Frequently asked questions

In case you want to achieve the best long-term returns and do not plan to withdraw your entire II pillar within the next 5 years, then we recommend to follow these two principles when saving for pension:

- Your pension savings should be invested in the asset class with a maximum expected return. For our pension savers that asset class is shares in companies. So you should keep your money in a pension fund with maximum proportion in shares i.e. aggressive strategy funds.

- Among those funds that satisfy point 1, choose the lowest cost funds. Historical data shows that the fund cost ratio is the best predictor of long-term returns. The higher the expenses, the lower the return, and vice versa.

If you plan to withdraw your entire II pillar within the next 5 years and are willing to give up returns for security, then it makes sense to consider conservative funds or using pension investment account to keep your II pillar as deposit. Even though such conservative funds are expected to return less, the value of their shares also fluctuates less then stocks.

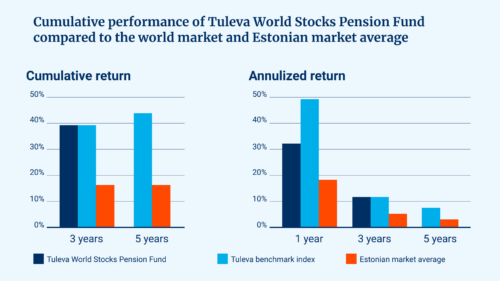

If you want to achieve the best long-term returns and do not plan to withdraw your entire II pillar within the next 5 years, then Tuleva World Stocks Pension Fund suits you.

If you plan to withdraw your entire II pillar within the next 5 years and are willing to give up returns for security, then Tuleva World Bonds Pension Fund may be suitable for you if the volatility of the stock market is completely unacceptable to you.

Log in to your pension account on our website, and you can bring both your second and third pillars to Tuleva with a few mouse clicks.

Yes, if you work and file your taxes in Estonia, you can open a pension account and start saving in II pillar. You can open the pension account on Tuleva website or in your internet bank.

There are two different applications for changing your second pillar fund:

1) a choice application, which directs your monthly pension contributions to a new fund and becomes effective immediately

2) an exchange of units application, which transfers your existing units to a new fund.

These applications are fulfilled three times a year on certain dates (1 May if the application is submitted before 31 March, 1 September if the application is submitted before 31 July, and 2 January if the application is submitted before 30 November).

We invest passively and keep costs very low. In this way, we achieve a fund performance that goes hand in hand with world markets. Therefore, we can ensure that Tuleva pension funds’ performance will never lag far behind the average of the world securities markets.

No. This is not a good idea. This question has been analysed quite thoroughly in the world and the conclusion is: those people who try to time the market tend to buy when markets are at their peak and sell when at the bottom.

Many investors attempt to predict market movements but most often they do not succeed, even professional investors. This is one reason why Estonian pension funds have significantly underperformed world market average returns.

Remember that a market decline is not necessarily bad news for you. Most of us will be buyers of pension fund units for many years to come. A fixed amount of your salary goes to the pension fund every month and when the market is down, you will get more units for the same amount of money. So when the markets start to rise again, you will have more units that grow in value. This is called dollar-cost averaging. This works for you only in case you do not jump in and out of the funds, attempting to “step on the gas” or “decelerator” all the time.

The best way to protect yourself is to do nothing and stick to your strategy of low cost funds through both market boom and bust.Jack Bogle, the founder of the world’s largest fund manager Vanguard, recommends: “Put your money in a low cost index fund and don’t peek!” One of the world’s most successful investors Warren Buffett recommends: “Keep buying it through thick and thin, and especially through thin. The temptation when you see bad headlines in newspapers is to say, well, maybe I should skip a year or something. Just keep buying.”

Why?

Markets are cyclical – there is always a fall after a rise and vice versa. At least that’s how it has been in the past. When you save for your pension, you are a long-term investor. The past is no guarantee for the future, but at least history has shown that a long-term investor does not need to worry about market cycles.

Look at it this way: markets will fall. This is certain. Also, it is certain that nobody knows when it will happen. If you doubt this, try to find a fund manager or analyst who has precisely forecast all recent market crashes – in January 2000, autumn 2007 and summer 2011 and who recommended to buy shares in the intermediate period. There are no such people – some were too optimistic and lost money and others missed out on market gains because they were too pessimistic. All Estonian pension funds have underperformed the market average because fund managers have sometimes been too bold and sometimes too scared.

If you manage to avoid the temptation of making decisions based on short-term market fluctuations and keep smooth-talking salesmen and scaremongering bank tellers at bay, you will get the world market average returns for your investments. Over the long term, these returns have been higher than what most professional fund managers have achieved with their active buying and selling.

All Estonian pension funds’ risks are well diversified, that is required by law. A pension saver does not have to manage their risks by spreading money among many funds. In addition, a pension saver does not bear any business risk of the fund manager. That is why spreading your money among many funds does not reduce your risk.

The only way to reduce your risk is to put some part of the money into a conservative strategy fund e.g Tuleva World Bonds Pension Fund or Swedbank K1.

This could be a sensible choice if you have only a few years until retirement. It could also make sense if you are very sensitive to risks and short-term fluctuations make you really suffer. But you need to understand that there are no risk free returns – if you avoid risk, then you get no or very little return.

You can compare funds’ results on the Pensionikeskus website – you don’t have to invest into many funds to do that.

Learn the basic facts of long-term saving and decide, what is you strategy. You should change your pension fund when it turns out that your pension fund’s strategy is not aligned with your own saving principles. We (and most expects, like investment guru Warren Buffett) recommend that you follow two main rules:

- If you have more than 10 years to retirement, invest in the asset class with maximum expected return. For our pension savers that asset class is shares in companies. So you should keep your money in a pension fund with a maximum weight in shares i.e. aggressive strategy funds. If your fund is not keeping as much of your money as possible in shares, change the fund.

- Keep your money in a fund with the lowest possible expenses because the lower the expenses, the better the chances that you will have more money for retirement. Change your pension fund if it isn’t among the lowest cost ones in your chosen investment strategy category.

Yes. Your money is protected in addition to Tuleva’s own internal rules and procedures by these three pillars:

Financial Inspection has issued Tuleva fund manager a license and is overseeing that our activities comply with its rules.

Swedbank is the depositary bank of Tuleva pension funds. Depositary bank confirms every transaction made with the fund`s assets. Exactly the same way as with the bank`s own funds.

State guarantee fund protects all pension fund investors against the worst, in case the fund manager’s fault has caused damage to the fund

It might seem unbelievable, but in reality only a quarter of the management fees of a bank’s fund will go towards handling the assets. Fund managers will channel the rest of the money to the parent company for cost of sales and profit. These expenditures will not create any value to us, the pension savers. If we minimize those charges, it is really not that difficult to start a low-cost pension fund.

Tuleva started with managing pension assets of 3000 people. Every pension fund has fixed costs that decrease proportionally as the fund’s volume increases. So, the more people bring their savings to Tuleva, the cheaper we can take care of our assets. In other words, when Tuleva’s funds grow bigger, the management fees will drop even more.

If you have any questions, please contact 644 5100 or [email protected]. Saving for your pension is one of the most important things to do when thinking about your future. Unfortunately, the pension system has been made rather difficult to understand – don’t hesitate to ask further information.

If you want to know more about Tuleva’s story and goals, the association or how to become a member, start here.

How does the calculator work?

The world's leading analysts have determined that fees are the surest predictor of returns: the lower the fees, the better prospects for growth. (And higher fees correlate with poorer results.)

Expected returns depend greatly on the evolving rate of return, and neither we nor anyone else are able to guarantee a 5% annual return.

In a low-cost index fund your assets grow hand-in-hand with the average returns of world markets. Low-cost index funds have outperformed Estonian pension funds every year to date, but past performance is no guarantee of future performance.

Assumptions

Funds' average annual return before management fees

5%

Average annual salary growth

3%

Minimum eligible age

21yrs

Is our money in Tuleva as protected as in bank’s pension fund?

YES!

Financial Inspection

issued a licence to Tuleva fund manager and controls that our everyday operations comply with regulations.

Swedbank

is Tuleva pension funds’ depositary bank. Depositary bank approves every transaction with fund’s assets. Exactly like with bank’s own funds.

State guarantee fund

protects all pension fund investors against the worst in case fund manager causes harm to investors.