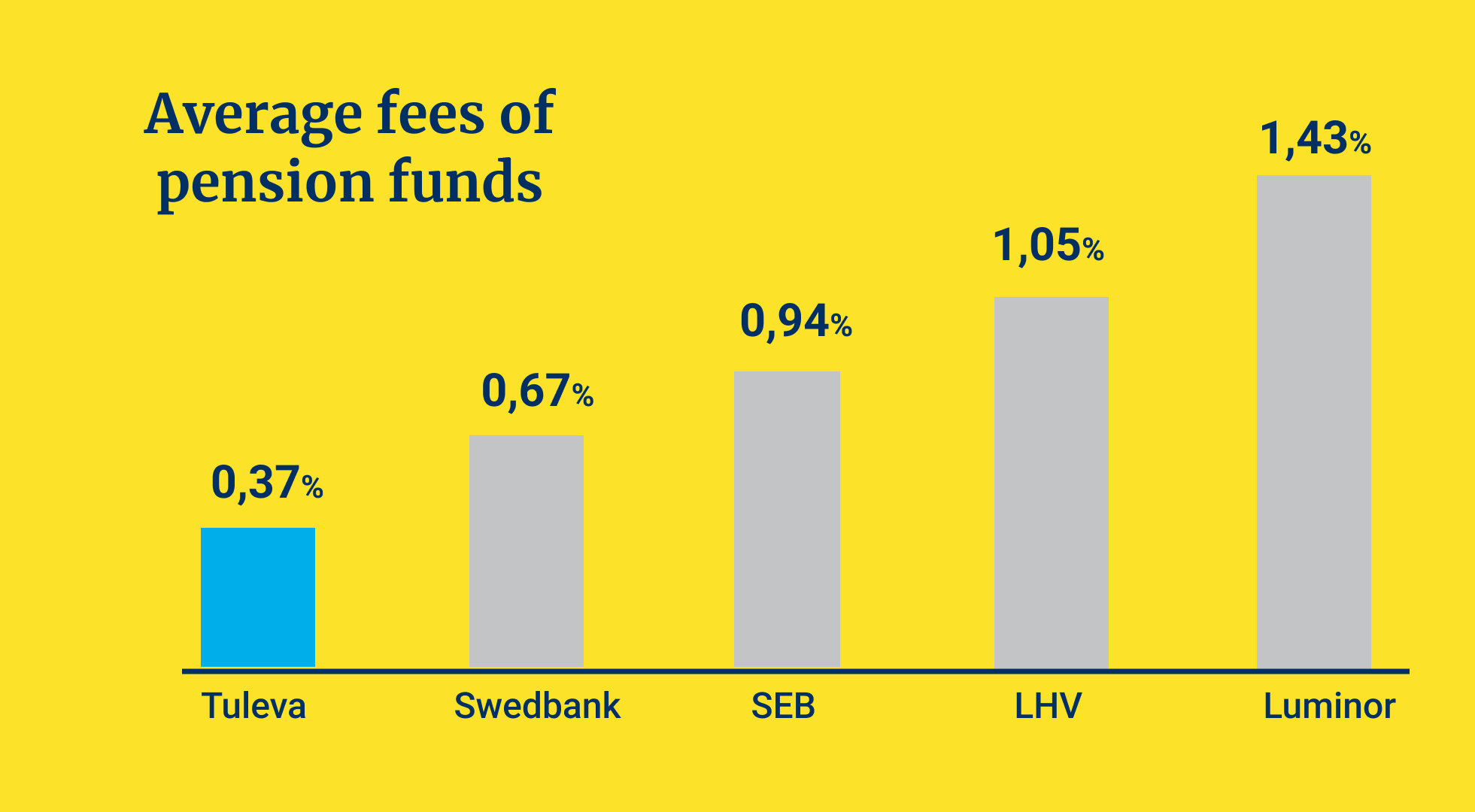

Global securities markets data consistently shows that low-cost funds outperform high-cost funds in the long run. Due to the increased volume of the funds, we reduced the fees even twice this year. We stay firmly among the price leaders, although being the cheapest fund at any given time is not our main goal. What is certain is that the larger the volume of our funds, the lower our fees will be in the future.

Our low fees are not the result of a remote investor or a high-margin product covering the loss. Our low fees are based on low costs. We only spend money on things that improve the fund’s performance for the investor. Last year, the rapid growth of asset volumes made it possible to earn a consolidated operating profit of 152,000 euros in addition to lower fees.

The larger the funds grow, the higher the return for the Tuleva membership capital. Laura, a Tuleva member who contributed 1,000 euros to Tuleva five years ago and transferred both her second and third pillars to Tuleva at the earliest opportunity, has grown her membership capital by about 50% in five years. The membership capital has increased due to the growth of the global securities market (most of our membership capital is invested in our own pension fund), the membership bonus and, since last year, operating profit.

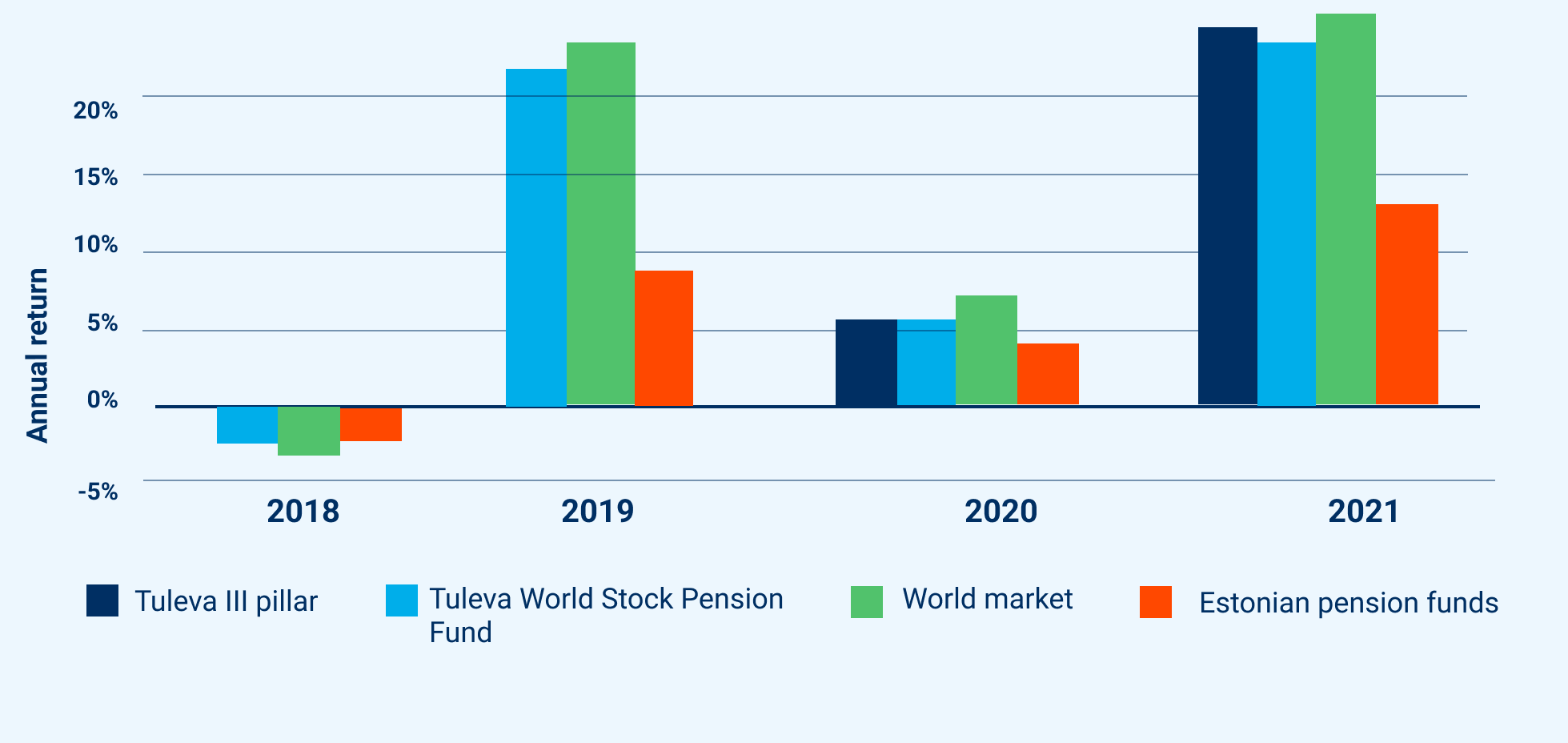

Our money is growing at world market pace

Ninety-eight per cent of our investors’ money is in two equity funds: Tuleva World Stocks Pension Fund and Tuleva III Pillar Pension Fund. The money in these funds is growing at the pace of the world market. The price of a Tuleva World Stocks Pension Fund unit has grown by an average of 10% per annum during just under five years since its launch. The world market index has grown by 11% per annum at the same time. We lag behind the index due to fees (even a small fee reduces returns!) and because there is still a small portion of bonds in our portfolio. The share of bonds has decreased to 6% of the fund’s volume. By next spring, the share of bonds will reach zero.

The unit price of Tuleva III Pillar Pension Fund has grown by an average of 16% per annum during a little more than two years. The world market index has increased by 18% per annum at the same time. The difference with the index is due to fees and the share of cash in the fund’s assets. We kept at least 5% of the fund’s assets in deposit during the start-up period to cover possible redemptions according to the fund rules. The fund’s growth allows the liquidity reserve to be gradually reduced to an insignificant size.

The average return of Estonian pension funds has been 5% per annum for the past five years since the launch of our second pillar fund. In addition to high fees, the large share of bonds in Estonian pension funds reduces the returns for investors. Although the law has allowed 75% of pension fund assets to be invested in equities for more than a decade (and 100% for the past two years), management companies continue to hold more than half of the investors’ assets in zero-yield bonds (2).

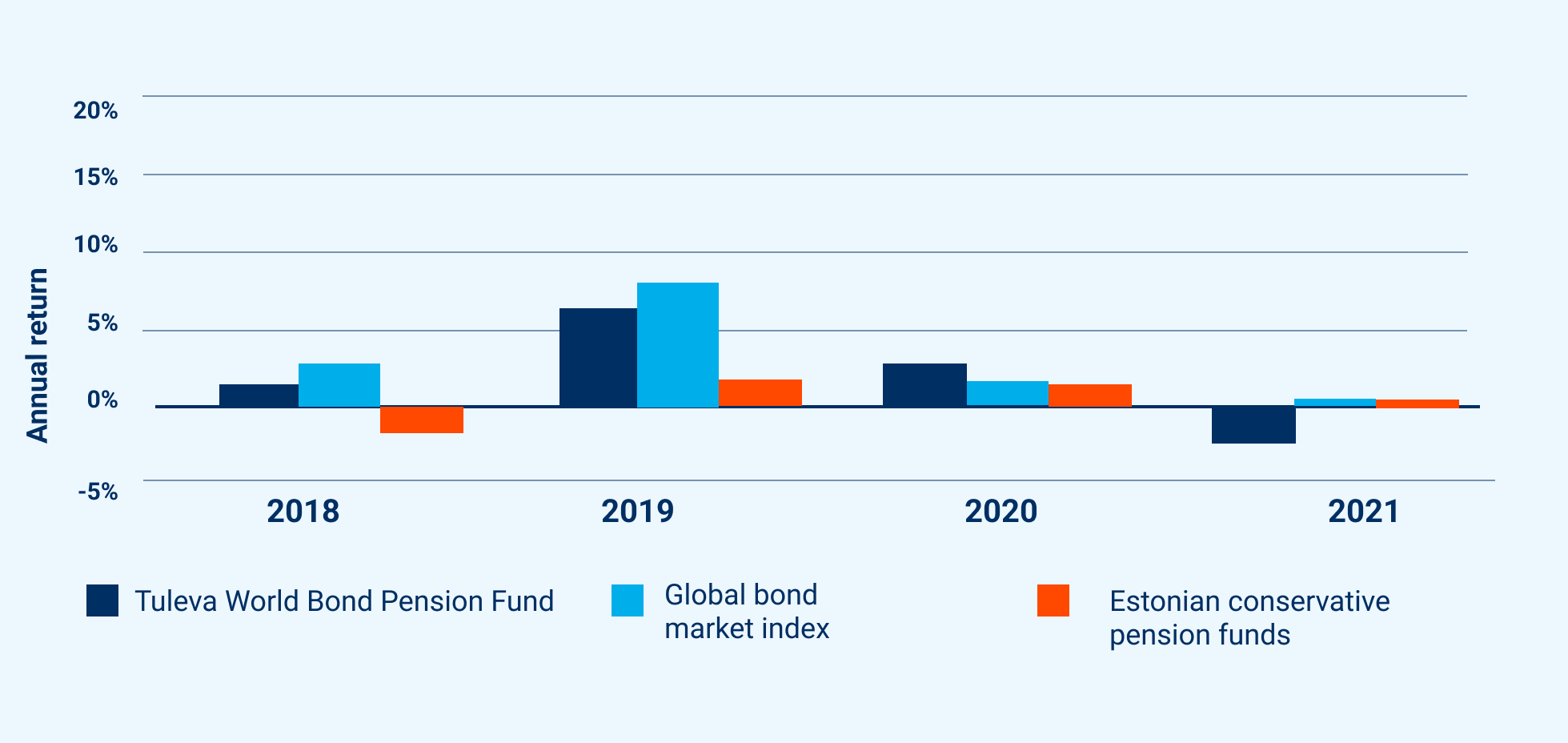

Just under 2% of our investors invest in Tuleva World Bonds Pension Fund. Since the fund’s establishment in 2017, the unit price has grown by an average of 1% per annum (global bond markets have grown by 1.8% per annum and Estonian pension funds with a conservative strategy by 0.5% per annum). This return is lower than inflation and much lower than the global stock market return.

In addition, due to interest rate fluctuations, there have been periods when the fund’s performance has been negative. Last year, the value of the fund’s unit decreased by 2.2%. The performance of our fund differs from the benchmark index year by year not only because of costs but also because our portfolio contains slightly more euro-denominated bonds than the benchmark index. Due to the small size of the fund, we do not have enough low-cost funds available to emulate the global bond market.

We do not know how the world financial markets will perform in the future. The past years have been excellent for equity investors, but there will definitely be worse periods in the future. What is certain is that there is no risk-free return. Assets kept in bonds will certainly shrink due to fees and inflation. In the long run, the best way to save money is to continue to make regular contributions to a low-cost equity fund. Bonds are not suitable for long-term saving, but only for smoothing out fluctuations in the value of your pension assets in combination with shares or for short-term investing if the investor definitely plans to use their pension assets in the coming years.

Legal amendments are saving people tens of millions of euros

The legal amendments made in response to Tuleva’s proposals save Estonian people tens of millions of euros every year. The major amendments in previous years have been as follows: The state now automatically directs new second-pillar investors to a low-cost index fund, does not allow a part of second-pillar assets to be taken out as an exit fee upon switching funds, and prohibits hidden costs. The fees of pension funds have decreased 2–3 times in the past five years.

Tuleva has been fighting for several years for the state not to restrict people from using their second pillar assets in retirement. The restrictions were lifted in 2021, and nearly 30,000 people over the age of 60 could use their second pillar as they wished. In the past, they had to enter into a costly contract with an insurance company to use their assets, which we estimated reduced the return on their assets by more than one-third.

Unfortunately, the pension reform that entered into force in 2021 did not meet all expectations. We know that our funded pension system was already unnecessarily complex. Regrettably, the pension reform added even more complexity. As a result, many people who actually want to continue saving took their money out of the second pillar. We received a lot of questions from people who had withdrawn money from the second pillar and now wanted to invest it in our third pillar. There were other confusing issues.

Pension reform has taught us that we need to use more partners to work more effectively in legislation. In January, we became a member of Finance Estonia, an association of financial companies, and will participate in their funded pension working group.

We help you get through the information noise

Our blog, emails, and customer support help people navigate amid information noise and achieve their saving goals. Thanks to this, all Tuleva investors have been able to make their choices independently. No one has pulled their sleeve at a bank branch or in a shopping mall. It’s also important for keeping costs low: we don’t spend investors’ money on commissions to sales agents who solicit impulsive decisions.

People who have made an independent choice stay on course and do not jump from one fund to another: the number of people leaving our funds is several times lower than in other pension funds. On average, less than 3% of our investors leave for other funds every year. This figure is 3–4 times higher in other pension funds (3).

In the autumn, we received great recognition when the global customer support platform HelpScout recognised our customer support: we are among the 25 companies with the highest customer satisfaction score on the HelpScout platform! Pirje Keeroja performs most of our customer support work, but all other team members can also answer the investors’ questions on a regular basis.

…

Tuleva’s first five years have been beneficial for members, investors and Estonia as a whole. What can we do in the next five years?

Tuleva 2026: our mutual funds will amount to 2.5 billion euros, and we will have 100,000 dedicated investors

We know that most Estonians want to financially secure their future, and they know that they have to do something for it. We also know that our second and third pillar funds are the best tool for most Estonians to secure their financial future. However, most people, including those who have already started saving in Tuleva, are not saving enough.

Having good funds is not enough for people to start saving. We have a lot of work to do to get people who have already opened an account in Tuleva to start saving properly: make sure that their second pillar accumulates in a low-cost index fund, and set aside at least 10% or more of their income in the third pillar.

Even more, people have not even heard of Tuleva. How can we reach people who happen to have no higher education in finance or whose spouse or friend has not thoroughly investigated saving in pension funds?

We need to transform our current “club of the wise” into an investment company accessible to all. Over the next five years, we will help 100,000 people in Estonia save more than 15% of their income. If we succeed, the assets of our mutual funds will increase to 2.5 billion euros.

What needs to be done to achieve this?

- This year, we will focus on existing investors: we will consistently identify and remove obstacles that prevent people from taking full advantage of Tuleva. Above all, the emphasis is on getting to know and measuring the investors and, based on that, improving content and the customer journey.

- Next year, we will make an additional fund for those who have already made the most of the pension pillars or want to save for their children. The success of the third pillar fund cautiously gives hope that, if the needs of investors are truly met, it will be possible to do something with this product that is significantly better than the products on the market today. We will use the year to map these needs for a new product.

- Now that the major obstacles to using pension pillar money have been removed from the law, we are focusing on removing barriers to starting saving. We will use the ongoing process of analysing the sustainability of the state pension system this year and will carry out clarification work to make third pillar contributions easier.

What will not change is that we will still focus only on people who make informed choices. We do not attract anyone to our funds with tricks, but we help people see through the information noise. The success of the third pillar gives hope that this is possible. We do not have inferior, expensive funds that we try to sell to careless customers.

And more. We will be applying a sustainability filter to our investments from this year. We care about the impact of our actions on the world, and today we have the opportunity to take one small step to make our investments less damaging to the world. We will also help the Estonian people better understand the real impact of investments on the environment. We know that the mere word “green” in the name of a fund means nothing. With all this in mind, we are keeping our investment strategy unchanged: we continue to be a low-cost index fund that aims to achieve average global market returns over the long term.

This change is currently awaiting approval from the Financial Supervision Authority. We will write more about it soon.

…

We established Tuleva to invest our retirement assets better. Tens of thousands of people have joined us over the past five years, believing that together we can achieve a better future. In the next five years, we will make Tuleva work in a way that will significantly increase the volume of capital saved by the Estonian people.

Happy saving!

Tõnu Pekk

Tuleva founder and fund manager

Based on Pensionikeskus statistics on second and third pillar funds, Tuleva calculations as of 6 December 2021.

Source: Statistical review by the Ministry of Finance.

You can find statistics on switching second pillar funds on the Pensionikeskus page.