-

2. Which fund is the best to save in?

Warren Buffett has said that it doesn’t really take much to succeed in investing. You only have to do a very few things right, so long as you don’t do too many things wrong. The 15-minute recipe In the first chapter about Laura, age 25, I gave you a few ideas about what you can…

-

Bonus chapter: Questions and hesitations

In the first chapter of the Laura’s Journey to Wealth article series, I described how 25-year-old Laura can use the second and third pension pillars to save a million by her 67th birthday. I have received some thought-provoking feedback. A lot of feedback came from people who were happy to realise from Laura’s example that…

-

1. Starting to invest is easier than you think

It is said that you have to set aside at least one-fifth of your salary to have a sufficient income in the second half of your adult life, after retirement. The first good news is, it’s easier than you think. The second good news is that you’re pretty likely to make a million if you…

-

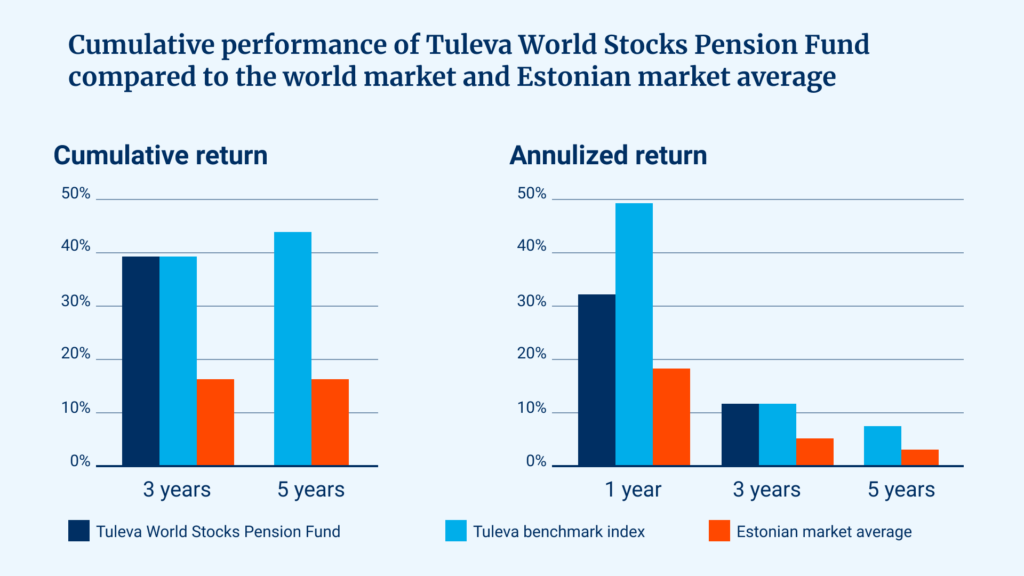

What return can we expect saving money in Tuleva?

When saving money for retirement, the goal is clear: to grow the value of assets as much as possible by the time you retire and start living with the money set aside. The return of a few months or years is irrelevant. Summary: What counts is the long-term return over 10, 20, 30 and 40…

-

How to transfer your second pillar to Tuleva?

On average, you will pay three times less in fees with Tuleva than in other pension funds – this means more money is left for you. Our investment rules are based on best practices, which have helped people grow their savings the most. Our fund manager is owned by Tuleva members – they are pension…

-

Tuleva pension funds: where do we invest and which pension fund is the best choice for you?

About a year ago, 22 people gave each other a promise to help make pension contributions more favourable to Estonian people. These people paid the membership fee and became the founding members of the commercial association Tuleva. The founding members on their own could not have possibly built up the kind of pension funds we…

-

Tõnu’s journal for the first year

A little more than a year ago, on the 12 April 2016, 22 people each contributed EUR 150 and, in the presence of a notary, signed memorandums of association for Tuleva Tulundusühistu. One month ago, we started up Estonia’s most affordable second pillar pension funds. The time has come to write down the most important…

-

Chapter One: Why does Warren Buffett advise his heirs to place their savings in index funds?

From the series “What is the role of a fund manager? Who needs a fund manager? Index funds and the ABC of long-term investing“ Ever heard of Efficient market hypothesis? Don’t worry, it is nothing unfathomable. The price of securities is affected by a number of different factors, e.g. corporate results, economic growth expectations, etc….

-

What is the role of a fund manager? Who needs a fund manager? An introduction

Index funds and the ABC of long-term investing The above two interrelated terms form the foundation of an investment strategy that is rapidly gaining popularityall over the world. According to leading international analysis centres, passive, index-based investing is the most profitable option for most investors in the long term. Index funds have now finally gained…

How do we use membership fees?

Membership fees are used to develop the Association and to represent the interests of members. The fees of our first members were used to raise the fund’s initial capital, introduce Tuleva to the general public, and make preparations to start the fund, including application for an activity license from the Financial Inspectorate. From this point forward, membership fees will be used for the following activities:

- Membership community management and communication

- Development of Tuleva’s web page, blog, and other informational channels

- The creation of proposals and influence analysis to improve the Estonian pension system, in cooperation with the Ministry of Finance and other state organizations

- Development of Tuleva’s IT systems

- Preparation and analysis of voluntary savings products and Third Pillar options