-

[Updated in 2025] Have a look: how much can you invest tax-free in the third pillar?

It is worth noting that the calculation of income tax refunds for the third pillar is based on the calendar year. It doesn’t matter when or how many contributions you make. Therefore, you can calculate your total income for this year now and make contributions to the third pillar for the entire year or in…

-

Tuleva 2020 management report

I have a good feeling as I’m writing this report. 2020 was a great year for us. It seems to me that all our previous years’ work has really borne fruit last year, thanks to some supportive external events. Most people save less than they would like. Tuleva connects with people who want to improve…

-

Why doesn’t Tuleva speculate on market sentiment?

There are two types of investors. Those who buy stocks for a long term to take part in the companies’ growing profits. And others that buy and sell often, hoping to take advantage of temporary market deviations. Tuleva has chosen the first path – our joint pension fund is a passive, consistent investor with a…

-

2019 Management report

Dear Tuleva member, 2019 was a landmark year for Tuleva. We achieved the goals we set at the beginning almost three years ago. We have successfully launched our joint second pillar, and now also the third pillar, pension funds. In other words, while politicians are still arguing about pension savings, we Tuleva members have already…

-

Third annual summary: What have Tuleva members already achieved?

Each of the 4,050 owners of Tuleva, which will soon be three years old, has contributed 100 euros to help build a financial company unique in Estonia, born of people’s own initiative. What have we achieved with this money? Estonia’s first fintech owned by the users themselves Imagine a world in which Amazon is owned…

-

How to transfer your second pillar to Tuleva?

On average, you will pay three times less in fees with Tuleva than in other pension funds – this means more money is left for you. Our investment rules are based on best practices, which have helped people grow their savings the most. Our fund manager is owned by Tuleva members – they are pension…

-

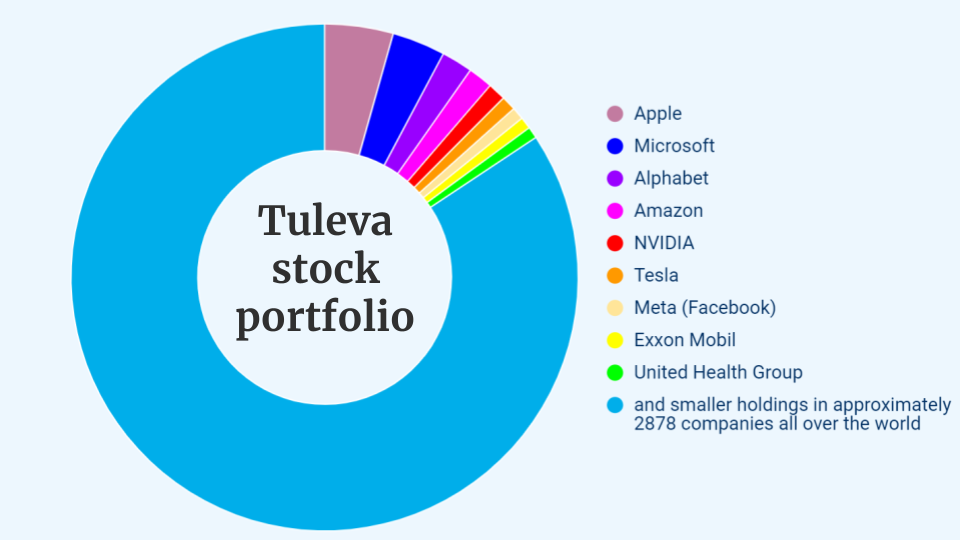

Tuleva pension funds: where do we invest and which pension fund is the best choice for you?

About a year ago, 22 people gave each other a promise to help make pension contributions more favourable to Estonian people. These people paid the membership fee and became the founding members of the commercial association Tuleva. The founding members on their own could not have possibly built up the kind of pension funds we…

-

Bonus chapter: Are index funds threatening the health of the world’s securities markets?

* This article is for those people with a deeper appreciation for securities market theory. If you would simply like to decide which pension fund is suitable for you, you can jump directly to the end. Suitable background music for reading is available here. Today’s Luddites are not textile workers, but rather white-collar investment bankers,…

-

Tõnu’s journal for the first year

A little more than a year ago, on the 12 April 2016, 22 people each contributed EUR 150 and, in the presence of a notary, signed memorandums of association for Tuleva Tulundusühistu. One month ago, we started up Estonia’s most affordable second pillar pension funds. The time has come to write down the most important…

How do we use membership fees?

Membership fees are used to develop the Association and to represent the interests of members. The fees of our first members were used to raise the fund’s initial capital, introduce Tuleva to the general public, and make preparations to start the fund, including application for an activity license from the Financial Inspectorate. From this point forward, membership fees will be used for the following activities:

- Membership community management and communication

- Development of Tuleva’s web page, blog, and other informational channels

- The creation of proposals and influence analysis to improve the Estonian pension system, in cooperation with the Ministry of Finance and other state organizations

- Development of Tuleva’s IT systems

- Preparation and analysis of voluntary savings products and Third Pillar options