-

Tuleva Management Report for First Half of 2022

Tuleva’s mission is to help people accumulate capital efficiently and confidently. The first six months of this year tested the nerves of many investors: falling stock markets, rising inflation and war in Europe shook the sense of security. While other pension funds shrank, we at Tuleva stayed firmly on course and continued to save. The…

-

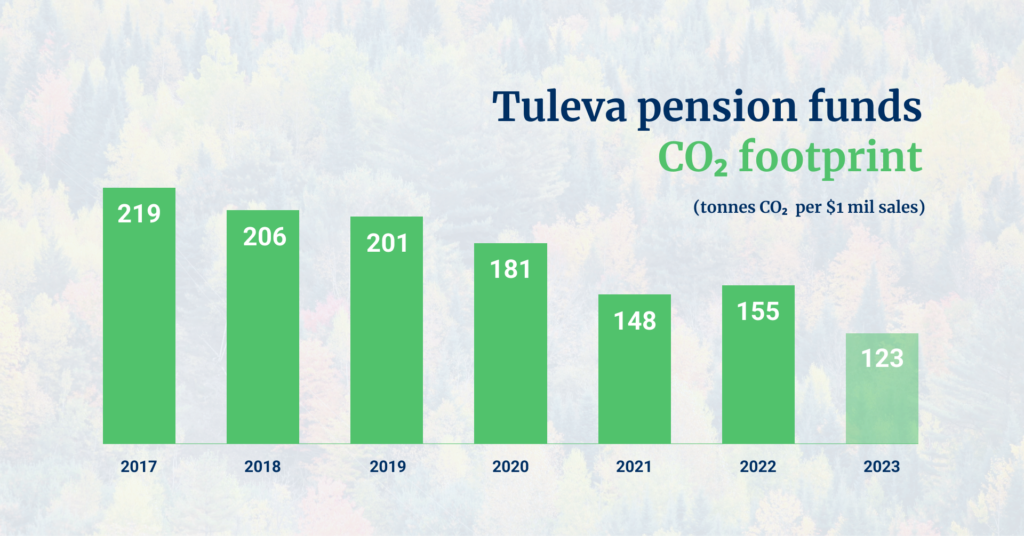

Tuleva funds will implement sustainability policy from the autumn

Tuleva pension funds will follow the principles of environmental sustainability and social responsibility, excluding investments in companies that do not meet the relevant criteria. Rather than creating an additional small “green fund”, Tuleva will make its large funds more sustainable. In exactly the same way as we don’t have a single good pension fund hidden…

-

The second pillar is your asset: How to get the most benefit from It?

Kristi Saare and Tõnu Pekk have helped cut through the clutter of information about pension pillar reforms. Below you’ll find a summary that outlines how to withdraw from the second pillar and how to maximize its benefits. The second pillar is truly your asset While the second pillar was always legally your own, many didn’t…

-

Tuleva management report 2021

The more people save capital for the future in our mutual funds, the better for all of us. The year 2021 confirmed this more than the previous years combined. While other management companies lost assets due to the pension reform, our funds increased by 150 million euros. The regular contributions made by all of us…

-

[Updated in 2025] Have a look: how much can you invest tax-free in the third pillar?

It is worth noting that the calculation of income tax refunds for the third pillar is based on the calendar year. It doesn’t matter when or how many contributions you make. Therefore, you can calculate your total income for this year now and make contributions to the third pillar for the entire year or in…

-

Retirement age is approaching: How should you use the assets accumulated in your pension pillars?

After Parliament lifted restrictions on the use of the second pillar, the assets you accumulated in the second and third pillars are really yours. You can use them as you wish; you can take them out all at once or pay yourself a pension supplement every month. You can also keep your assets growing in…

-

Tuleva 2020 management report

I have a good feeling as I’m writing this report. 2020 was a great year for us. It seems to me that all our previous years’ work has really borne fruit last year, thanks to some supportive external events. Most people save less than they would like. Tuleva connects with people who want to improve…

-

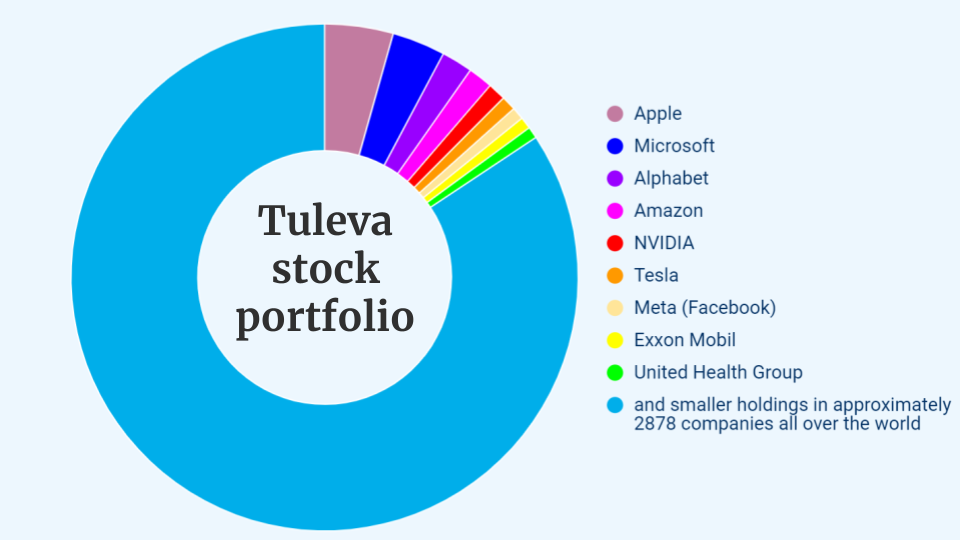

Why doesn’t Tuleva speculate on market sentiment?

There are two types of investors. Those who buy stocks for a long term to take part in the companies’ growing profits. And others that buy and sell often, hoping to take advantage of temporary market deviations. Tuleva has chosen the first path – our joint pension fund is a passive, consistent investor with a…

-

Summary: Become a millionaire in 15 minutes

You can build a very decent investment portfolio in a quarter of an hour if you make the second and third pension pillars work for you. With all the information noise around the pension pillars lately, we tend to forget the basics. Instead of pondering whether or not to take out the second pillar money,…

How do we use membership fees?

Membership fees are used to develop the Association and to represent the interests of members. The fees of our first members were used to raise the fund’s initial capital, introduce Tuleva to the general public, and make preparations to start the fund, including application for an activity license from the Financial Inspectorate. From this point forward, membership fees will be used for the following activities:

- Membership community management and communication

- Development of Tuleva’s web page, blog, and other informational channels

- The creation of proposals and influence analysis to improve the Estonian pension system, in cooperation with the Ministry of Finance and other state organizations

- Development of Tuleva’s IT systems

- Preparation and analysis of voluntary savings products and Third Pillar options