-

5 common myths about investing in pillar III

Pillar III has gained significant popularity – it’s become the most common financial asset among people in Estonia. (1) Still, only around 20% of them use pillar III as a state-supported, tax-advantaged way to save. Many investors are put off by confusing information. There are several common myths about saving that need to be dispelled….

-

[Updated in 2026] How to make the most of your third pillar pension?

The third pillar is an excellent way to save for your future. It offers a simple and automatic investment option where you can invest your money in broad-based index funds. In addition, the Estonian state provides support through an income tax rebate on the amount you save. Thanks to the tax rebate, the third pillar…

-

Wise added to Tuleva’s portfolio

In May, MSCI, the world’s largest compiler of stock market indexes, included the first Estonian company, Wise plc, in its global equity market indexes. As a result, Wise shares were added to our pension fund portfolio. Interestingly, just a few months earlier, MSCI had removed Western Union, a company operating in a similar sector but…

-

[Updated in 2025] Have a look: how much can you invest tax-free in the third pillar?

It is worth noting that the calculation of income tax refunds for the third pillar is based on the calendar year. It doesn’t matter when or how many contributions you make. Therefore, you can calculate your total income for this year now and make contributions to the third pillar for the entire year or in…

-

Retirement age is approaching: How should you use the assets accumulated in your pension pillars?

After Parliament lifted restrictions on the use of the second pillar, the assets you accumulated in the second and third pillars are really yours. You can use them as you wish; you can take them out all at once or pay yourself a pension supplement every month. You can also keep your assets growing in…

-

Why doesn’t Tuleva speculate on market sentiment?

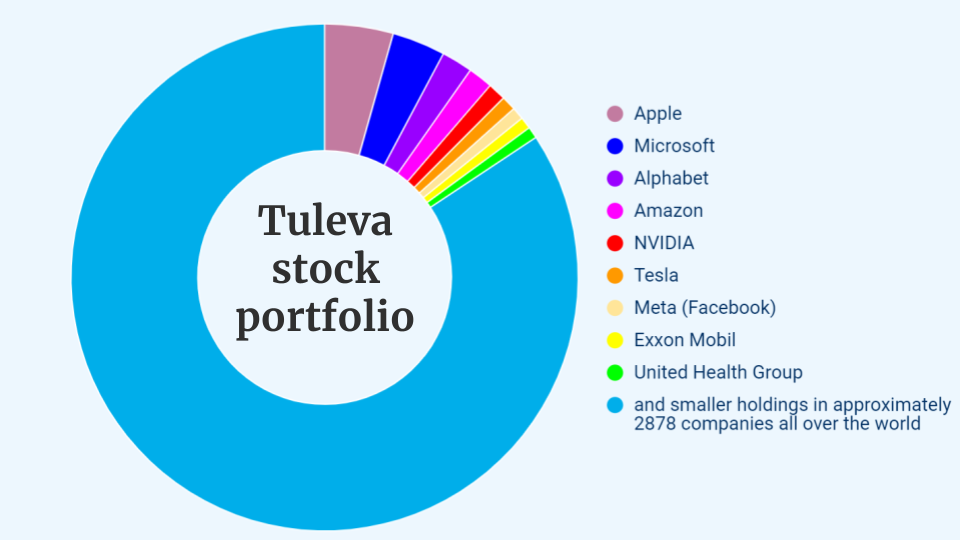

There are two types of investors. Those who buy stocks for a long term to take part in the companies’ growing profits. And others that buy and sell often, hoping to take advantage of temporary market deviations. Tuleva has chosen the first path – our joint pension fund is a passive, consistent investor with a…

-

Summary: Become a millionaire in 15 minutes

You can build a very decent investment portfolio in a quarter of an hour if you make the second and third pension pillars work for you. With all the information noise around the pension pillars lately, we tend to forget the basics. Instead of pondering whether or not to take out the second pillar money,…

-

5. How can you accumulate more money?

Once in a while a friend, relative or Tuleva member asks me for tips on how to start investing. I tell them what I have already described in the previous chapters: it is wise to start with the second and third pension pillars. I don’t know a more logical tool for saving money – the…

-

3. Use the tax incentive to leverage your investment portfolio

Do you tend to forget the simple truth that seemingly boring but actually highly leveraged pension funds are the basis of a smart investor’s portfolio? Why did thousands of active people – valued professionals in their fields – come together to form Tuleva Association and go into pensions, the most boring business in the world?!…

How do we use membership fees?

Membership fees are used to develop the Association and to represent the interests of members. The fees of our first members were used to raise the fund’s initial capital, introduce Tuleva to the general public, and make preparations to start the fund, including application for an activity license from the Financial Inspectorate. From this point forward, membership fees will be used for the following activities:

- Membership community management and communication

- Development of Tuleva’s web page, blog, and other informational channels

- The creation of proposals and influence analysis to improve the Estonian pension system, in cooperation with the Ministry of Finance and other state organizations

- Development of Tuleva’s IT systems

- Preparation and analysis of voluntary savings products and Third Pillar options