-

Tuleva management report 2021

The more people save capital for the future in our mutual funds, the better for all of us. The year 2021 confirmed this more than the previous years combined. While other management companies lost assets due to the pension reform, our funds increased by 150 million euros. The regular contributions made by all of us…

-

[Updated in 2025] Have a look: how much can you invest tax-free in the third pillar?

It is worth noting that the calculation of income tax refunds for the third pillar is based on the calendar year. It doesn’t matter when or how many contributions you make. Therefore, you can calculate your total income for this year now and make contributions to the third pillar for the entire year or in…

-

Tuleva 2020 management report

I have a good feeling as I’m writing this report. 2020 was a great year for us. It seems to me that all our previous years’ work has really borne fruit last year, thanks to some supportive external events. Most people save less than they would like. Tuleva connects with people who want to improve…

-

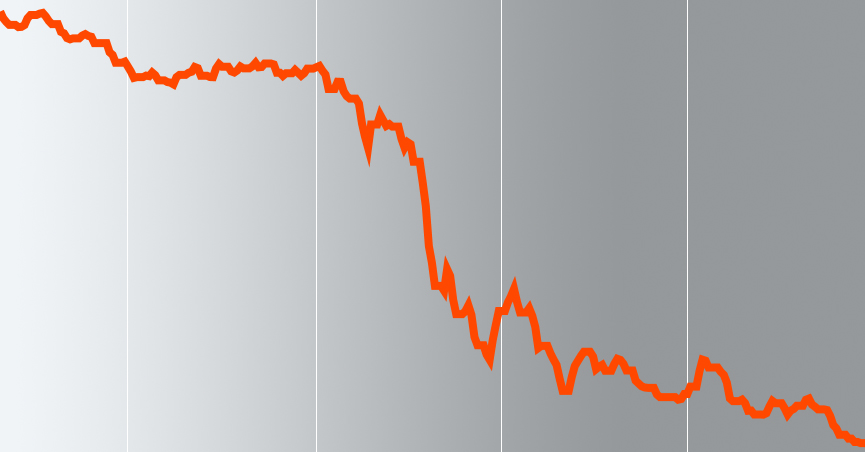

4. What happens when stock prices fall?

Since you brought your money from the old bank pension fund to an index fund, the return has been much better. You can be satisfied! But what if one day you see a minus instead of growth in your account? Let’s take a closer look at the example of the already familiar Laura. In Chapter…

-

What is a membership bonus?

Everyone benefits from Tuleva, but only members earn a membership bonus, which increases their share in the membership capital of our mutual company. Who are Tuleva members and what are their rights? When you save for your pension with Tuleva, you’re part of our community. Everyone in Estonia can save with Tuleva – membership isn’t…

-

Bonus chapter: Are index funds threatening the health of the world’s securities markets?

* This article is for those people with a deeper appreciation for securities market theory. If you would simply like to decide which pension fund is suitable for you, you can jump directly to the end. Suitable background music for reading is available here. Today’s Luddites are not textile workers, but rather white-collar investment bankers,…

-

Tõnu’s journal for the first year

A little more than a year ago, on the 12 April 2016, 22 people each contributed EUR 150 and, in the presence of a notary, signed memorandums of association for Tuleva Tulundusühistu. One month ago, we started up Estonia’s most affordable second pillar pension funds. The time has come to write down the most important…

-

Chapter Four: Are index funds riskier than managed funds? Part II

Part II: What is a risk and why market fluctuations are not the pension savers’ enemy? In Part I of the Chapter, we discussed real-life scenarios which show that, in one way or another, investment is risky, as is life. Even the most brilliant analyst can only hope that his predictions will come true. This…

-

Chapter Four: Are index funds riskier than managed funds

Part I: Practice I will answer the question raised in the title in Part II of this Chapter. In Part II, we will also discuss theory. But let me first sketch out three pension-related scenes from real life. The first story is bit ahead of its time, but as topical as the second and third….

How do we use membership fees?

Membership fees are used to develop the Association and to represent the interests of members. The fees of our first members were used to raise the fund’s initial capital, introduce Tuleva to the general public, and make preparations to start the fund, including application for an activity license from the Financial Inspectorate. From this point forward, membership fees will be used for the following activities:

- Membership community management and communication

- Development of Tuleva’s web page, blog, and other informational channels

- The creation of proposals and influence analysis to improve the Estonian pension system, in cooperation with the Ministry of Finance and other state organizations

- Development of Tuleva’s IT systems

- Preparation and analysis of voluntary savings products and Third Pillar options