-

Summary: Become a millionaire in 15 minutes

You can build a very decent investment portfolio in a quarter of an hour if you make the second and third pension pillars work for you. With all the information noise around the pension pillars lately, we tend to forget the basics. Instead of pondering whether or not to take out the second pillar money,…

-

5. How can you accumulate more money?

Once in a while a friend, relative or Tuleva member asks me for tips on how to start investing. I tell them what I have already described in the previous chapters: it is wise to start with the second and third pension pillars. I don’t know a more logical tool for saving money – the…

-

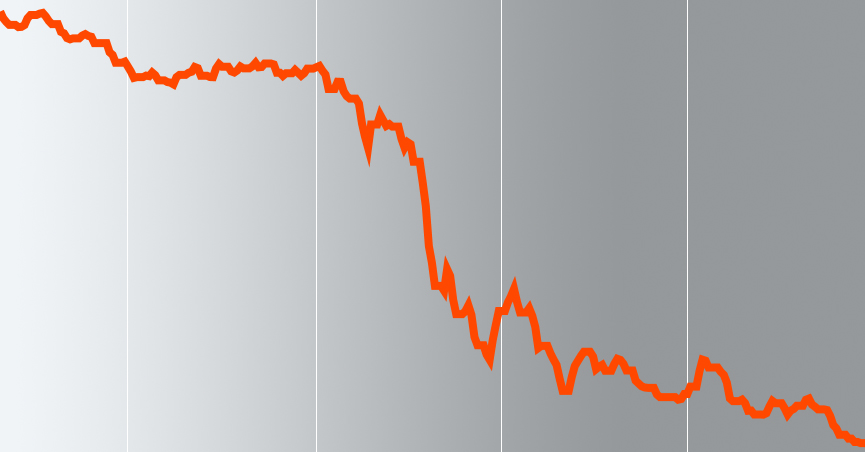

4. What happens when stock prices fall?

Since you brought your money from the old bank pension fund to an index fund, the return has been much better. You can be satisfied! But what if one day you see a minus instead of growth in your account? Let’s take a closer look at the example of the already familiar Laura. In Chapter…

-

3. Use the tax incentive to leverage your investment portfolio

Do you tend to forget the simple truth that seemingly boring but actually highly leveraged pension funds are the basis of a smart investor’s portfolio? Why did thousands of active people – valued professionals in their fields – come together to form Tuleva Association and go into pensions, the most boring business in the world?!…

-

2. Which fund is the best to save in?

Warren Buffett has said that it doesn’t really take much to succeed in investing. You only have to do a very few things right, so long as you don’t do too many things wrong. The 15-minute recipe In the first chapter about Laura, age 25, I gave you a few ideas about what you can…

-

Bonus chapter: Questions and hesitations

In the first chapter of the Laura’s Journey to Wealth article series, I described how 25-year-old Laura can use the second and third pension pillars to save a million by her 67th birthday. I have received some thought-provoking feedback. A lot of feedback came from people who were happy to realise from Laura’s example that…

-

1. Starting to invest is easier than you think

It is said that you have to set aside at least one-fifth of your salary to have a sufficient income in the second half of your adult life, after retirement. The first good news is, it’s easier than you think. The second good news is that you’re pretty likely to make a million if you…

How do we use membership fees?

Membership fees are used to develop the Association and to represent the interests of members. The fees of our first members were used to raise the fund’s initial capital, introduce Tuleva to the general public, and make preparations to start the fund, including application for an activity license from the Financial Inspectorate. From this point forward, membership fees will be used for the following activities:

- Membership community management and communication

- Development of Tuleva’s web page, blog, and other informational channels

- The creation of proposals and influence analysis to improve the Estonian pension system, in cooperation with the Ministry of Finance and other state organizations

- Development of Tuleva’s IT systems

- Preparation and analysis of voluntary savings products and Third Pillar options