-

Tuleva management report for first half of 2023

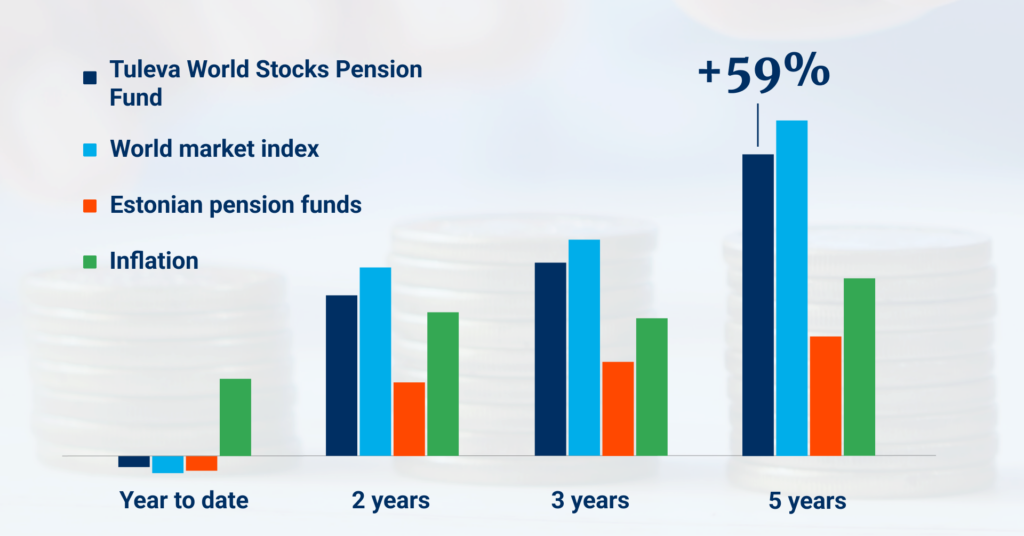

If you have just a 1 minute to read: Since the beginning of the year, world stock markets and the prices of Tuleva’s World Stocks Pension Fund and Tuleva’s Third Pillar Pension Fund units have increased by 15%. Over the past five years, the price of a unit in Tuleva’s World Stocks Pension Fund has…

-

How to talk about pension fund performance?

Performance is the buzzword of pension fund marketing. Swedbank writes: “The bar is high. And fees low.” LHV claims to be the only one to increase the value of funds since early 2022. And Tuleva says its “performance will never lag far behind the average of the world securities markets”. How do you know who…

-

[Updated in 2024] How to make the most of your third pillar pension?

The third pillar is an excellent way to save for your future. It offers a simple and automatic investment option where you can invest your money in broad-based index funds. In addition, the Estonian state provides support through an income tax rebate on the amount you save. Thanks to the tax rebate, the third pillar…

-

[Updated 2025] Tuleva pension funds: where do we invest and which fund is right for you?

In spring 2016, 22 Estonian entrepreneurs and prominent public figures made a promise to one other to help make pension saving more cost-effective for people in Estonia. We established Tuleva. The birth of better pension funds was made possible by the 3,000 Tuleva members who teamed up with the founders right from the first months. Today, the dream is…

-

Tuleva management report 2022

Dear Tuleva members and investors, The past year was hectic. Inflation reached the highest level seen in recent decades. A war was started in Ukraine. World stock markets fell by nearly 15%. As you know, when saving with Tuleva, we set aside a piece of our salaries every month and use it to buy more…

-

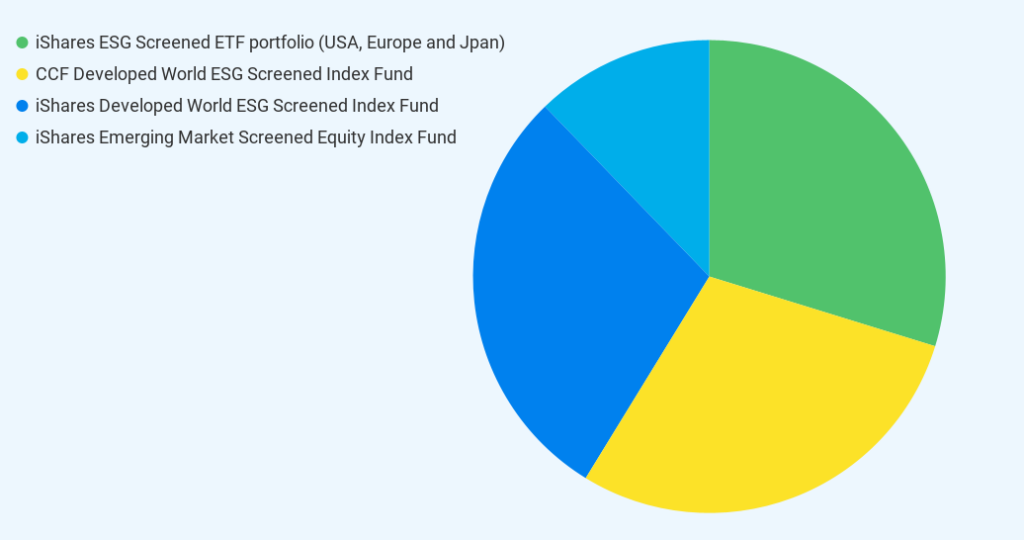

[Updated in 2025] What is inside Tuleva III Pillar Pension Fund?

To date, we have been able to save money in Tuleva’s very own third pillar fund more than three years! As in our second pillar funds, you don’t have to be a member of the association to join us in the Tuleva third pillar. Start investing from the third pillar! A simple rule to follow…

-

Tuleva Management Report for First Half of 2022

Tuleva’s mission is to help people accumulate capital efficiently and confidently. The first six months of this year tested the nerves of many investors: falling stock markets, rising inflation and war in Europe shook the sense of security. While other pension funds shrank, we at Tuleva stayed firmly on course and continued to save. The…

-

The second pillar is your asset: How to get the most benefit from It?

Kristi Saare and Tõnu Pekk have helped cut through the clutter of information about pension pillar reforms. Below you’ll find a summary that outlines how to withdraw from the second pillar and how to maximize its benefits. The second pillar is truly your asset While the second pillar was always legally your own, many didn’t…

-

Tuleva management report 2021

The more people save capital for the future in our mutual funds, the better for all of us. The year 2021 confirmed this more than the previous years combined. While other management companies lost assets due to the pension reform, our funds increased by 150 million euros. The regular contributions made by all of us…

How do we use membership fees?

Membership fees are used to develop the Association and to represent the interests of members. The fees of our first members were used to raise the fund’s initial capital, introduce Tuleva to the general public, and make preparations to start the fund, including application for an activity license from the Financial Inspectorate. From this point forward, membership fees will be used for the following activities:

- Membership community management and communication

- Development of Tuleva’s web page, blog, and other informational channels

- The creation of proposals and influence analysis to improve the Estonian pension system, in cooperation with the Ministry of Finance and other state organizations

- Development of Tuleva’s IT systems

- Preparation and analysis of voluntary savings products and Third Pillar options