-

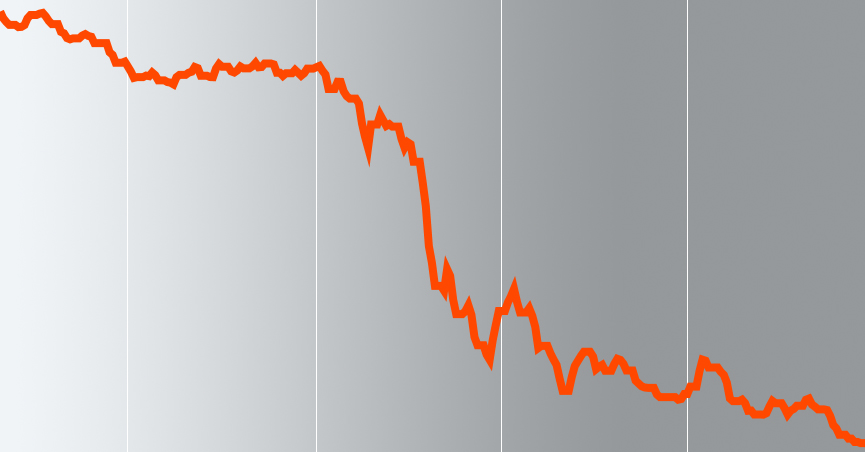

4. What happens when stock prices fall?

Since you brought your money from the old bank pension fund to an index fund, the return has been much better. You can be satisfied! But what if one day you see a minus instead of growth in your account? Let’s take a closer look at the example of the already familiar Laura. In Chapter…

-

3. Use the tax incentive to leverage your investment portfolio

Do you tend to forget the simple truth that seemingly boring but actually highly leveraged pension funds are the basis of a smart investor’s portfolio? Why did thousands of active people – valued professionals in their fields – come together to form Tuleva Association and go into pensions, the most boring business in the world?!…

-

2. Which fund is the best to save in?

Warren Buffett has said that it doesn’t really take much to succeed in investing. You only have to do a very few things right, so long as you don’t do too many things wrong. The 15-minute recipe In the first chapter about Laura, age 25, I gave you a few ideas about what you can…

-

Bonus chapter: Questions and hesitations

In the first chapter of the Laura’s Journey to Wealth article series, I described how 25-year-old Laura can use the second and third pension pillars to save a million by her 67th birthday. I have received some thought-provoking feedback. A lot of feedback came from people who were happy to realise from Laura’s example that…

-

1. Starting to invest is easier than you think

It is said that you have to set aside at least one-fifth of your salary to have a sufficient income in the second half of your adult life, after retirement. The first good news is, it’s easier than you think. The second good news is that you’re pretty likely to make a million if you…

-

Third annual summary: What have Tuleva members already achieved?

Each of the 4,050 owners of Tuleva, which will soon be three years old, has contributed 100 euros to help build a financial company unique in Estonia, born of people’s own initiative. What have we achieved with this money? Estonia’s first fintech owned by the users themselves Imagine a world in which Amazon is owned…

-

What is a membership bonus?

Everyone will benefit from Tuleva, but only members will earn a membership bonus that will increase their stake in the membership capital of our mutual company. What is it, and how does it work? Tuleva’s purpose is to make its members richer. We have two main goals to that end, and everyone in Estonia will…